FxNews—WTI crude oil futures dropped 5% to around $70 per barrel on Tuesday following reports that Israel might not target Iran’s oil facilities. This development has eased concerns about significant supply interruptions in the area.

It appears Israel will adhere to US advice to avoid striking energy facilities and instead concentrate on military sites in Iran, although tensions continue.

IEA Cuts Global Oil Demand Growth for 2024-2025

Furthermore, the International Energy Agency (IEA) has revised its demand growth projections downward, attributing this to the high spare capacity within OPEC+ and a deceleration in demand from key markets, including China.

Global oil demand is forecasted to grow by approximately 900,000 barrels per day (bpd) in 2024 and by 1 million bpd in 2025, a reduction from the 2 million bpd increase experienced post-pandemic.

China’s Oil Demand Drops for Fourth Straight Month

In China, oil demand has notably weakened, with a reduction of 500,000 bpd in August, marking the fourth month of decline. This trend highlights the slow recovery of the Chinese economy in terms of energy consumption.

Conversely, oil production in the Americas is projected to surge, with an increase of 1.5 million bpd expected this year and the next. This boost comes as production ramps up across the region.

OPEC Cuts Global Oil Demand Forecast Again

On Monday, OPEC made another downward revision to its global oil demand forecasts for the coming years. This marks the third consecutive month of lowered expectations, reflecting broader economic pressures and evolving market dynamics.

- Next read: NATGAS Price Drops Amid Increase in Storage

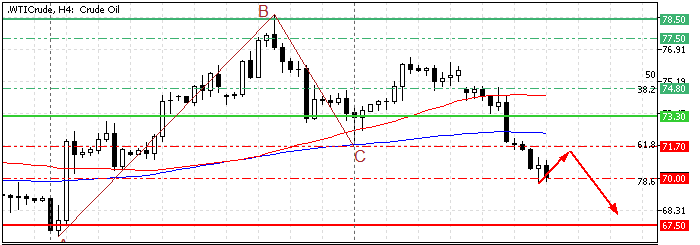

Crude Oil Technical Analysis – 15-October-2024

The primary trend reversed from bullish to bearish when the Oil price flipped below the 100-period simple moving average at approximately $72.4. As of this writing, the black gold is testing the $70 barrier as support, which is the 78.6 % Fibonacci retracement level of the AB wave.

The Stochastic Oscillator and RSI 14 stepped into oversold territory, recording 5 and 27 in the description, respectively. This means oil is oversold, and the price could consolidate.

Overall, the technical indicators suggest the primary trend is bearish, but Crude Oil has the potential to erase some of its recent losses before the downtrend resumes.

Crude Oil Price Forecast – 15-October-2024

The immediate support is at $70. For the downtrend to resume, the bears must close below $70. In this scenario, the next bearish target will likely be the October 10 low at $67.5.

Conversely, if the price maintains a position above the immediate resistance, the oversold signals from the momentum indicators could result in the Oil price consolidating near the immediate resistance at $71.7, the October 9 low.

Oil Support and Resistance Levels – 15-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $70.0 / $67.5 / $65.5

- Resistance: $71.7 / $73.3 / $74.8