The Mexican peso dropped below 20.55 per U.S. dollar in November, hitting its lowest point since July 2022. This decline is mainly due to worries about protectionist policies from the United States, which is Mexico’s biggest trading partner. Many fear that stricter U.S. trade measures could harm Mexican exports and reduce the inflow of foreign currency.

Lighthizer’s Return Could Mean More Trade Barriers

These concerns intensified because there’s talk that President-elect Donald Trump might bring back Robert Lighthizer as the trade representative. Lighthizer is known for supporting protectionist trade policies.

Furthermore, investors are uneasy about the possibility of Republicans gaining full control of Congress. Such a “clean sweep” could lead to more aggressive trade restrictions and higher tariffs.

Peso at Risk as Mexico Eyes Interest Rate Cut

Additionally, the peso might weaken even more if Mexico’s central bank decides to cut interest rates at its upcoming meeting. Lower interest rates often make a currency less attractive to foreign investors.

Although recent reports show slight growth in industrial production and increasing consumer confidence, these positive signs haven’t eased the prevailing worries. Consequently, the peso remains vulnerable against the U.S. dollar.

USDMXN Forecast – 13-November-2024

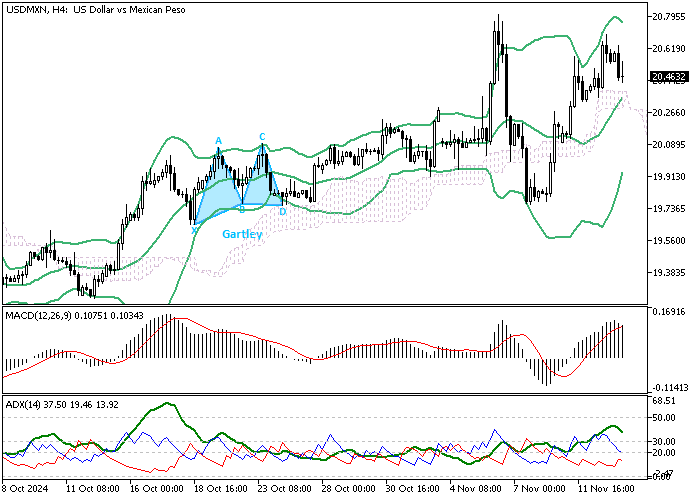

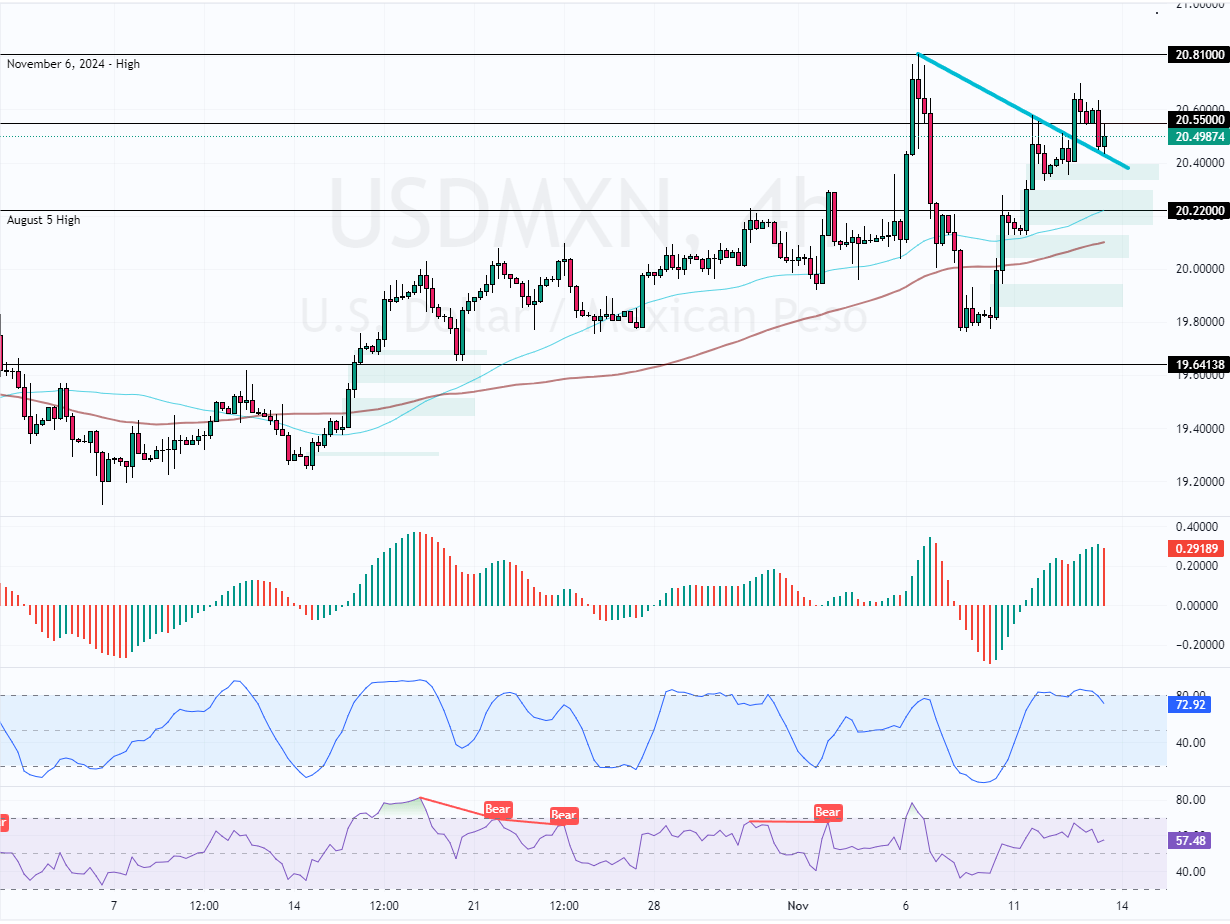

The USD/MXN consolidated at approximately 20.51 in today’s trading session after it broke above the descending trendline. This downtick momentum was expected because the Stochastic Oscillators were hovering in overbought territory.

The primary trend should be considered bullish because the USD/MXN price is above the 100-period simple moving average and the 20.0 resistance. From a technical perspective, the uptrend will likely resume if bulls stabilize the price above 20.55, which is an immediate resistance.

USDMXN Eyes 20.81 as Bulls Push Higher

The next bullish target could be 20.81. Furthermore, if the buying pressure exceeds 20.81, the uptrend could extend to 21.0. Please note that the bull market should be invalidated if USD/MXN falls below the 20.0 level.

- Support: 20.22 / 20.20 / 19.8

- Resistance: 20.81 / 21.0