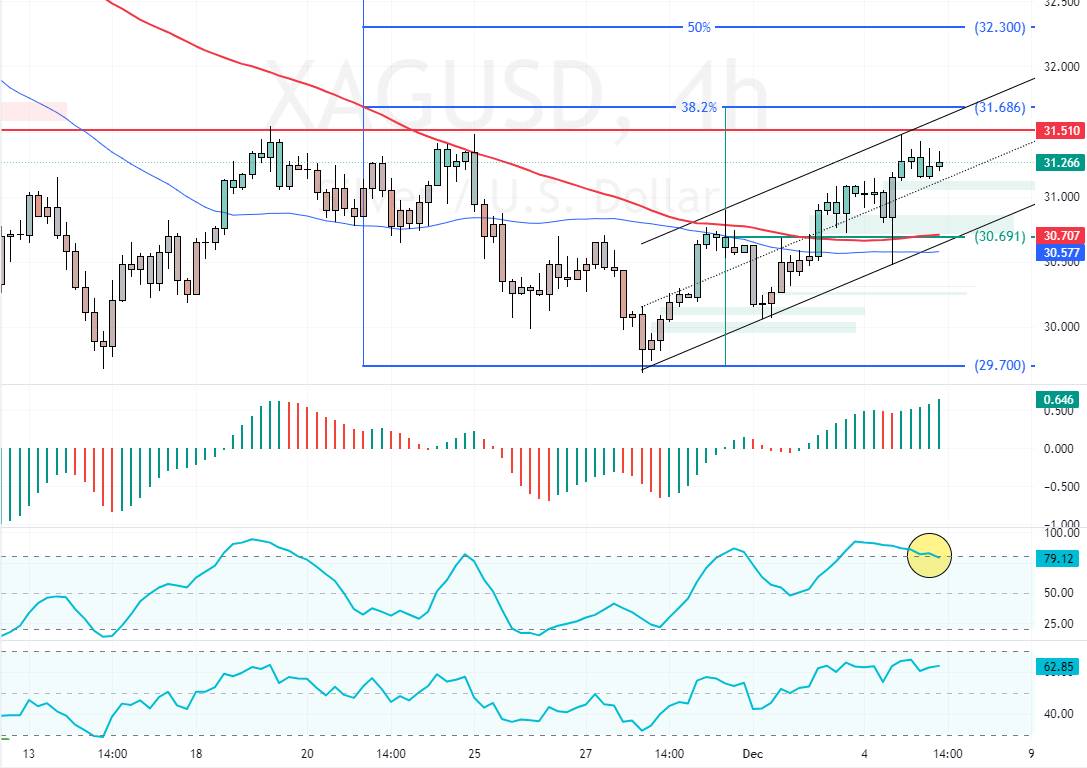

FxNews—Silver trades bullish, above the 50-period simple moving average at approximately $31.28, testing the 38.2% Fibonacci resistance level. Market participants are increasingly wagering that the U.S. Federal Reserve will lower interest rates again this month.

- December rate cut odds for a 0.25% decrease climbed to 79%.

- U.S. services sector growth in November slowed more than expected.

- Expectations rise for China to announce new stimulus initiatives.

Growing Likelihood of Federal Reserve Rate Reduction

The likelihood of the Federal Reserve enacting a 25 basis point rate cut in December has jumped to nearly 79%, up from 66.5% just a week earlier. This shift is driven by data indicating that the U.S. services sector’s growth in November was slower than anticipated.

Nevertheless, Fed Chair Jerome Powell has stated there is no urgency to reduce rates. He attributes this stance to strong economic performance, a solid labor market, and sustained inflation pressures.

Global Factors Driving Demand for Precious Metals

Anticipation is mounting that China will unveil additional stimulus measures during key political gatherings this month. Such actions could boost demand in China, the world’s largest metal consumer.

Silver and other commodities are also seeing increased demand as safe-haven assets. This trend is influenced by political instability in France and South Korea and ongoing conflicts in Eastern Europe and the Middle East.