FxNews—Silver prices eased to $30 per ounce as the Stochastic overbought signaled promised when the prices neared the October 17 low. The pessimistic outlook for the metal’s industrial use weighed against new support from bullion due to escalations in the Russia-Ukraine conflict.

For the first time since the war began in 2022, Ukraine fired UK-built and US-built missiles into Russian territory. In the same week, Russia adjusted its nuclear doctrine to settle conditions for atomic weapon responses, which dampened investor risk sentiment.

Solar Panel Surplus Impacts Silver Price Stability

Nevertheless, decreased demand for silver in industrial applications limited the price recovery. Furthermore, the absence of new stimulus measures from the Chinese government reinforced the belief that the solar panel industry—a major consumer of silver—will remain oversupplied.

Additionally, reports indicated that Chinese-owned solar panel companies began reducing production amid concerns over potential higher tariffs in the sector.

Silver Technical Analysis

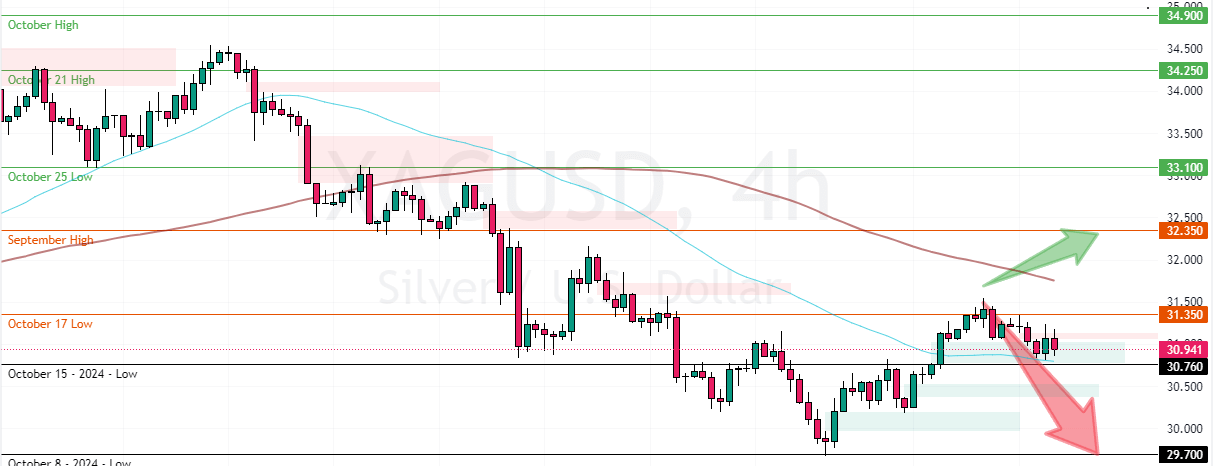

The XAG/USD primary trend is bearish because the prices are still below the 100-period simple moving average. As for the technical indicators, the Awesome Oscillator histogram is red, nearing the signal line from above. Meanwhile, the Stochastic and RSI 14 indicators declined, depicting 50 and 49 in the description, meaning the bear market should prevail.

Overall, the technical tools suggest the primary trend is bearish and should resume.

Silver (XAG/USD) Price Forecast

The immediate support is the October 15 low at $30.7. From a technical perspective, the downtrend will likely resume if Silver sellers push the prices below the immediate support. The next bearish target in this scenario could be the October 8 low at $29.7.

Please note that the downtrend outlook should be invalidated if Silver prices exceed the immediate resistance, the 31.25 mark. If this scenario unfolds, the bullish wave from $29.7 can potentially extend to $32.35.

Silver Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 30.76 / 29.7

- Resistance: 30.76 / 29.7