FxNews—The 10-year Swiss government bond yield is approximately 0.43%. This figure comes as investors reevaluate their expectations for monetary policies and the likelihood of rapid cuts to interest rates by the Federal Reserve decreases.

Swiss National Bank Relieved by 0.8% Inflation

In September, Switzerland’s inflation rate dropped to a three-year low of 0.8%, a decrease from 1.1% in the prior month. This drop was lower than analysts had predicted. With this reduction in inflation, there is less pressure on the Swiss National Bank (SNB) to lower interest rates significantly.

The SNB reduced its main interest rate by 0.25% to 1% in September 2024, marking the third cut in a row and bringing borrowing costs to their lowest point since early 2023.

USD Rises as U.S. Election Nears

The Swiss Franc is trading at about 0.865 against the U.S. dollar, near its lowest in two months. This is due to the stronger U.S. dollar, which is influenced by the upcoming U.S. presidential election and expectations that the Federal Reserve will slow down its rate reductions after recent strong U.S. economic reports.

SNB Eyes Rate Cut Amid Swiss Inflation Drop

Additionally, the ongoing slowdown in Swiss inflation has led to anticipations of a further rate decrease by the SNB at their next meeting in December. In September, inflation fell to 0.8%, the lowest it has been in more than three years, after falling from 1.1% in August.

With these continued drops, the SNB has hinted at the possibility of more rate cuts soon due to significantly reduced inflationary pressures.

- Editor’s pick: NATGAS at Key Resistance as Cold Weather Looms

USDCHF Technical Analysis – 22-October-2024

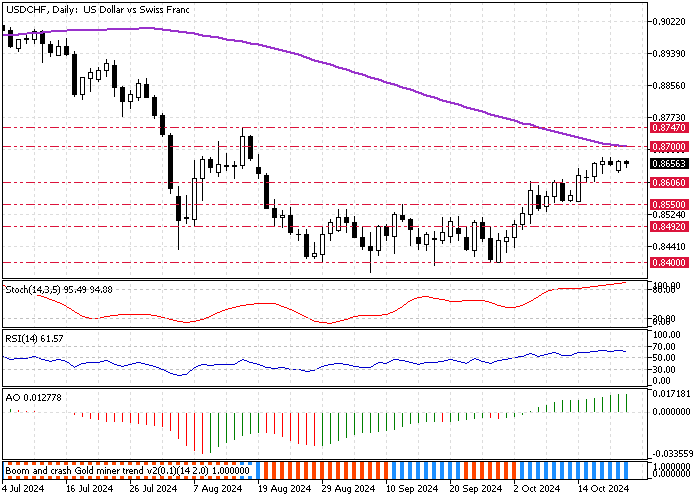

The USD/CHF currency pair trades in a robust bull market, approaching the 100-period daily moving average at approximately 0.87. The strong buying pressure that began at 0.84 resulted in the Stochastic Oscillator stepping above 80, signaling an overbought market.

However, the Relative Strength Index, or RSI 14, records 62 in the description, meaning the uptrend could resume.

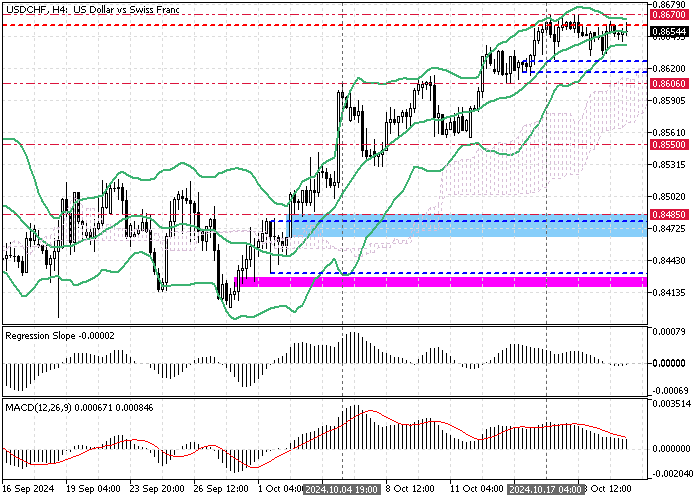

Zooming into the 4-hour chart, we notice Bollinger Bands narrowing down, which interprets as a low-momentum market. However, the pair trades above the Ichimoku Cloud, meaning the bull trend should prevail.

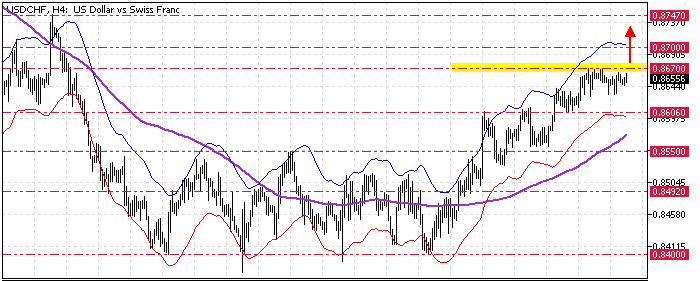

Overall, the technical indicators suggest the primary trend is bullish, and the uptrend should resume after a minor correction.

USDCHF Forecast – 22-October-2024

The October 17 high at 0.867 was the immediate resistance that halted the bullish wave. From a technical perspective, the bull market will likely resume if USD/CHF bulls exceed this mark. If this scenario unfolds, the next bullish target could be the August 15 high at approximately 0.874.

Please note that immediate support is at 0.8606, the October 4 high. The bullish outlook should be invalidated if the USD/CHF price dips below this critical resistance.

USDCHF Bearish Scenario

If bears (sellers) close and stabilize the USD/CHF price below the critical resistance at 0.8606, the consolidation phase could extend to the September 12 high at 0.855.

In this scenario, the Stochastic’s overbought signal in the daily chart will come into play, which could result in the Swiss Franc erasing more of its recent losses against the U.S. dollar. Hence, if the selling pressure exceeds 0.855, the next bearish target could be 0.8485, the October 1st high.

USDCHF Support and Resistance Levels – 22-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.8606 / 0.855 / 0.8485

- Resistance: 0.867 / 0.87 / 0.8747