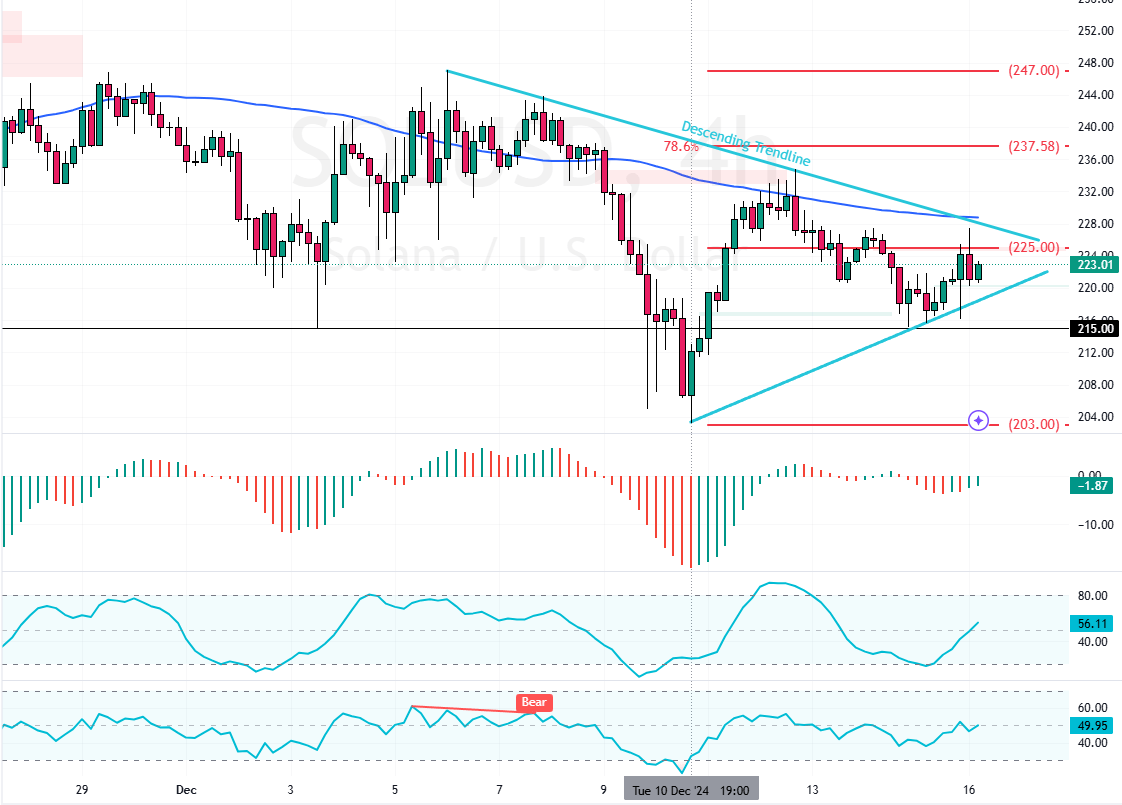

Solana is closing the apex of the symmetrical triangle amid bullish sentiments. A close above the 75-period SMA should trigger the uptrend, targeting $237.

Please note that the bullish outlook should be invalidated if SOL/USD dips below $215.

Solana Technical Analysis – 16-December-2024

FxNews—The cryptocurrency erased 15.0% of its recent losses this month and shifted above the $215.0 critical support. As of this writing, SOL/USD trades at approximately $223, slightly below the 75-period simple moving average.

The 4-hour chart shows Solana approaching the apex of the symmetrical triangle. This means a bullish or bearish breakout is on the horizon.

As for the technical indicators, the Awesome Oscillator histogram is green but below zero. Furthermore, the Stochastic flipped above 55, demonstrating bullish sentiments. However, the RSI 14 clings to the median line, indicating a low-momentum market.

Overall, the technical indicators suggest Solana’s primary trend is bearish, but bullish sentiment has strengthened, and a breakout is required for the uptrend to restart.

Watch Solana for Potential Surge to $237

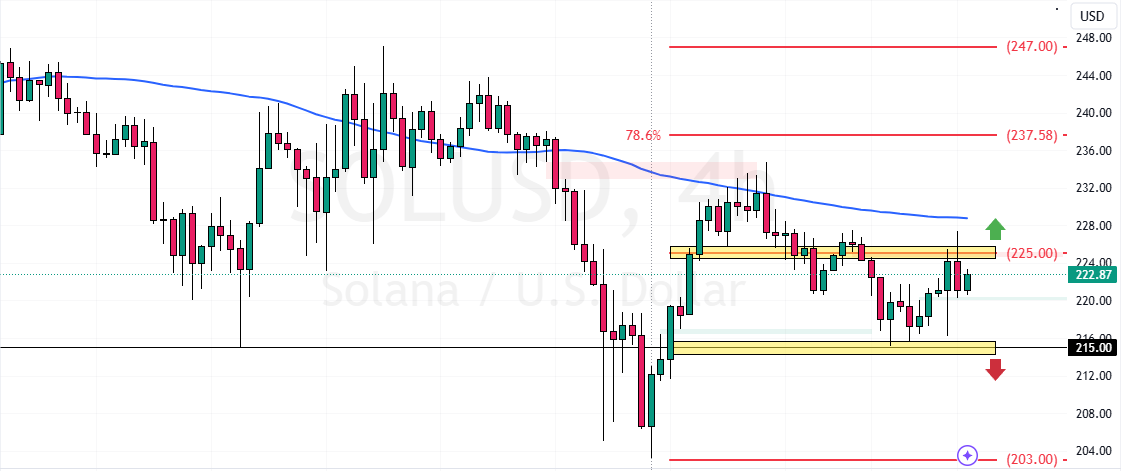

The immediate resistance is at $225.0. From a technical perspective, the uptrend will likely extend to the next resistance level if bulls (buyers) close and stabilize above this barrier. The next bullish target in this scenario could be the 78.6% Fibonacci retracement level at $237.0.

- Also read: Watch Ethereum for a Potential Rise to $4200

The Bearish Scenario

Please note that the bullish outlook should be invalidated if SOL/USD dips below $215.0. If this scenario unfolds, the downtrend from $237.0 will likely spread to the December 10 low at $203.0.