FxNews—On Tuesday, WTI crude oil futures fell below $68 per barrel, continuing a two-day decline driven by weak demand concerns. China’s attempts to stimulate its economy have stopped short of direct action, and persistently low inflation raises doubts about demand from the world’s largest crude importer.

Additionally, a stronger US dollar has put extra pressure on Oil prices by making commodities priced in dollars less attractive. Furthermore, the likelihood of resolving conflicts in the Middle East has increased, which eases some of the upward pressure on prices.

Meanwhile, investors are closely monitoring the global demand outlook for the coming years, expecting an oil surplus next year. Lastly, OPEC will release its monthly market report later today, providing detailed insights into expected market balances.

Crude Oil Technical Analysis – 12-November-2024

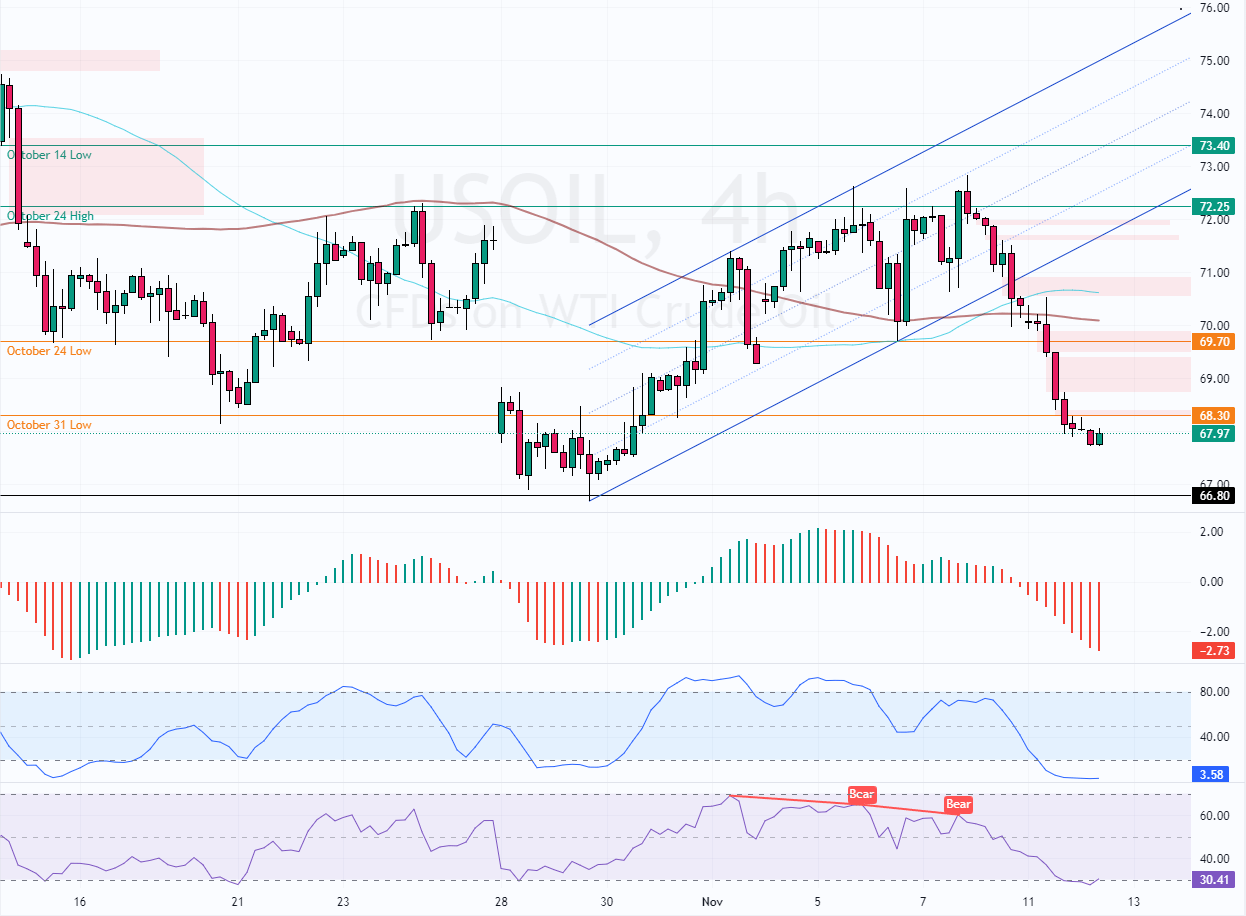

Crude Oil prices dipped after bulls failed to hold above the 72.25 resistance. The downtrend expedited once it broke below the ascending trendline. Furthermore, the RSI 14 divergence signal promised a bearish trend.

As of this writing, Oil prices are oversold, as hinted by the Stochastic and RSI 14. Hence, the Crude Oil price is expected to bounce from this point or consolidate near upper resistance levels.

Low-Risk Oil Entry Near $69.7 Bear Market Alert

From a technical perspective, the immediate resistance is $68.3, followed by the critical $69.7 bullish barrier, backed by the Fair Value Gap.

The oil price will likely consolidate near $69.7, offering a low-risk entry price into the bear market. In this scenario, traders and investors should closely monitor the above resistance areas for bearish signals such as candlestick patterns.

- Support: $66.8

- Resistance: $68.3 / $69.7