FxNews—On Thursday, the S&P/TSX Composite Index, Canada’s main stock market index, fell by 1.4% to close at 24,157, its lowest level in three weeks. The decline was mainly due to poor performances by commodity producers, such as mining and energy companies.

Agnico Eagle Shares Drop Despite Strong Third Quarter

Mining stocks were among the hardest hit. Agnico Eagle’s shares dropped by 2.1%, even though the company had a strong third quarter. This was because gold prices decreased from their record highs. Major mining companies like Barrick Gold and Wheaton Precious Metals saw their stock prices fall by 3.5% and 2.1%, respectively.

The energy sector also pulled the market down. Cenovus Energy led losses in this sector, with its stock declining by 3.4% after it reported disappointing third-quarter results. Meanwhile, large companies such as RBC (Royal Bank of Canada), Shopify, and Brookfield also performed poorly, with their shares decreasing between 1.8% and 2.1%.

On the economic side, preliminary estimates suggest that Canada’s economy grew by 0.3% in September, bringing third-quarter growth to 0.2%. Despite the recent declines, the TSX index managed to post a 0.7% gain in October.

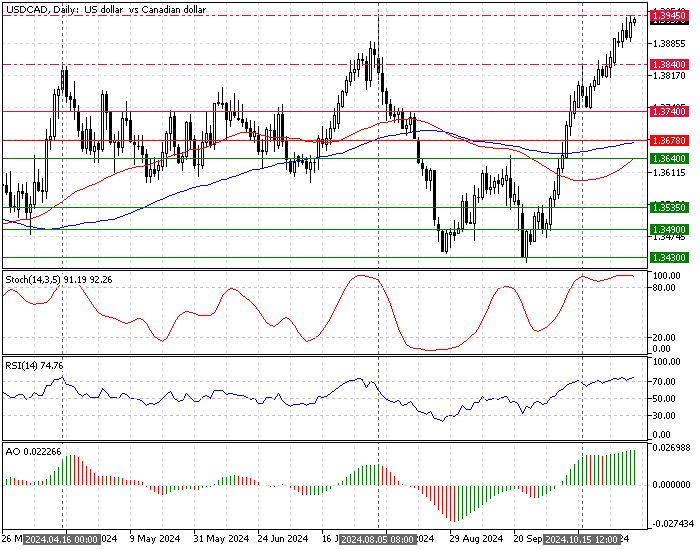

USDCAD Technical Analysis – 1-Novermber-2024

The U.S. Dollar is in a strong uptrend against the Loonie, poised to break the 1.394 resistance. Interestingly, USD/CAD pulled back from 1.394 before August 5.

Additionally, the Stochastic Oscillator and RSI 14 hover in overbought territory on the daily chart. This development in the technical indicators means the U.S. dollar is overpriced against its northern neighbor, the Canadian dollar.

USDCAD Overbought at 1.399 Resistance – Is a Drop Coming?

Therefore, it is not advisable to join a bull market when it is saturated with buying pressure. We suggest waiting patiently for the USD/CAD price to consolidate near the lower support levels, starting with 1.384. This level can provide a decent bid to join the bull market.

Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.384 / 1.374

- Resistance: 1.394 / 1.412