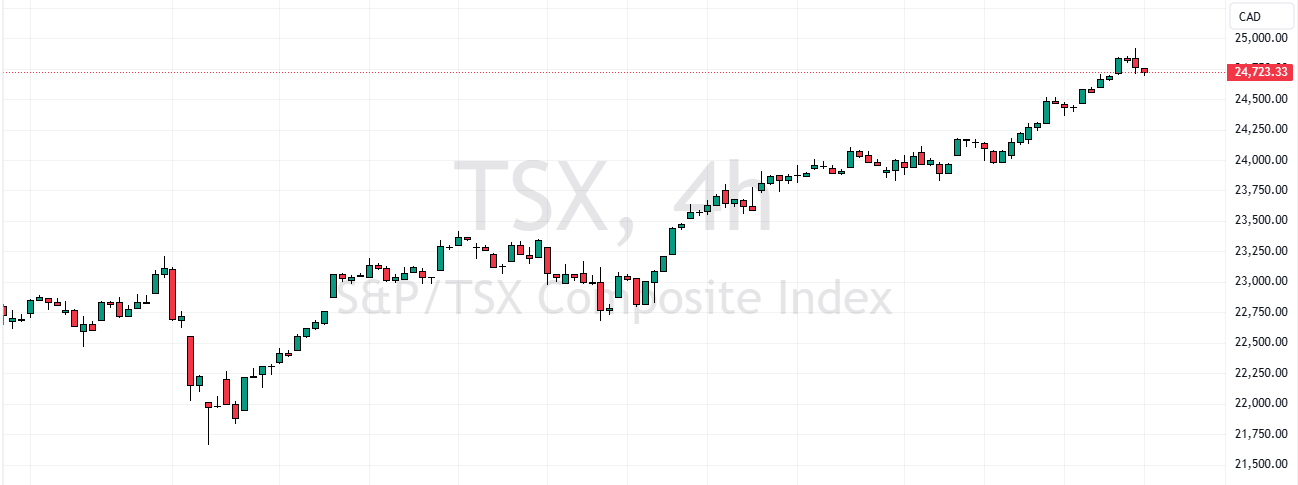

FxNews—On Monday, the S&P/TSX Composite Index dropped by 0.4% to 24,723, breaking its three-day run of gains.

Top Canadian Banks See Shares Dip Up to 1.6%

Major banks like RBC, Brookfield, BMO, Scotiabank, and Manulife saw their share values decrease between 0.6% and 1.6%.

Other key companies also experienced drops, including Enbridge, which fell by 0.9%, Canadian Pacific Railway by 1.4%, Canadian National Railway by 1%, and Constellation Software by 1.4%.

On a positive note, companies involved in energy and materials saw some gains, which helped reduce the Toronto stock market’s overall losses.

Bank of Canada Plans Major Rate Cut This Week

There’s anticipation of a major interest rate cut by the Bank of Canada, which is expected to be around 50 basis points this Wednesday. This would be the first significant cut in 15 years, apart from those made during the pandemic, prompted by recent lower-than-expected inflation figures.

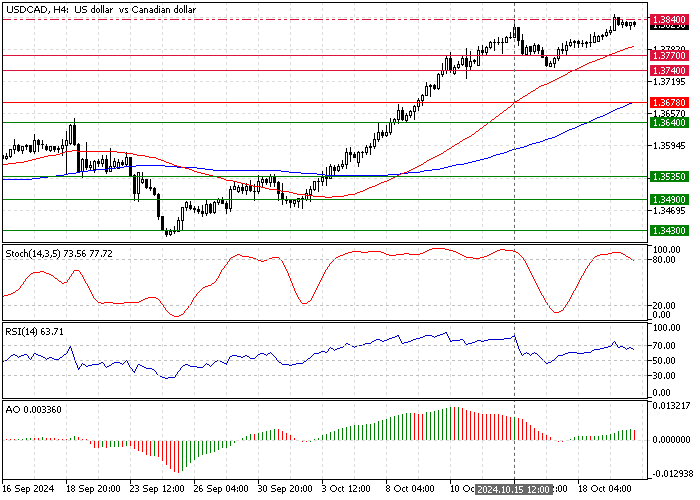

USDCAD Technical Analysis – 22-October-2024

The U.S. dollar is in a robust uptrend against the Loonie, testing the October 15 high at 1.3840. The primary trend is bullish because the price is above the 50-period moving average.

On the other hand, the Awesome Oscillator signal divergence resulted in the USD/CAD price consolidating near the 1.374 support, backed by the 50-period SMA.

From a technical perspective, the uptrend will likely resume if USD/CAD maintains a position above the 1.374 immediate support. The next bullish target in this scenario could be the 1.3945 resistance, the August 5 high.

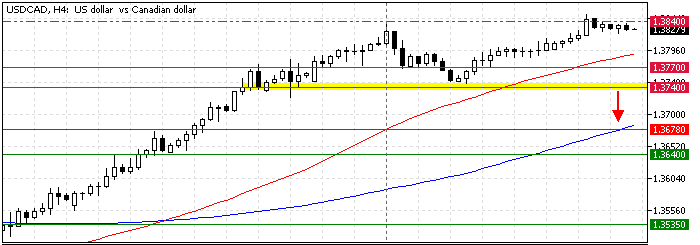

USDCAD Bearish Scenario

Conversely, the bullish outlook should be paused if bears push the price below 1.374. If this scenario unfolds, a new consolidation phase will likely begin, which could drop the price toward the 100-SMA at 1.367.

- Editor’s pick: EUR/USD Bear Market Prevails in Response to ECB Rate Cut

USDCAD Support and Resistance Levels – 22-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.377 / 1.374 / 1.367

- Resistance: 1.384 / 1.394