FxNews—US gasoline futures dipped from $2.0 on December 4, testing the $1.96 critical support in today’s trading session.

- OPEC+ may extend oil production cuts into the first quarter of 2025.

- US sanctions on Iranian oil transporters are tightening the global oil supply.

- China’s upcoming economic strategies could include new monetary stimulus.

- US crude oil stockpiles have decreased significantly, while gasoline and distillate stocks have risen more than expected.

OPEC+ Expected to Extend Cuts into 2025

The OPEC+ group will likely continue its oil production cuts through the first quarter 2025. This strategy is intended to support the oil market by reducing supply and maintaining higher prices.

The decision is significant as it aims to stabilize the market amid uncertain demand and geopolitical issues.

US Sanctions and China’s Plans Impact Oil Markets

The United States has imposed sanctions on entities transporting Iranian oil, further tightening the global oil supply.

In Asia, attention is focused on China’s economic plans for 2025, which may introduce new stimulus measures affecting oil demand. Additionally, data from the Energy Information Administration indicates a sharp decline in US crude oil inventories, while stocks of gasoline and distillate fuels have increased more than analysts expected.

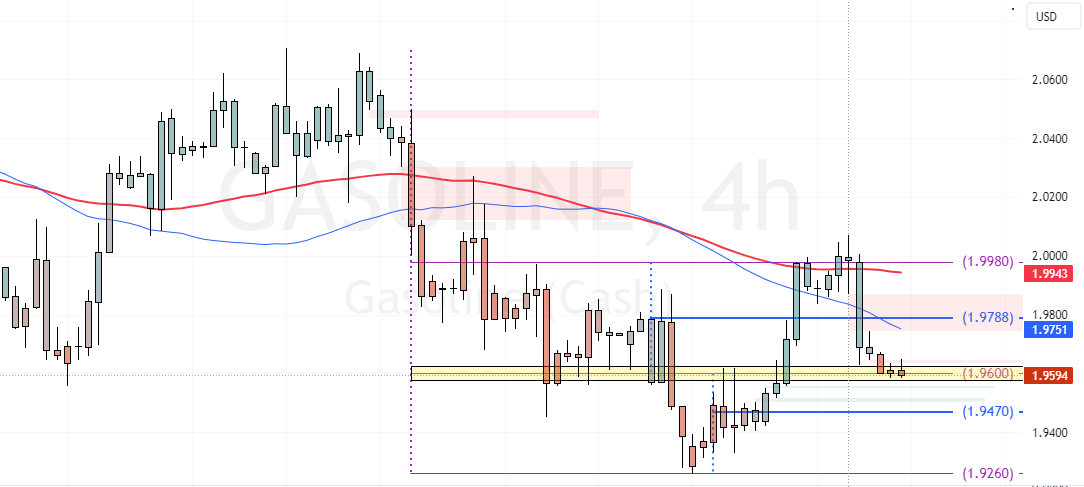

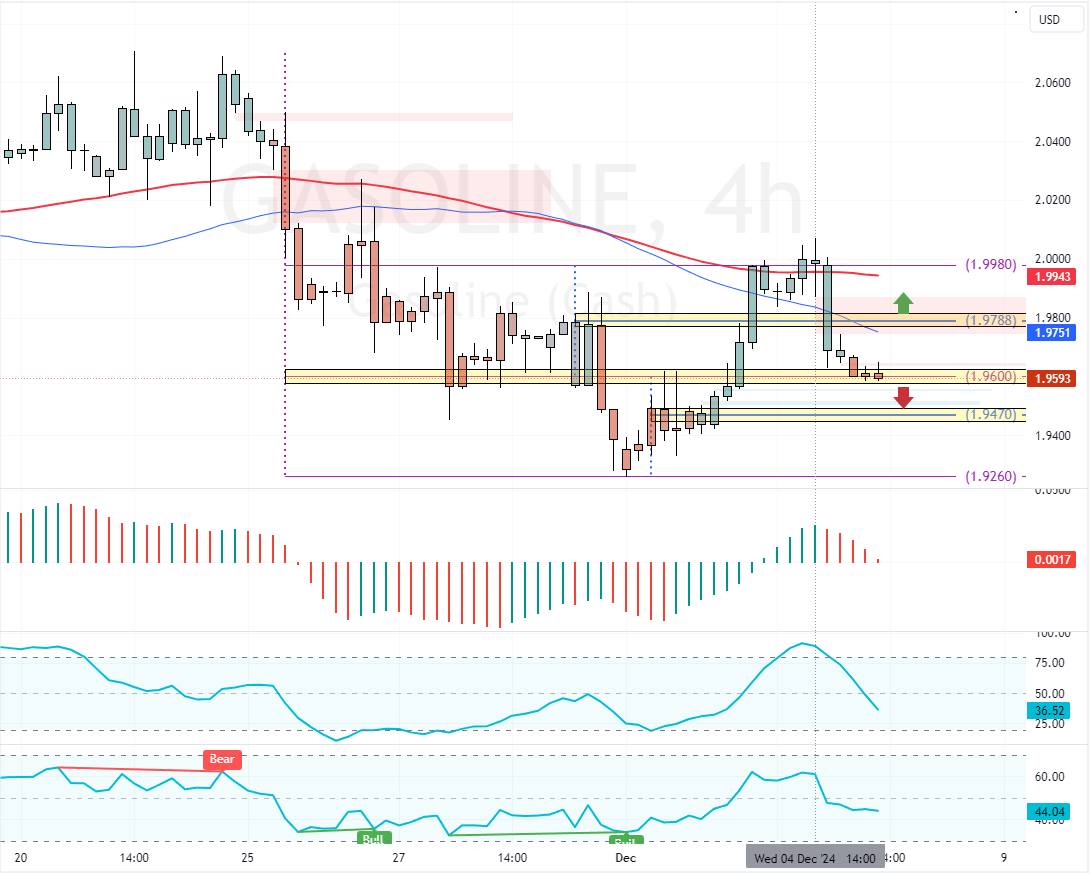

Gasoline Technical Analysis – 5-December-2024

As of this writing, Gas prices are testing the $1.96 critical resistance. Meanwhile, the Awesome Oscillator, RSI 14, and Stochastic are declining. Additionally, Gasoline prices are below the 50-period simple moving average, making the primary trend bearish.

From a technical perspective, the downtrend could extend to lower support levels if bears (sellers) push gasoline prices below $1.96. In this scenario, the next bearish target could be the $1.94 mark.

Please note that that bearish outlook should be invalidated if gasoline’s value exceeds $1.97, a resistance level backed by the 50-period SMA.