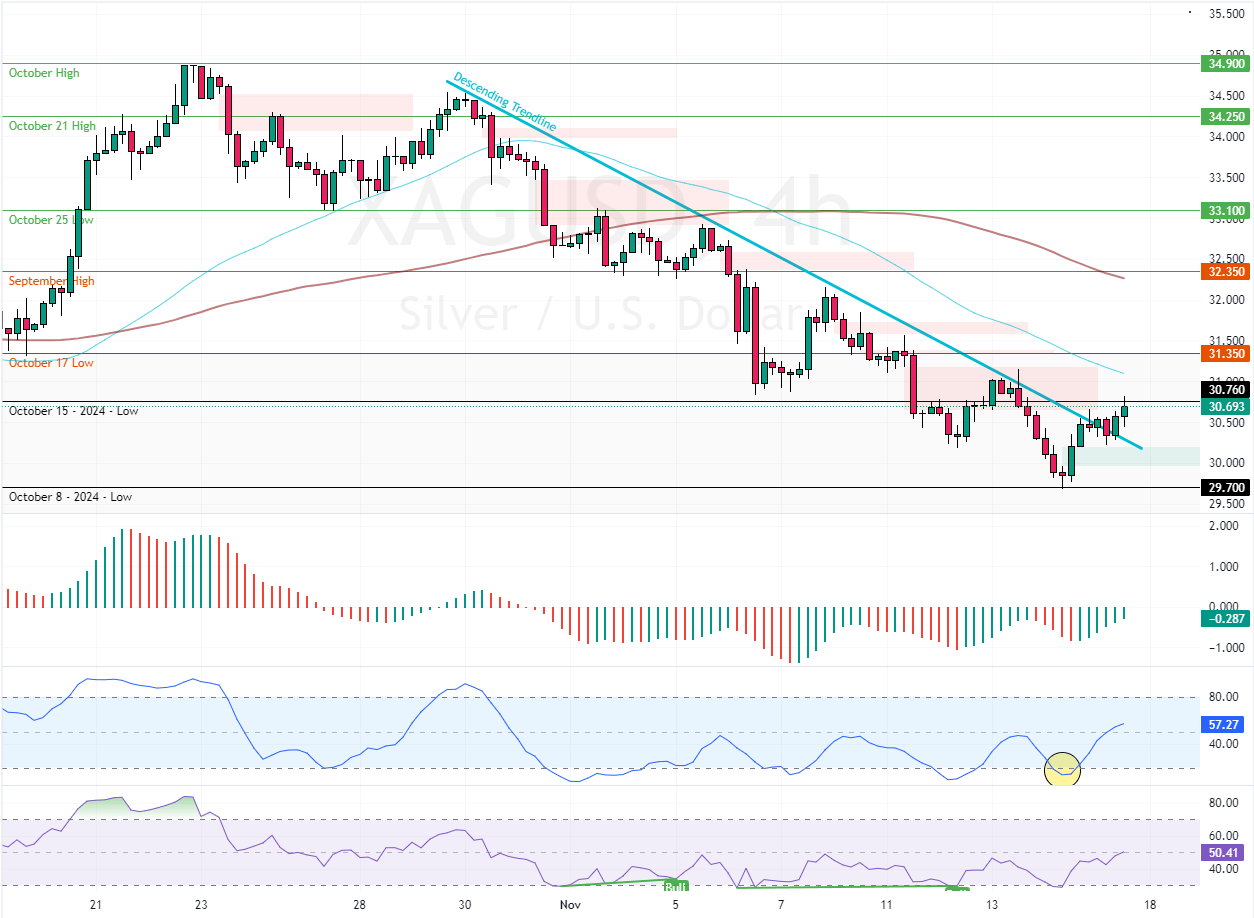

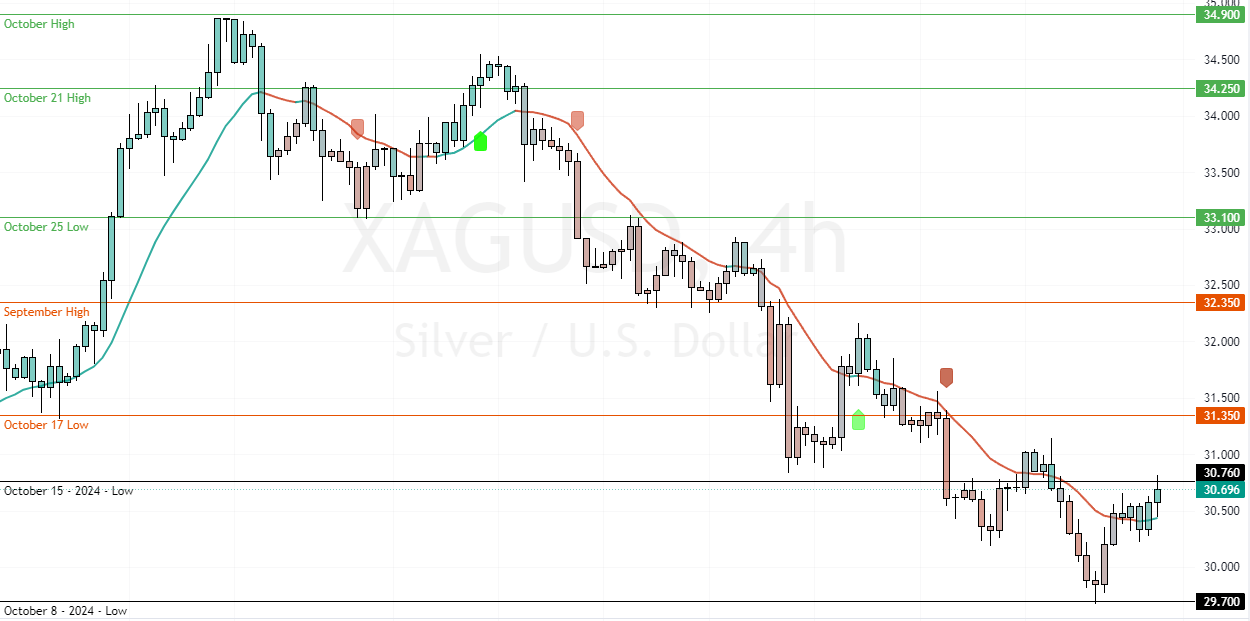

FxNews—Silver trades in a bear market, below the 50-period simple moving average. However, the market started consolidating on Stochastic’s oversold signal, testing at $29.7.

As of this writing, XAG/USD trades at approximately $30.5, testing the October 15 low as resistance.

Silver Technical Analysis – 15-November-2024

As for the technical indicators, the Awesome Oscillator histogram is green, nearing the signal line. Additionally, the RSI 14 and Stochastic records show 49 and 56, respectively.

These developments in the technical indicators suggest that while the primary trend is bearish, the bulls have the potential to extend the consolidation phase toward the upper resistance levels.

Silver Price Forecast -15-November-2024

The immediate support is $29.7, and the support rests at $30.7. From a technical standpoint, the current uptick in momentum will likely extend to October 17, which is low at $31.5 if bulls break above the immediate support. It is worth mentioning that the $31.3 resistance area is robust because the 50-period simple moving average backs it.

On the other hand, the downtrend will likely resume if bears push XAG/USD below the immediate support. If this scenario unfolds, the next bearish target could be the 78.6%

Fibonacci retracement level at $28.2.

- Support: 29.7 / 28.2

- Resistance: 30.7 / 31.3 / 32.3

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.