FxNews—The WTI crude oil price slightly increased today’s trading session, peaking at $68.3. This small rise was mainly due to escalating tensions between Russia and Ukraine.

Over the weekend, Russia carried out its largest air strike in almost three months, causing significant damage to Ukraine’s power infrastructure.

China’s Factory Slowdown Affects Oil Prices

However, several factors are preventing oil prices from climbing higher. One major issue concerns the weak demand for fuel in China. Recent government data shows that China’s refinery output dropped by 4.6% in October compared to last year.

Additionally, China’s factories produce less, indicating a slowdown in industrial activity.

Surplus Oil Forecast to Lower Prices

A global oil surplus prediction is another reason to keep oil prices under pressure. The International Energy Agency forecasts that by 2025, there will be more than 1 million extra barrels of oil per day worldwide, even though OPEC+ countries are cutting their production.

This means more oil could be available than needed, which usually leads to lower prices.

These concerns led to oil prices falling by over 3% last week. Investors are also worried about the Federal Reserve’s decisions on interest rates. Uncertainty about whether the Fed will cut rates is adding to the instability in global markets.

Crude Oil Technical Analysis

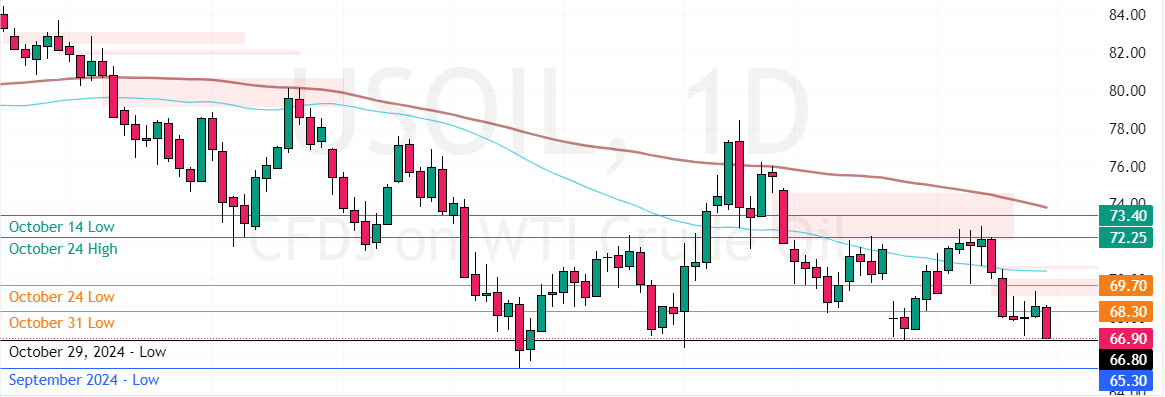

The primary trend is bearish because the prices are below the 50- and 100-period simple moving averages. As of this writing, bears (sellers) are increasing pressure to break below the $66.8 support.

From a technical perspective, the downtrend will likely resume if Oil prices fall below the 66.8 support. In this scenario, the downtrend will likely extend to the September 2024 low, the 65.3 support.

Please note that the bearish outlook should be invalidated if Crude Oil prices exceed the 69.7 critical resistance, backed by the 100-period simple moving average.