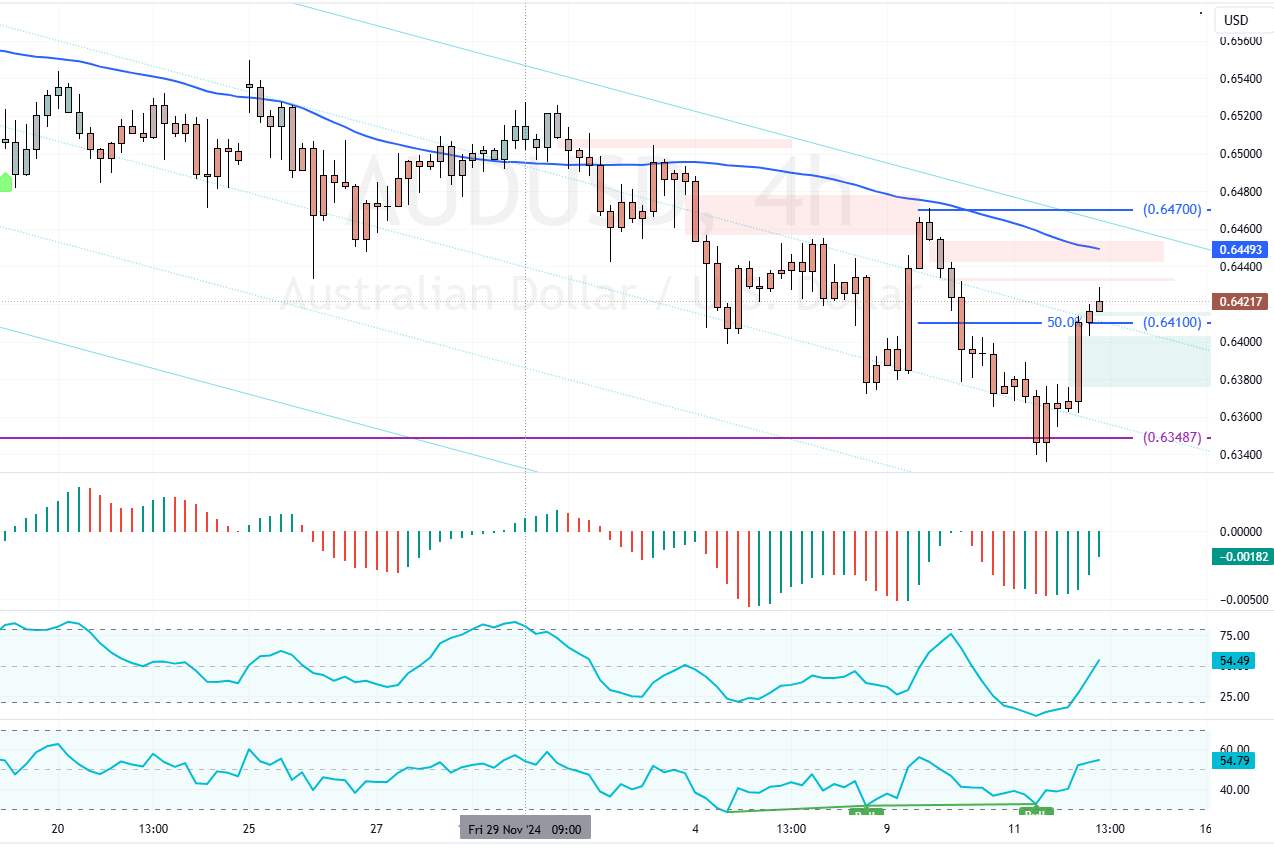

The AUD/USD currency pair resumed its bullish trend above the 50.0% Fibonacci retracement level, approaching the 75-period simple moving average. This recovery from its lowest level in a year was due to unexpectedly strong job numbers.

As of this writing, AUD/USD trades at approximately $0.642.

Australia Sees Unexpected Drop in Unemployment to 3.9%

These figures made investors rethink their expectations of an early interest rate reduction. The latest data revealed that Australia’s unemployment rate dropped to 3.9% in November, its lowest in eight months, even though it was predicted to increase slightly to 4.2%.

Additionally, the number of employed people increased by 35,600 last month, more than the anticipated 25,000.

Reserve Bank of Australia Rate Cut Chance Falls to 50%

The likelihood of the Reserve Bank of Australia lowering interest rates in February has decreased from 68% to about 50%. On Tuesday, the central bank maintained its policy rate at 4.35% but adopted a more cautious tone due to decreasing inflation pressures.

Governor Michele Bullock emphasized that this change in tone was a conscious response to weakening economic indicators.