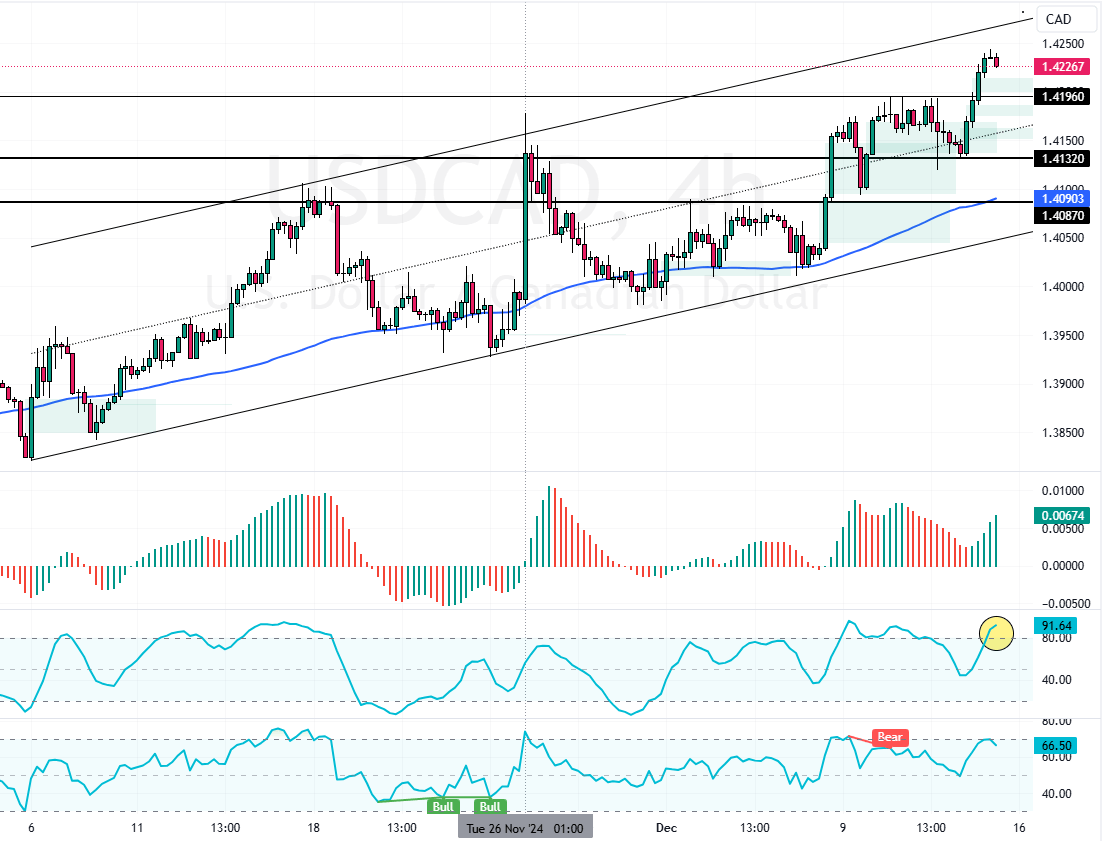

USD/CAD‘s uptrend resumed after it broke the 1.419 resistance, leaving a bullish fair value gap behind. Meanwhile, Stochastic signals were overbought, suggesting a correction before the bullish trend resumed.

The next bullish target could be 1.442 if the critical support level of 1.409 stands firm.

USDCAD Technical Analysis – 13-December-2024

FxNews—The currency pair‘s primary trend is bullish, above the 75-period simple moving average or the 1.409 support. As for the other key technical indicators, the Awesome Oscillator histogram is green, above zero.

However, Stochastic is overbought territory, meaning the American dollar is overpriced. The 4-hour price chart also formed a long upper shadow candlestick pattern, hinting at a consolidation phase or trend reversal.

Overall, the technical indicators suggest the primary trend is bullish and should resume after a minor dip toward the lower support levels.

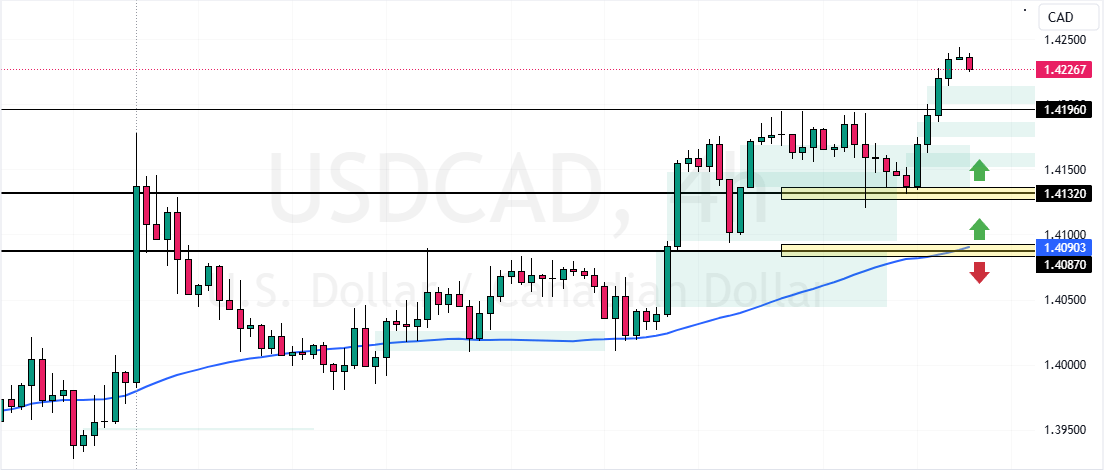

Eye Key USDCAD Levels Before Joining Bull Run

In most of our articles, we have stated that it is risky to join a bull market when the prices are high. The Stochastic’s overbought signal hints at this, suggesting retail traders and investors should wait patiently for USD/CAD to consolidate near lower-key support.

In this strategy, monitoring the key support levels at 1.419, 1.413, and 1.409 for bullish signals such as candlestick patterns is crucial. The uptrend will likely resume if the prices remain above the 75-period simple moving average or the ascending trendline. That said, the next bullish target could be 1.442.

Conversely, the bullish outlook should be invalidated if USD/CAD falls below 1.408.