Silver prices have recently climbed above $31.10 per ounce, nearing one-month highs. Investors focus on key US inflation data that may shape interest rate policies. These developments suggest shifting market sentiment and potential changes in monetary strategy.

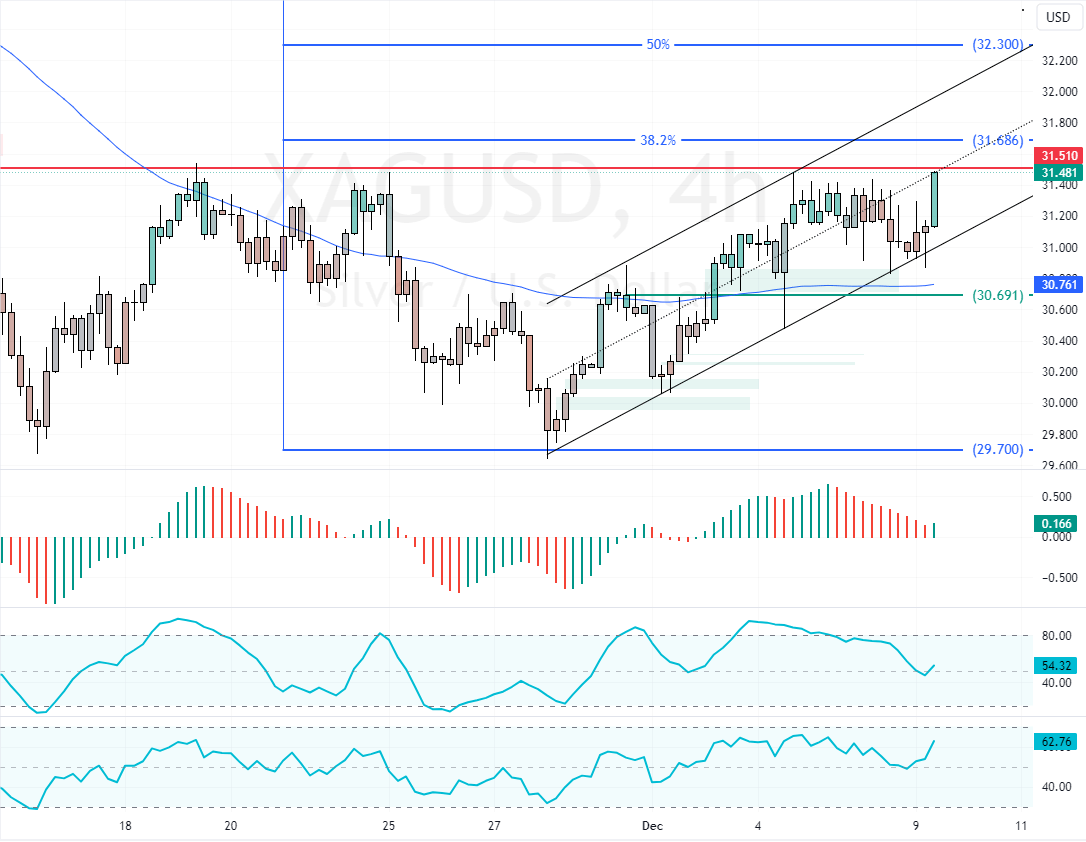

As of this writing, XAG/USD trades at approximately $31.5, testing the November 19 high as resistance.

- Silver crossing $31.10 per ounce

- Upcoming US Inflation Report Influencing Markets

- Potential Federal Reserve rate cuts anticipated

Federal Reserve Policies Shape Investor Expectations

Current market forecasts place an 83% probability of a 25-basis point rate cut, up from 62% the previous week. Lower interest rates often strengthen demand, which could boost precious metals. Investors align their decisions with these expectations, hoping for higher returns in a changing economic landscape.

- Also read: Gasoline Prices Rebound from 2-Month Lows

China’s Economic Plans Drive Metals Demand Outlook

China’s central bank has resumed gold purchases after a pause, signaling possible broad support for metals. The Central Economic Work Conference will outline China’s priorities and targets for 2025.

Traders are betting on new economic measures, confident that these steps will enhance China’s metals demand and reinforce global market stability.