The USD/CAD currency pair has risen to 1.435, recovering from its lowest levels in January 2016. This increase comes as traders responded to two major political events:

- The resignation of Canadian Prime Minister Trudeau and U.S.

- President Trump’s dismissal of rumors about more severe tariffs.

Trudeau Resigns Amid Political Challenges

Trudeau decided to step down after a series of issues, including threats of tariffs, the loss of important political supporters, and a decline in his popularity. His resignation after nine years in office could lead to early elections.

Current opinion polls show that the Conservative Party, which supports tax reductions and stronger ties with Trump, is leading.

Trump Denies Washington Post Tariff Story

On another front, President Trump denied a Washington Post story, claiming his team is considering tariff plans that would affect vital imports from various countries, moving away from the broader tariffs he initially proposed during his campaign.

However, specifics on how these plans might impact Canada haven’t been disclosed.

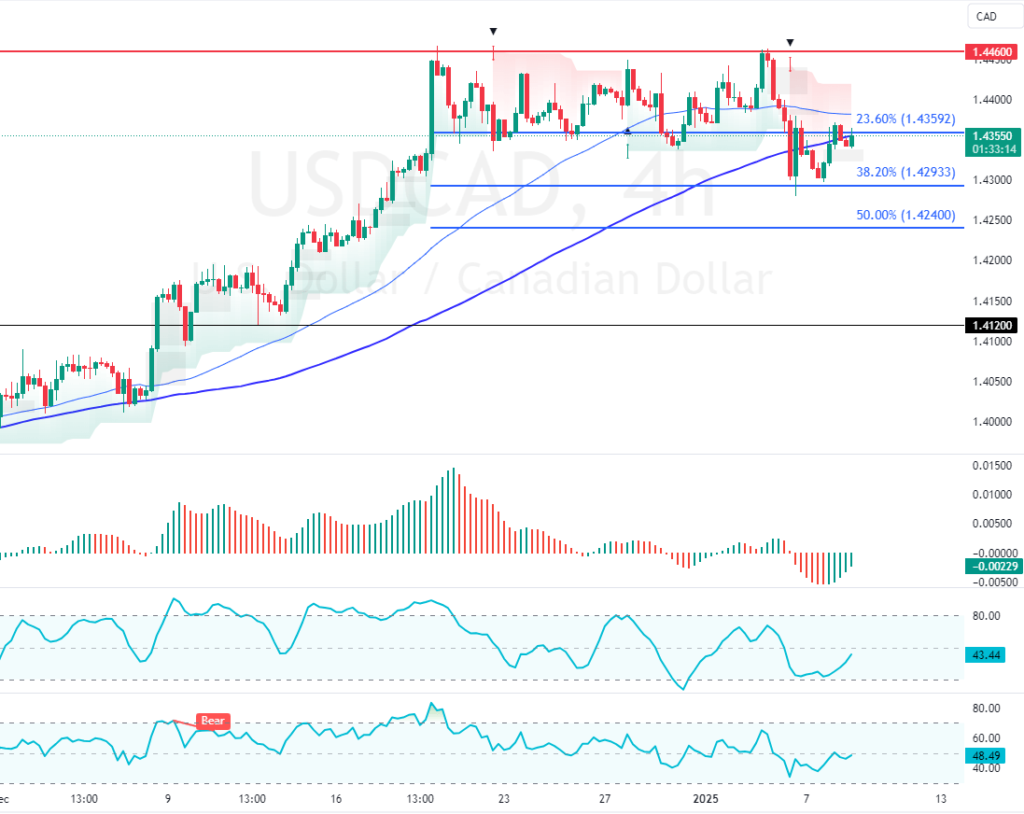

USDCAD Technical Analysis – 8-January-2025

As of this writing, the currency pair trades at approximately 1.435, testing the 23.6% Fibonacci resistance level. The Awesome Oscillator, RSI, and Stochastic are rising, suggesting the bull market should resume.

From a technical perspective, a firm close above 1.435 resistance can potentially trigger the uptrend, targeting 1.446.

Please note that the bull market should be invalidated if USD/CAD dips below the 38.2% Fibonacci support level at 1.429. If this scenario unfolds, the bearish wave from 1.446 could extend to the %50 Fibonacci level at 1.424.