FxNews—On Tuesday, Silver prices stayed strong, trading around $34.1 per ounce, the highest in nearly 12 years. The increase is due to worries about the US election, ongoing conflicts in the Middle East, and the likelihood of more monetary policy adjustments to stabilize the economy.

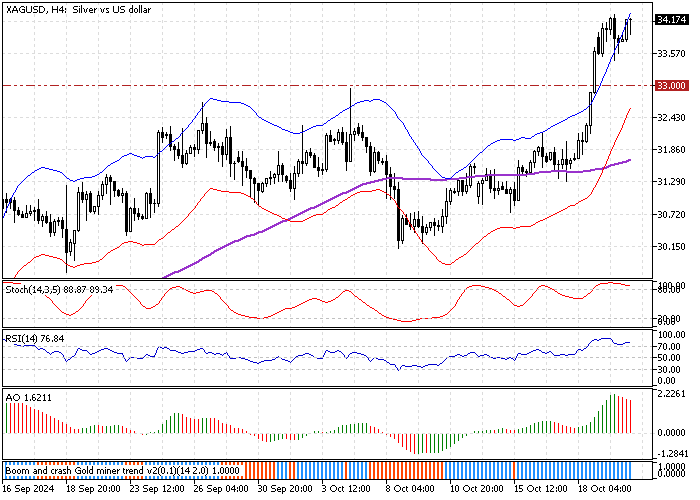

The below XAG/USD 4-hour chart demonstrates the price, support, and resistance levels.

Silver Demand Soars with Solar Panel Growth

The demand for silver is expected to rise because it’s vital for making solar panels, an important part of the shift toward renewable energy. This expected increase in industrial use is another factor pushing silver prices upward.

China Cuts Loan Rates to Boost Economic Growth

China, a significant player in metal consumption, has implemented new economic stimuli to boost its growth. This week, the People’s Bank of China cut its one- and five-year loan rates by 25 basis points, bringing them to 3.1% and 3.6%, respectively.

Moreover, on Friday, the Bank expressed intentions to support the stock market further and hinted at possibly reducing the reserve requirements for banks by the end of the year.