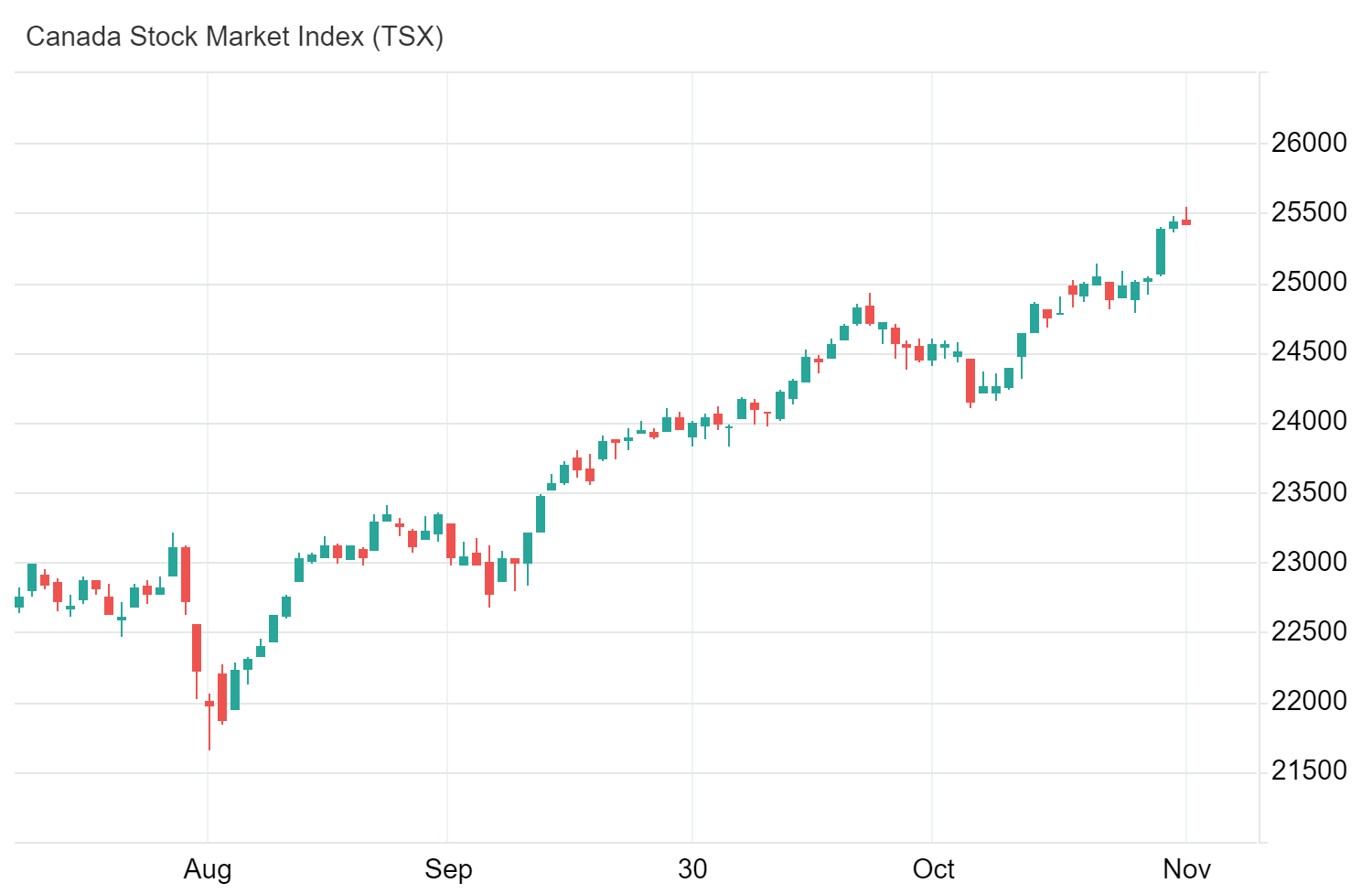

FxNews—The S&P/TSX Composite Index rose by 0.3% on Monday, surpassing the 25,400 mark to set a new high. This increase marks six straight sessions of gains, reflecting the USD/CAD trend.

Shopify Leads Market Surge with 2.5% Gain

Investors reacted positively to recent developments viewed as steps toward market stability. E-commerce giant Shopify led the gains with a rise of about 2.5%. Financial heavyweight Brookfield followed with a 1.9% increase, and Canadian Pacific Railway saw its stock climb nearly 2%.

On the downside, companies involved in precious metals experienced significant losses. Stocks like Agnico Eagle, Barrick Gold, Wheaton Precious Metals, and Franco-Nevada fell between 2.1% and 4%.

Meanwhile, market participants are looking ahead to Canada’s third-quarter GDP growth data, which will be released later this week.

- Also read: Watch AUDUSD for Potential Drop Below $0.657

USDCAD Technical Analysis

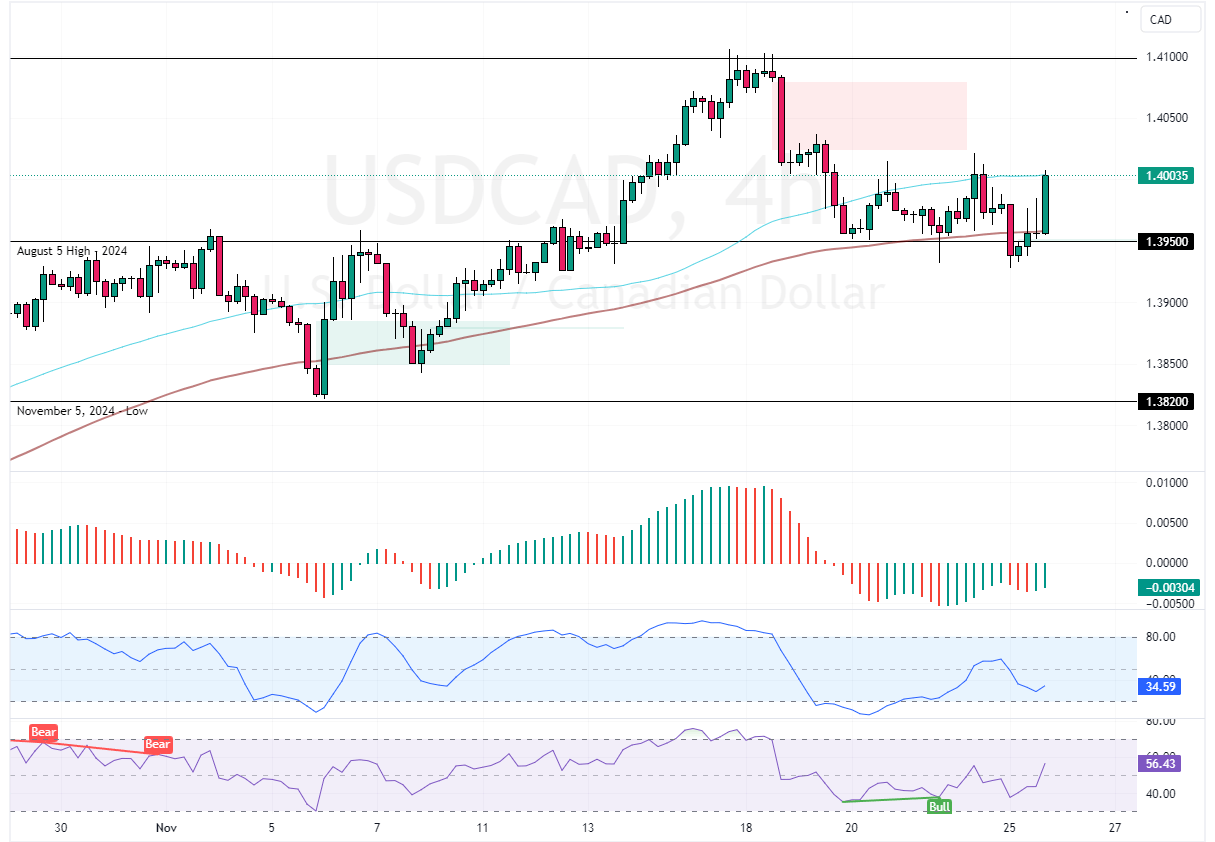

The American dollar trades bullish against the Canadian dollar. As of this writing, the currency pair trades at approximately 1.399. In today’s trading session, it bounced from the 100-period SMA.

This surge was due to the RSI indicator signaling a bullish divergence in the previous trading session.

USDCAD Set to Climb if Bulls Hold Key Support

The immediate support is at 1.395. From a technical perspective, the uptrend will likely resume if USD/CAD bulls maintain prices above the immediate support. In this scenario, the market could aim for the November high of 1.41.

- Good reads: GBPUSD Downtrend May Resume from $1.226

Please note that the bullish outlook should be invalidated if USD/CAD dips below 1.395. If this scenario unfolds, the pair could decline toward the November 5 low at 1.382.