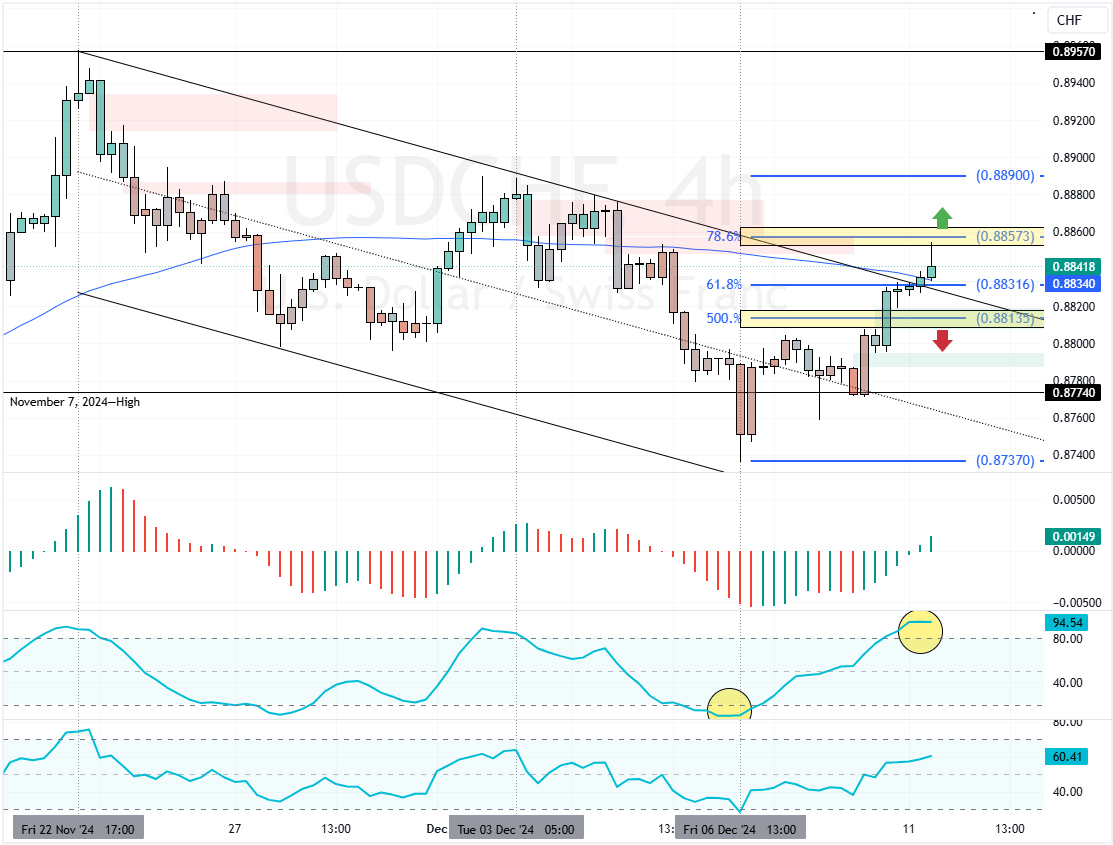

FxNews—The USD/CHF uptrend resumed from 0.875, as expected on Stochastic’s oversold signal on December 6. However, the bullish momentum eased after the prices reached the 0.885 resistance, backed by the 78.6% Fibonacci retracement level.

USDCHF Technical Analysis – 11-December-2024

As for the other technical indicators, the currency pair flipped above the 75-period simple moving average and the descending trendline, which signals a possible trend reversal.

However, because USD/CHF is overbought, the prices are likely to consolidate before the uptrend resumes. In this scenario, we expect the bears to push down the prices toward the 61.8% Fibonacci support level at 0.883, followed by 0.881. These supply zones can potentially provide a decent bid to join the bull market.

Therefore, retail traders and investors should monitor 0.883 and 0.881 for bullish signals, such as candlestick patterns. The USD/CHF’s next bullish target in this strategy could be the December 3 high at 0.889.

- Also read: NZDUSD Bears Dominate But Reversal Looms

Please note that the bullish outlook should be invalidated if USD/CHF dips below the 50.0% Fibonacci support level at 0.881.