Silver prices dipped below the $29.7 support, marking a three-month low. This decline was influenced by expectations of a more aggressive Federal Reserve and a dim view of silver’s use in industry.

Fed Signals Slowdown in Rate Cuts Amid High Inflation

The Federal Reserve hinted at fewer interest rate reductions next year, responding to high inflation, pressures from government spending, and new tariffs under President Trump’s incoming administration.

This outlook contributed to weaker demand for the commodity, particularly in industrial applications, causing its performance to lag behind gold in the last quarter of the year.

Silver Demand May Drop as China Controls Solar Supply

A surplus supply in China’s solar panel sector prompted photovoltaic (PV technology) manufacturers to join a government-led self-regulation industry, which might control supply and reduce silver demand.

Furthermore, the possibility of a yuan depreciation driven by China’s monetary policies also contributed to lower Silver prices.

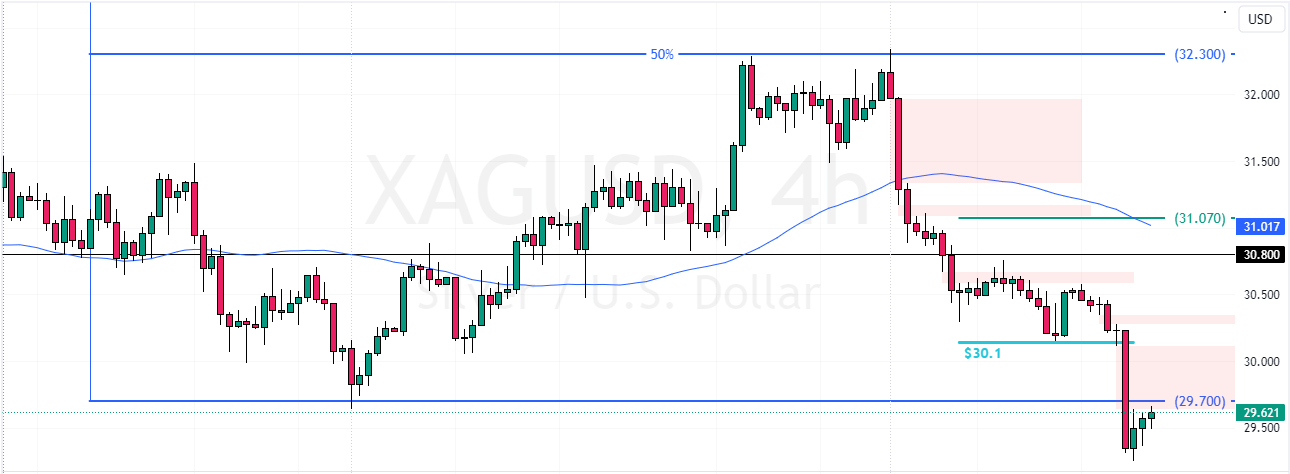

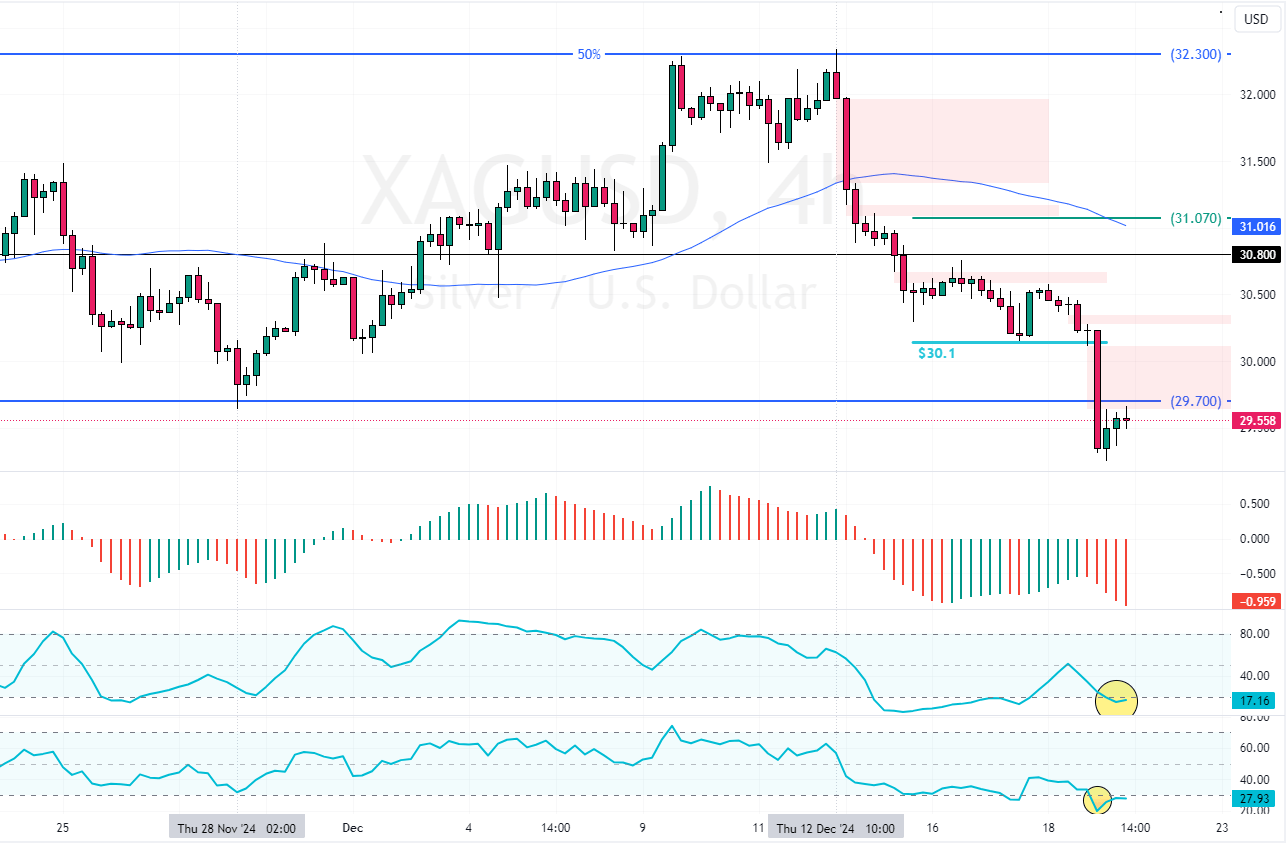

Silver Technical Analysis – 19-December-2024

XAG/USD trades in a bear market, below the 50-period simple moving average. However, robust selling pressure caused the Stochastic and RSI 14 to step into oversold territory.

The momentum indicators records show 18 and 29, respectively, meaning a pullback in Silver prices could be on the horizon.

$30.1 Key Level for Silver’s Next Move

The immediate resistance is at $29.7. From a technical perspective, Silver prices could consolidate toward the upper resistance levels if bulls pull the prices above $29.7. In this scenario, the $30.1 resistance could be targeted.

The $30.1 barrier can provide a decent ask price to join the downtrend strategically. Therefore, retail traders and investors should monitor this level closely.

Kindly note that Silver’s trend outlook remains bearish as long as the prices are below $30.8.