Last Friday, the price of WTI crude oil hovered around $75.5 per barrel, marking a potential second consecutive week of gains. This price rise is primarily attributed to growing concerns over possible supply interruptions.

The increase can be linked to heightened geopolitical tensions. Israel’s Prime Minister, Benjamin Netanyahu, convened with his security cabinet last Thursday to deliberate on how to respond to a recent missile strike by Iran.

This situation has left the global markets worried about possible counterstrikes targeting Iran’s facilities, which could disrupt oil supplies further.

Additional Factors Supporting Oil Prices

Another factor contributing to the rising oil prices is Hurricane Milton. This storm has caused significant disruptions, with one-fourth of gas stations in Florida depleting their fuel reserves.

Additionally, about 3.4 million residential and commercial establishments experienced power outages. These disruptions are notable as they directly impact fuel supply chains and availability.

Positive Shifts in Demand

On the demand side, an optimistic view follows China’s draft law, which is focused on bolstering private sector growth. This initiative aims to lift investor confidence, particularly during the economic slowdown. The law is a strategic move to stabilize and potentially enhance China’s crude oil consumer role.

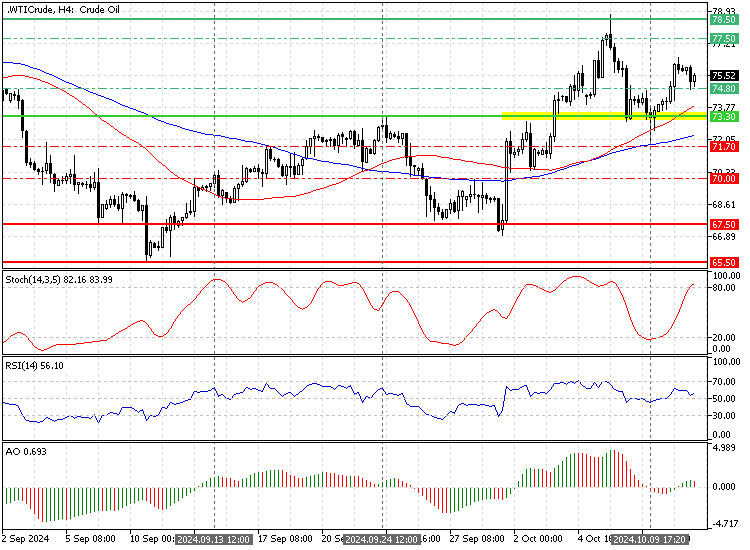

Crude Oil Technical Analysis – 11-October-2024

FxNews—The bears failed to keep the oil price below the 50-period simple moving average on October 9. Consequently, the price significantly bounced and closed above the August 28 low of $74.8. As of this writing, the Crude oil uptrend resumed after it tested the $74.8 mark as support.

The primary trend should be considered bullish because crude oil trades are above the 50- and 100-period simple moving averages. Hence, the price is expected to rise further, as the RSI 14 depicts 55 in the description, meaning Oil is not overpriced.

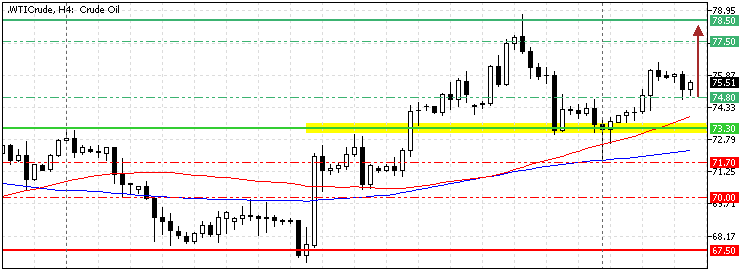

Crude Oil Price Forecast – 11-October-2024

In the bullish scenario, the uptick wave from $71.6 can potentially test the October high at $78.5. Furthermore, if buying pressure exceeds $78.5, the next bullish target could be the $80 mark.

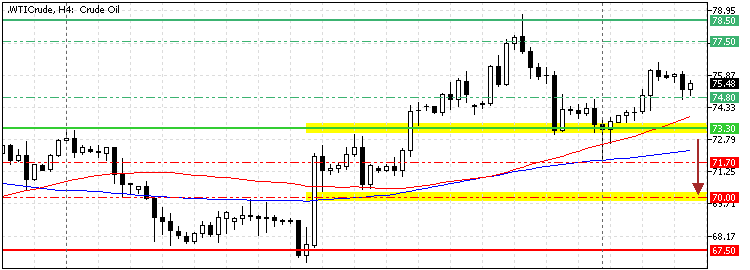

Bearish Scenario

The critical resistance remained safe at $73.3. If bears push the oil price, the bull market should be invalidated, and it can stabilize below this level. If this scenario unfolds, the price can potentially test last week’s at 71.6, backed by the 100-period simple moving average.