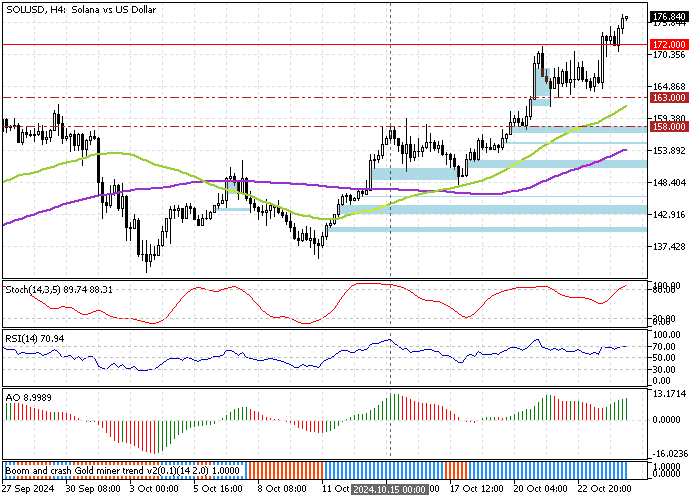

FxNews—Solana is in a bull market. It surpassed the Fair Value Gap zone at $172. As of this writing, SOL/USD trades at approximately $176, continuing its bullish trajectory.

Solana Technical Analysis – 24-October-2024

The SOL/USD daily chart shows the Stochastic Oscillator and Relative Strength Index (RSI 14) in overbought territory, recording 71 and 91 in the description, respectively.

This development in the momentum indicators suggests Solana is overpriced in the short term, and the price could consolidate before the uptrend resumes.

Solana Price Forecast – 24-October-2024

The immediate support is at the October 21 high, the $172.0 mark. From a technical perspective, if SOL/USD dips below $172, a new consolidation phase will likely form, targetting the 50-period simple moving average at $163.

Please note that the outlook will remain bullish as long as Solana’s price is above the $163 mark. In this scenario, after testing the $163, the next bullish target could be the July 2024 high at $194.

Furthermore, if Solana falls below the critical $163 support, the bullish outlook should be invalidated. In this scenario, the price could fall to the October 15 high at $158.