The Canadian dollar has dropped toward 1.4 per U.S. dollar, marking its lowest point since May 2020. This decline stems from a surge in U.S. dollar buying, falling oil prices, and concerns about China’s economic growth.

Dollar Rises as Markets Eye Trump’s Policies

The U.S. dollar strengthened because markets anticipate that inflationary policies, possibly linked to Trump’s potential return, could restrict the Federal Reserve’s ability to lower interest rates.

Moreover, proposed sanctions on imports to the U.S. have raised worries about decreased demand for Canadian exports to its primary trading partner.

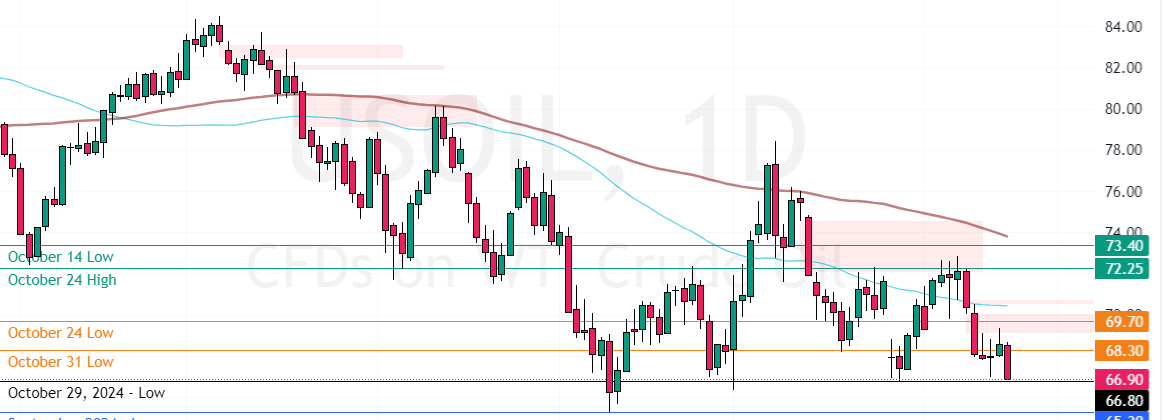

Candian Dollar Struggles Amid Falling Oil Prices

Another factor in Cad’s downfall is declining oil prices and a weakened demand outlook from China after disappointing economic data and stimulus efforts. However, Canada’s economy has shown resilience.

A lower-than-expected unemployment rate and positive Purchasing Managers’ Index (PMI) data have reduced expectations for significant interest rate cuts by the Bank of Canada, helping to limit the Canadian dollar’s decline.

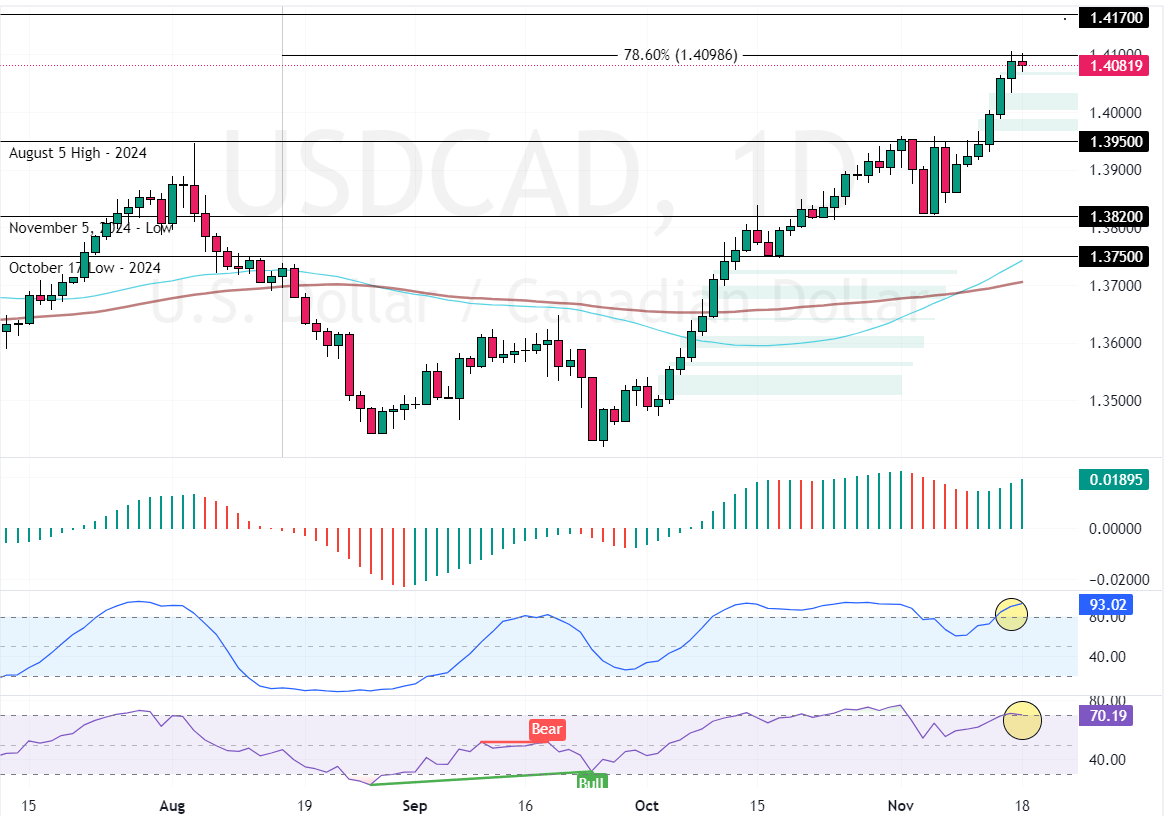

USDCAD Technical Analysis

The USD/CAD’s primary trend is bullish, above the 50- and 100-period simple moving averages. As of this writing, the currency pair in discussion is testing the 78.6% Fibonacci at 1.409.

Meanwhile, the Stochastic Oscillator and RSI records show 93 and 70 in the description, respectively, meaning the U.S. dollar is overpriced in the short term.

Overall, the technical indicators suggest while the primary trend is bullish, the USD/CAD currency pair has the potential to dip and consolidate near lower support levels.

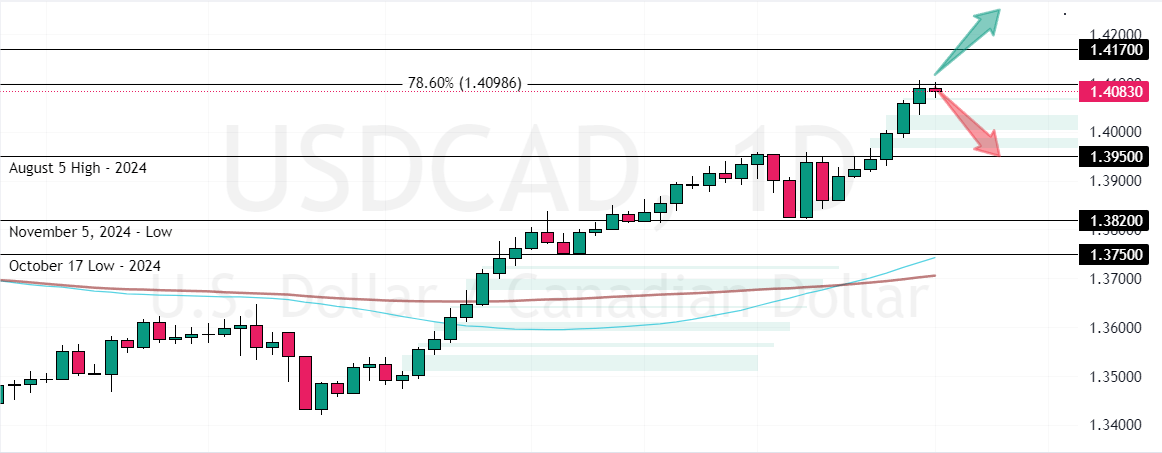

USDCAD Price Forecast

The immediate resistance is at 1.409, while the immediate support rests at 1.395. From a technical perspective, USD/CAD can potentially decline toward immediate support if the 78.6% Fibonacci level holds.

On the other hand, a new bullish wave could begin if bulls pull the price above the immediate resistance (1.409). In this scenario, the USD/CAD prices could target the 1.417 mark.

- Support: 1.395 / 1.382 / 1.375

- Resistance: 1.417 / 1.50