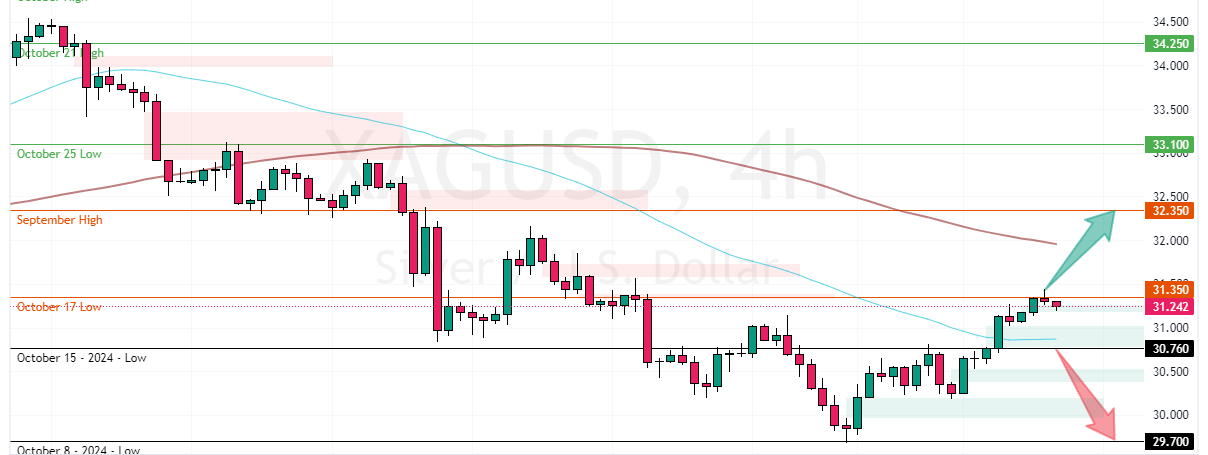

FxNews—Silver prices test the $31.3 resistance, above the 50-period simple moving average. However, the precious metal is still below the 100-SMA, making the primary trend bearish.

This increase occurred as the dollar weakened and investors rethought the Federal Reserve’s monetary policy outlook. Recently, the dollar had strengthened due to expectations of fewer interest rate cuts by the Fed and optimism about the U.S. economy under the new administration. However, profit-taking caused the dollar to retreat.

Investors Watch Fed Remarks for Rate Clues

Meanwhile, investors await more comments from Federal Reserve officials this week to get clearer guidance on future U.S. interest rates. Additionally, markets focus on China’s upcoming Loan Prime Rate (LPR) decision.

There is hope that Chinese authorities will introduce more stimulus measures to boost economic growth.

Biden Authorizes Ukraine Strikes Inside Russia

At the same time, geopolitical tensions have escalated. President Joe Biden authorized Ukraine to use U.S.-made weapons for strikes deep inside Russia. This development has raised concerns about a broader global conflict and increased demand for safe-haven assets like Silver.

Silver Technical Analysis and Price Forecast

The recent climb in the XAG/USD price resulted in the Stochastic Oscillator stepping into overbought territory, meaning Silver is overpriced in the short term. Additionally, Silver prices are below the 100-period simple moving average, making the primary trend bearish.

That said, the immediate resistance is $31.35, while the immediate support is $30.76. From a technical perspective, the downtrend will likely resume if XAG/USD closes and stabilizes below the immediate support. In this scenario, the prices could target the $29.7 critical resistance, the October 8 low.

- Also read: NATGAS Prices Climb as Winter Boosts Demand

Bullish Scenario

On the other hand, the current bullish momentum could extend to the 32.35 critical resistance, backed by the 100-SMA, if bulls pull the prices above the immediate resistance.

- Support: 30.76 / 29.7

- Resistance: 31.35 / 32.35