USD/PLN Forecast – Bulls Poised for $3.93 Breakthrough

FxNews—The American currency is in a bear market against the Polish Zloty. The downtrend, which began on April 16 at $4.12, has eased after it reached April’s all-time low at $3.91.

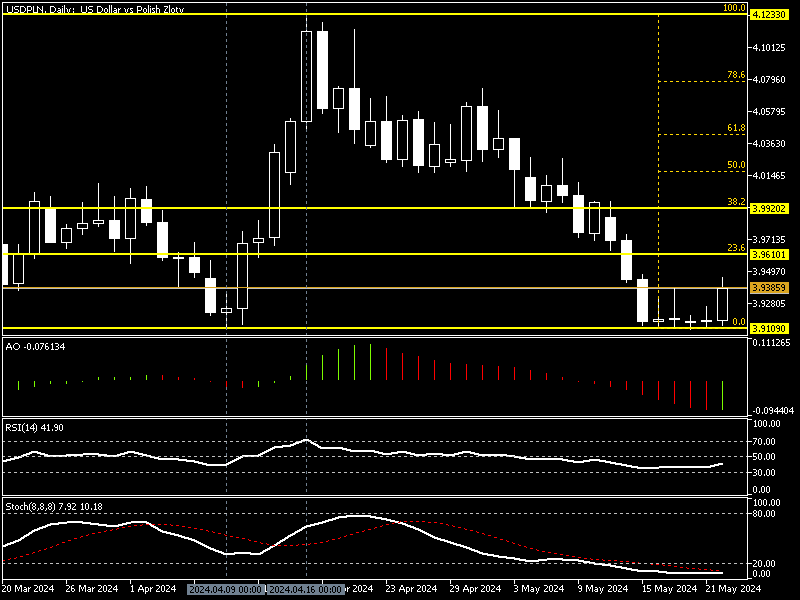

USD/PLN Technical Analysis Daily Chart

At the time of writing, the USD/PLN currency pair trades slightly below the immediate resistance at $3.93. The current pullback from $3.91 was expected because the stochastic oscillator has been residing in the oversold territory for eight consecutive days.

Other technical indicators show signs of bullish momentum, with the RSI value rising and approaching the middle line and the awesome oscillator bars turning green, recording -0.076 in the histogram. But AO bars are still below the signal line.

These developments in the technical indicators in the daily chart suggest the primary trend is bearish. Still, the USD/PLN pair might erase some recent losses by aiming for the upper resistance level.

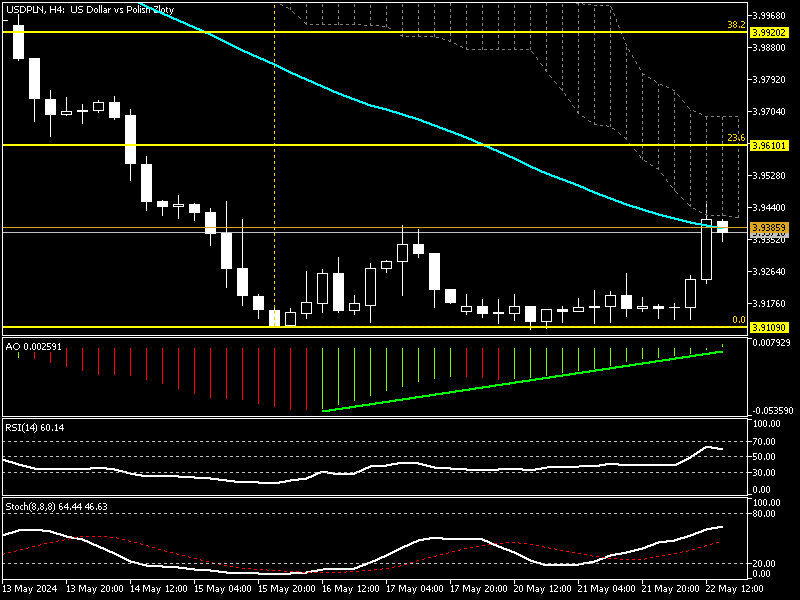

USD/PLN Technical Analysis 4-Hour Chart

The 4-hour chart provides more details of the price action. As shown in the diagram above, the bulls are trying to surpass the immediate support at $3.93, a level backed by EMA 50. The awesome oscillator bars are green and flipped above the signal line, demonstrating 0.0025 in the description. This indicates that the market is showing bullish momentum.

The relative strength index (RSI 14) value is 59, floating above the middle line, showing uptrend momentum. The stochastic oscillator %K line is rising, aligning with RSI’s signal.

These developments in the technical indicators in the 4-hour graph suggest the trend might reverse or the pullback that began this week from $3.91 could expand further.

USD/PLN Forecast – Bulls Poised for $3.93 Breakthrough

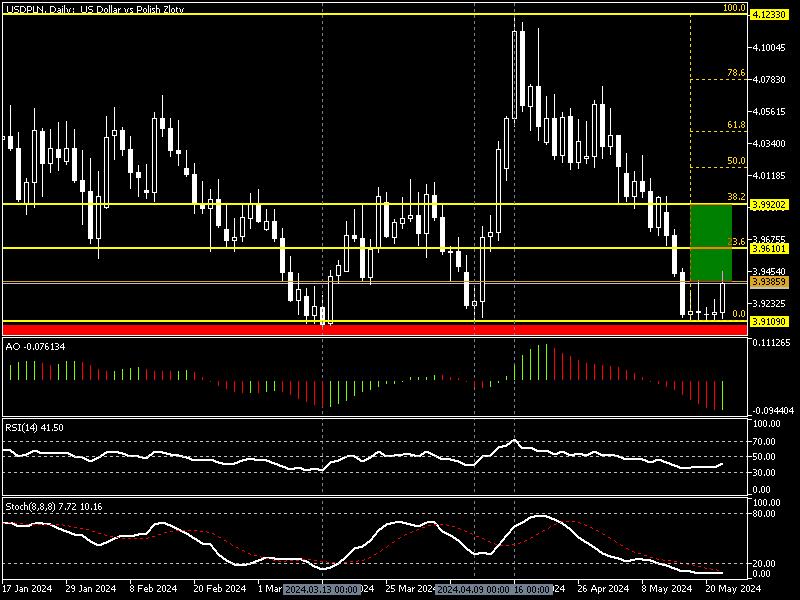

From a technical standpoint, the USD/PLN pair is in a bear market. However, if the bulls can make a precise cross above the immediate resistance ($3.93), the path to the 23.6% Fibonacci retracement level at $3.96 will likely be paved. If the bulls lift the price above the $3.93 mark, the follow-up target resistance is $3.99.

The Bearish Scenario

On the flip side, the $3.91 immediate support is robust. The USD/PLN price has bounced back from this point multiple times in the chart history. It aligns with the lowest prices in April and February. The image above clearly shows that the price bounced at least three times from the key support.

That said, for the downtrend to resume, the bears must close and stabilize the price below the $3.91 mark. If this scenario occurs, the downtrend can extend to the December 2023 all-time low at $3.88.

USD/PLN Key Support and Resistance Level

Traders and investors should closely monitor the USD/PLN key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $3.91, $3,88

- Resistance: $3.93, $3,96, $3,99

Employment Dips Again in Poland for Seventh Month

Bloomberg—Recent data shows that in April 2023, Poland’s corporate employment rate declined by 0.4% year-on-year to 6.499. The drop in corporate employment also had a 0.2% decline last month, but it is still slightly above investors’ expectations of 0.3%. This decline has been ongoing for seven consecutive months.

Employment also stalled by 0.1% in April, following the previous month. These developments in Poland’s economic data can boost the U.S. Dollar against the Polish Zloty.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.