FxNews—Silver held steady around $34 per ounce on Thursday, likely due to a technical bounce, after falling sharply from its 12-year highs and dropping over 3% the day before.

The recent losses followed a stronger dollar and higher Treasury yields as expectations grew that the Federal Reserve would take a more cautious approach to easing monetary policy.

Fed Rules Out Big Rate Cut Amid Election Worries

Fed officials dismissed any chances of a large 50 basis point rate cut at upcoming meetings. Ongoing worries about the US’ rising debt and uncertainties around the elections fueled market volatility.

Meanwhile, in China, traders are waiting for more stimulus measures from the upcoming National People’s Congress Standing Committee meeting. The market expects a package worth up to 10 trillion yuan as China works to meet its growth targets for the year.

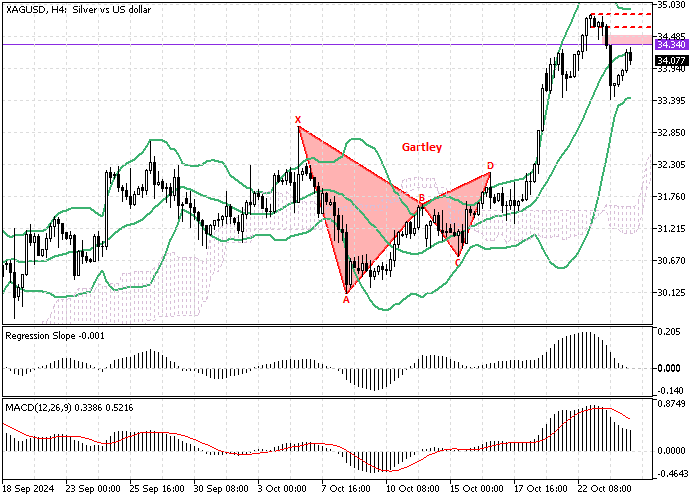

Silver Technical Analysis – 24-October-2024

Silver trades bullish above the Ichimoku Cloud, pulling back from the Fair Value Gap (FVG) at $34.34, a barrier backed by the upper line of the bullish flag. Meanwhile, the Stochastic Oscillator shows bearish signals by declining toward the 20 level, supported by the Awesome Oscillator red histogram nearing the zero line from above.

Additionally, the Boom and Crash Gold Miner indicator histogram turned red, signaling the Silver price could potentially dip.

- Overall, the technical indicators suggest that the primary trend is bullish, but XAG/USD has the potential to decline and test lower support levels.

Silver Price Forecast – 24-October-2024

Silver is at its historical high, which makes it a risky asset for buyers at this price. It is not advisable to join a bull market when the price is high. Hence, if the silver price drops near the October 4 high of $33, it could present a good opportunity for bullish traders.