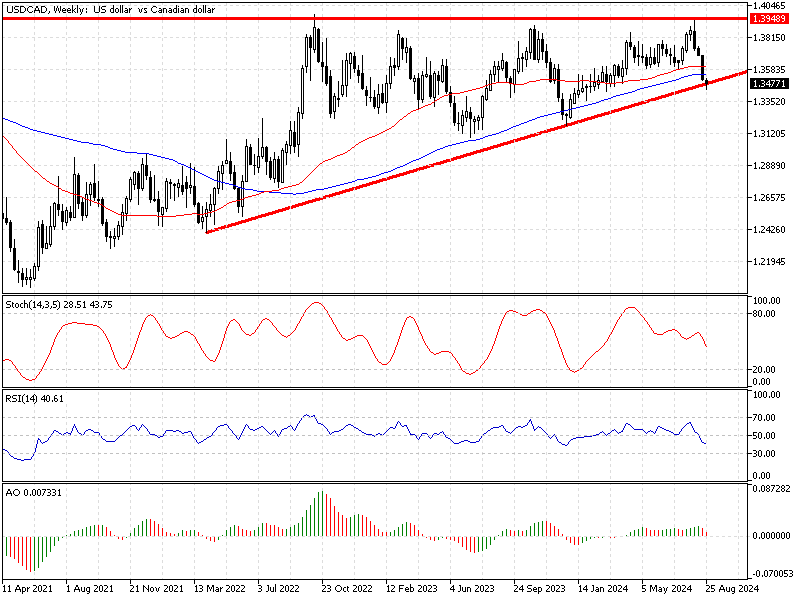

FxNews—The U.S. Dollar dipped to 1.343 this week against the Canadian dollar, a level supported by the robust ascending trendline shown in the weekly chart below.

As of writing, the USD/CAD currency pair trades at approximately 1.347, above the ascending trendline. The weekly chart below shows the price and the technical indicators utilized in today’s analysis.

USDCAD Technical Analysis – 30-August-2024

Zooming into the daily chart, we notice stochastic and relative strength index indicators hovering in oversold territory. This suggests the Canadian dollar is overpriced against the U.S. Dollar, and the market could bounce from the 1.343 mark.

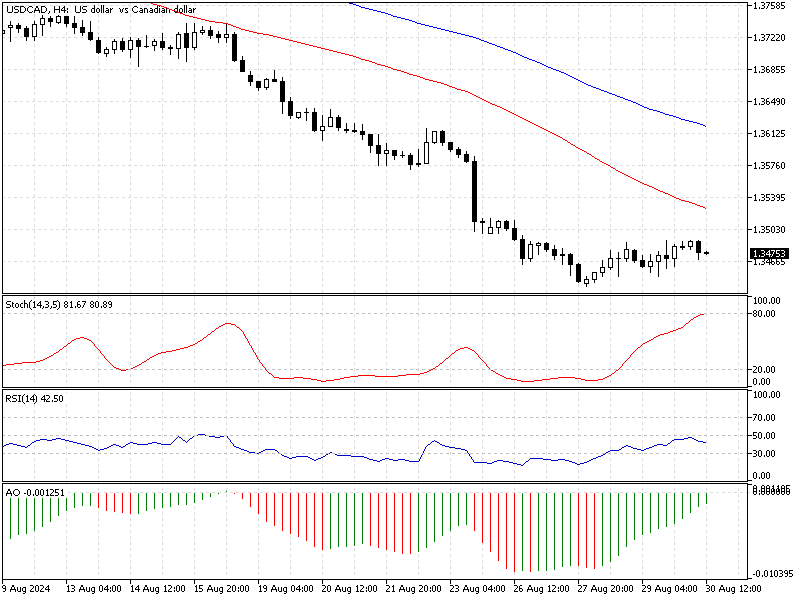

On the 4-hour chart, the USD/CAD price is below the 50- and 100-period simple moving averages, meaning the primary trend is bearish. Interestingly, the trading security in discussion trades inside the bearish channel, another sign of the robust downtrend.

- The awesome oscillator bars are green and approaching the signal line, indicating the downtrend is losing momentum.

- The relative strength index indicator is below the median line, signifying the bears are still in control.

Overall, the technical indicators suggest the primary trend is bearish, but the price could consolidate near the upper resistance levels.

USDCAD Forecast – 30-August-2024

As of writing, the USD/CAD price is testing the upper line of the bearish channel. From a technical standpoint, the downtrend is valid if the price remains below the 50-period simple moving average at approximately 1.352.

In this scenario, the pair will likely continue the primary trend by dipping to the August 28 low at 1.343. Furthermore, if the selling pressure exceeds 1.343, the next support area will be the weekly chart’s 38.2% Fibonacci retracement level at 1.320.

- Also read: USD/CHF Technical Analysis – 30-August-2024

USDCAD Bullish Scenario – 30-August-2024

On the flip side, if the bulls (buyers) close and stabilize the price above the 50-period simple moving average, the correction phase begun on August 28 will likely extend to the 100-period SMA at approximately 1.361.

Furthermore, if the buying pressure exceeds 1.362, the next bullish barrier will be 1.369, the August 14 low.

USDCAD Support and Resistance Levels – 30-August-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.347 / 1.320

- Resistance: 1.352 / 1.361 / 1.369