FxNews—Ripple downtrend slowed when the price reached the %50 Fibonacci retracement level at $0.531. As of this writing, the XRP/USD trades at approximately $0.542.

The daily chart below shows the price, Fibonacci retracement levels, and indicators used in today’s technical analysis.

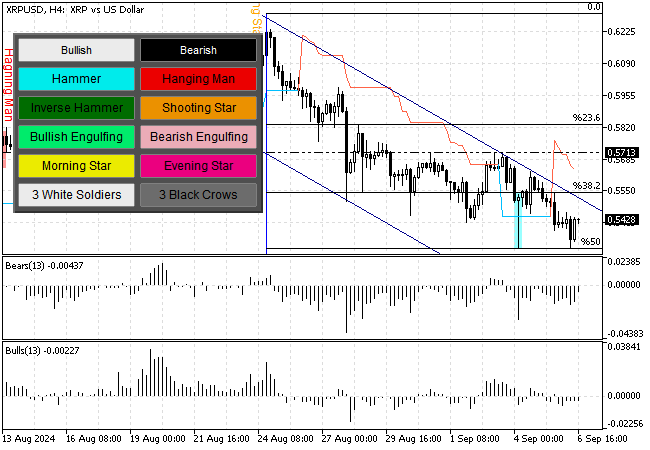

Ripple Technical Analysis – 6-September-2024

Zooming into the 4-hour chart, we notice XRP trades inside the bearish flag and below the 50- and 100-period simple moving average, interpreted as a bear market.

- As for the momentum indicators, the relative strength index is above 30 and increasing, but the stochastic value declines, giving mixed signals that could be interpreted as uncertainty in the market.

- On the other hand, the awesome oscillator bars are red and below the signal line, indicating the bear market prevails.

Interestingly, the super trend indicator signals sell as the Ripple price crossed below the indicator’s line, meaning the downtrend should resume.

Overall, the technical indicators suggest the primary trend is bearish and will likely resume at lower support levels.

Ripple Price Forecast – 6-September-2024

The September 9 low at $0.53 is the immediate support. From a technical standpoint, the downtrend will likely target $0.490 (August 7 Low) if the bears drive the XRP/USD price below $0.53.

In this scenario, the next support area will be the August 7 low at $0.49. Furthermore, if the selling pressure pushes the XRP price below $0.49, the next supply zone will be the August 20204 low at $0.432.

Please note that the 100-period simple moving average will be the primary resistance to the bulls, and the bearish analysis should be invalidated if the price exceeds the 100 SMA.

Ripple Bullish Scenario – 6-September-2024

The key resistance level to the current downtrend remains at $0.57 (September 3 High), in conjunction with the 100-period simple moving average.

The trend should be considered bullish if the buyers push the Ripple price above $0.57. If this scenario unfolds, the bulls’ path to $0.598 (August 27 High) will likely be paved.

Furthermore, if the buying pressure exceeds %0.59, the next barrier will be $0.63. It is worth mentioning that the 100-period simple moving average will provide primary support for the bullish scenario if the price exceeds $0.571.

Ripple Support and Resistance Levels – 6-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $0.53 / $0.49 / $0.46 / $0.432

- Resistance: $0.571 / $0.598 / $0.630

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.