FxNews—On Wednesday, the price of WTI crude oil fell by more than 2%, settling at around $70 per barrel. This decline halted a five-day gain streak influenced by the strengthening of the US dollar after Donald Trump was elected president.

Experts predict that Trump’s policies might negatively affect China’s economy, which is crucial since China is the largest importer of oil in the world. This could lead to decreased oil demand.

In addition, US crude stockpiles saw a larger-than-expected increase, growing by 3.13 million barrels versus the predicted rise of 1.1 million barrels. Furthermore, oil production in the US Gulf of Mexico faced interruptions as operations were halted and workers were evacuated in response to Tropical Storm Rafael. This storm is expected to escalate to a Category 1 hurricane, raising further concerns about disruptions in oil supply.

Crude Oil Technical Analysis – 6-November-2024

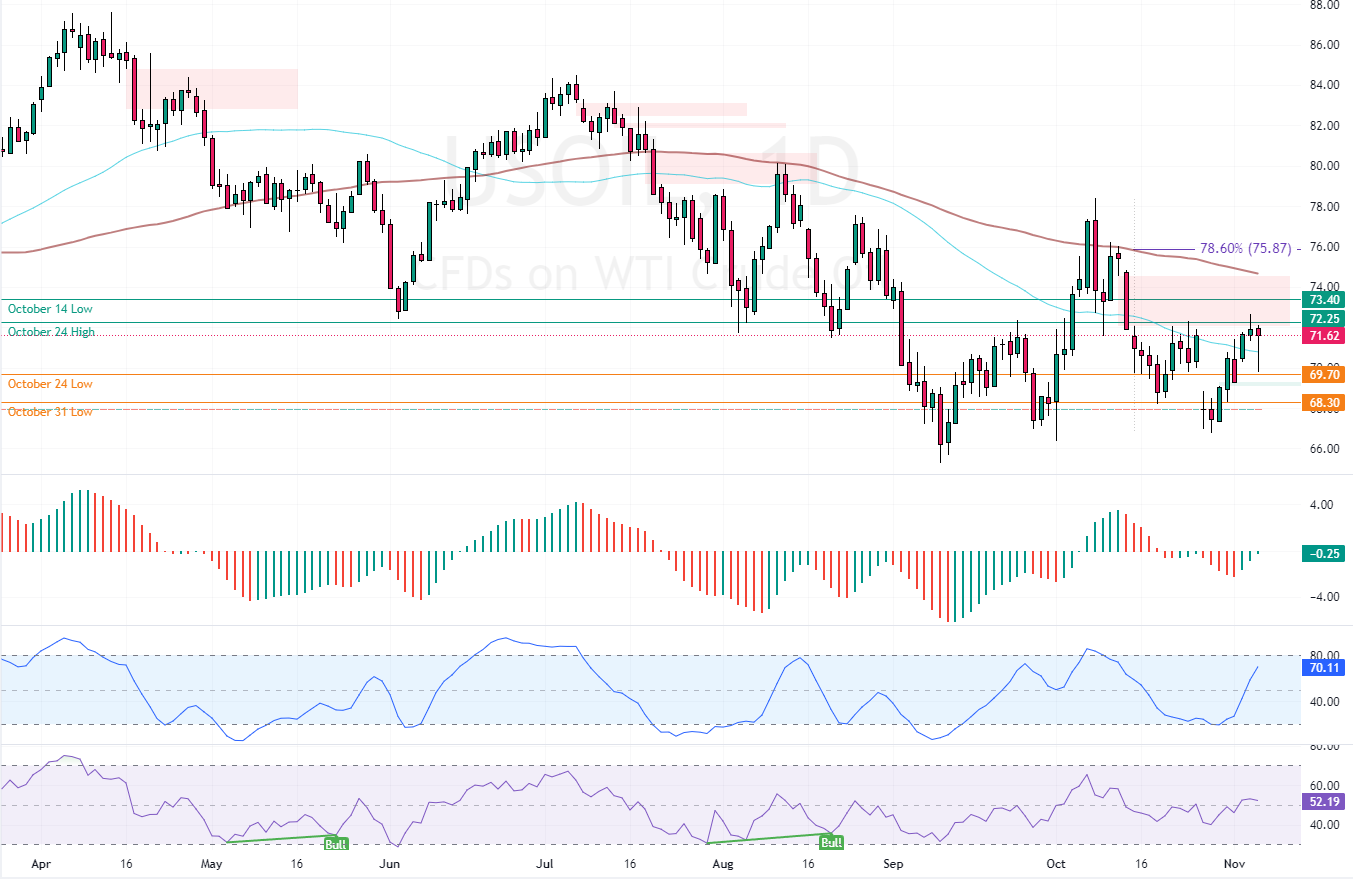

The crude oil price pulled back from the $69.7 support, testing the $72.25 immediate resistance for the second time in the last 20 days. As for the technical indicators, the RSI and Stochastic are rising and not overbought, meaning the uptrend has the potential to resume. Additionally, the Awesome Oscillator histogram is green and about to flip above the zero line, indicating the bull market should prevail.

Overall, the technical indicators suggest the current uptick is gaining momentum, which could cause the price to rise further.

Next Stop $73.4 If Bulls Break Through $72.25

The October 24 high at $72.25 is the immediate resistance. The uptrend will likely resume if bulls close and stabilize the price above that resistance. In this scenario, the next bullish target could be $73.4, followed by $75.8, the 78.6% Fibonacci retracement level.

- Also, read Silver Ready to Surge with Fed Rate Cuts Ahead.

Please note that the bullish outlook should be invalidated if Crude Oil prices fall below $69.7 immediate support.

- Support: 69.7 / 68.3

- Resistance: 72.25 / 73.4 / 76.6