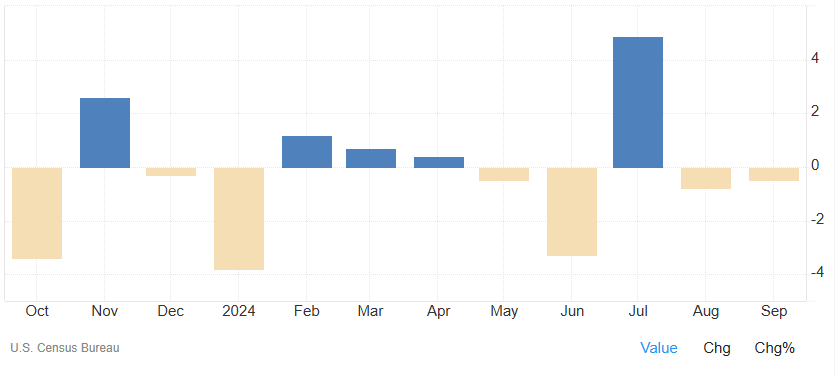

FxNews—In September 2024, new orders for manufactured goods in the United States decreased by 0.5% from the previous month, totaling $584.2 billion. This decline follows a revised 0.8% drop in August and is close to market predictions of a 0.4% decrease. These figures suggest that the U.S. manufacturing sector is slowing down.

Durable Goods Orders Fall Led by Transportation Dip

The decrease was mainly seen in industries that produce durable goods, items expected to last long. Orders in this category fell by 0.7%. Transportation equipment orders dropped by 3.1% to $95.4 billion, and machinery orders decreased by 0.2% to $37.6 billion.

Metal Orders Up 2.1% Amid Non-Durable Goods Drop

On the brighter side, orders for fabricated metal products increased by 2.1% to $37.4 billion, helping to lessen the decline. However, orders for non-durable goods—items not intended for long-term use—also fell by 0.2%.

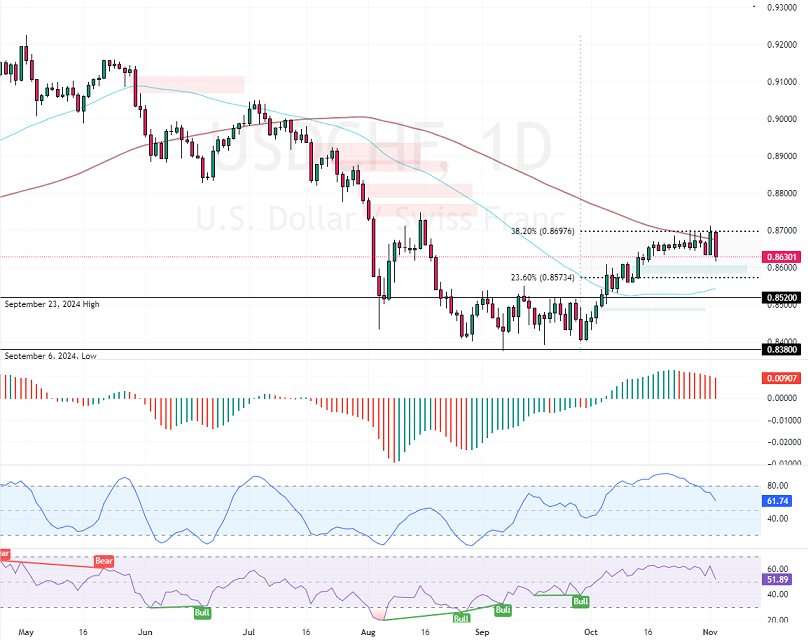

USDCHF Technical Analysis – 4-November-2024

The U.S. dollar has been trading bullish against the Swiss franc since early September 2024. However, the bullish momentum weakened after the price hit the 100-period daily moving average at 0.869, in conjunction with the 38.2% Fibonacci retracement level.

As for the technical indicators, the Awesome Oscillator histogram is red, declining toward the zero line from above, signaling that the downtrend is strengthening. The A.O.’s bearish signal is backed by the Stochastic Oscillator, which stepped down from the overbought territory, depicting 62 in the description and declining.

Overall, the technical indicators suggest the USD/CHF price hit a strong bullish barrier, which could cause it to consolidate or reverse from this point.

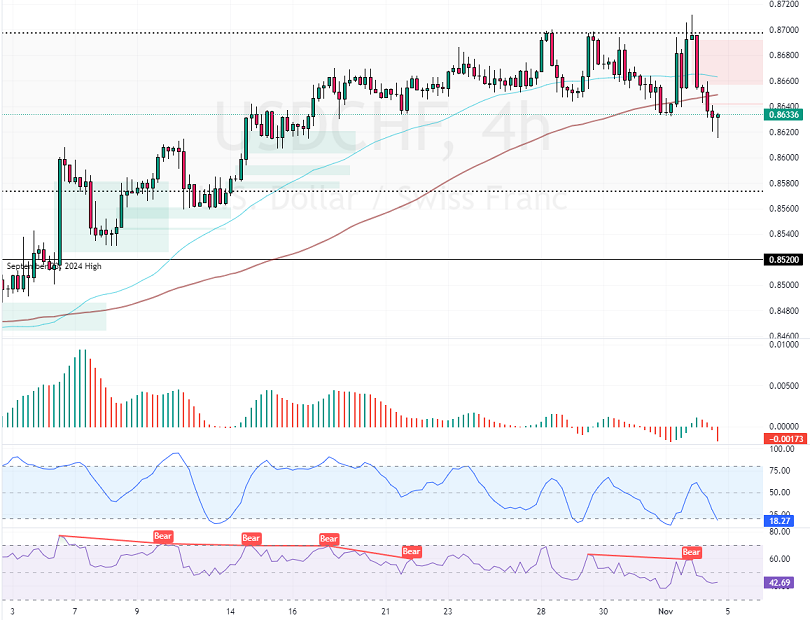

USDCHF Forecast – 4-November-2024

Zooming into the 4-hour chart, we notice USD/CHF stabilizes below the 100-period simple moving average, trading at approximately 0.863. The 38.2% Fibonacci retracement level at 0.869 is the critical resistance. That said, USD/CHF bears will likely target the 23.6% Fibonacci retracement level as support if the market holds below the 0.869 mark.

Furthermore, if the selling pressure pushes USD/CHF below 0.857, the downtrend could extend to the September 23 high at 0.852.

Please note that the bearish outlook should be invalidated if the price exceeds the 0.869 mark.