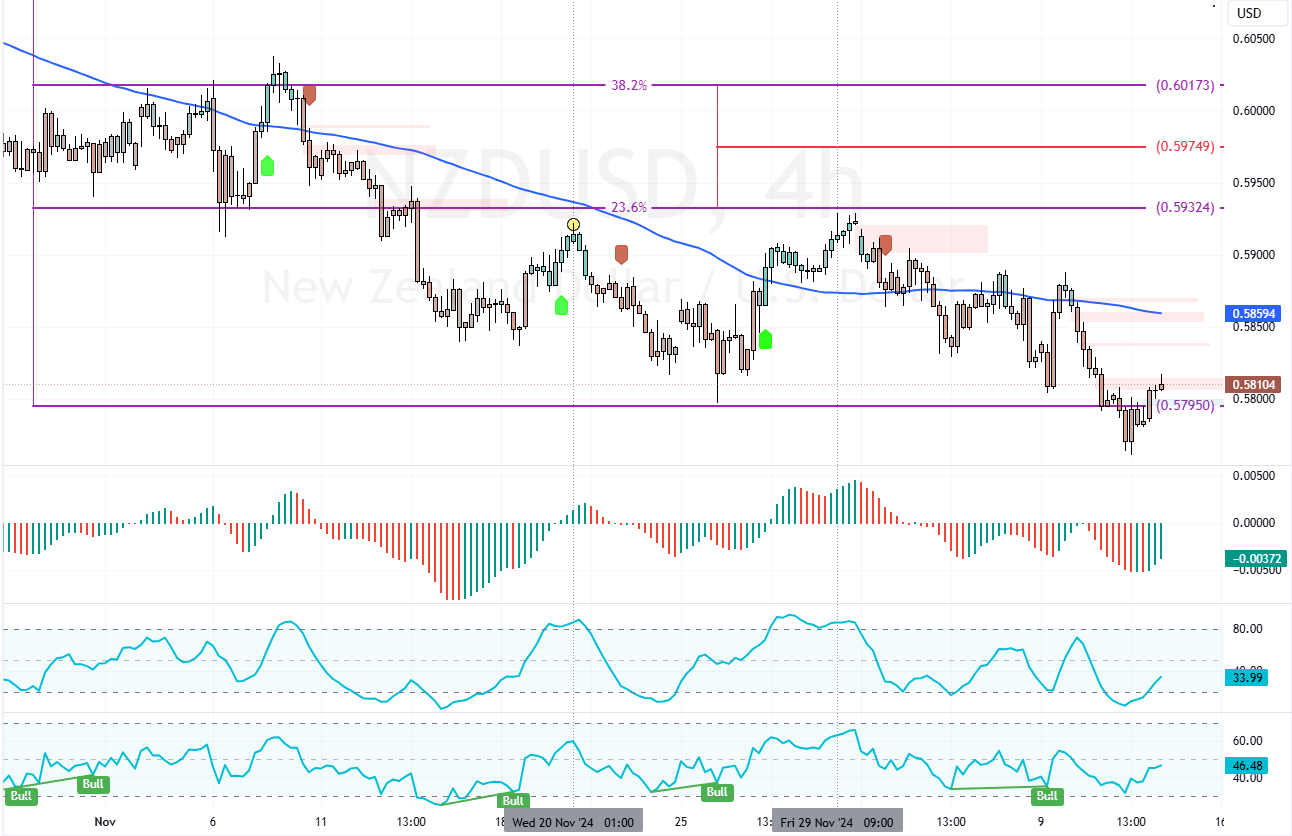

The NZD/USD currency pair edged closer to $0.581, making a small correction after hitting its lowest point in two years the day before. This mild recovery followed the release of US inflation data, which strengthened the belief that the US Federal Reserve will cut interest rates by 25 basis points next week.

NZD Faces Pressure from Potential Yuan Weakness

Despite this slight improvement, the New Zealand dollar still faces challenges. Reports suggest that China may let its currency, the yuan, weaken further next year to counter US tariffs.

Because New Zealand relies heavily on China for exports, a cheaper yuan often pressures the Kiwi.

- Also read: GBPUSD Nears 4-Week High on BoE Stance

Expected NZ Rate Cut by 50 Basis Points

Closer to home, many experts think the Reserve Bank of New Zealand will reduce its interest rates by another 50 basis points in February. This expectation also weighs on the New Zealand dollar, making it harder for the currency to gain strength.