FxNews—The U.S. Dollar is in a bear market against the Swiss Franc. The downtrend accelerated after the price dipped below the July 25 low at 0.877. Fast-forward to August 5, when selling pressure eased near 0.843, below the 78.6% Fibonacci.

Furthermore, the robust selling pressure has driven the stochastic and RSI 14 momentum indicators into oversold territory in the USD/CHF daily chart. This means the Swiss Franc is overvalued against the greenback, currently trading at about 0.855. Hence, the market might witness a consolidation phase anytime now.

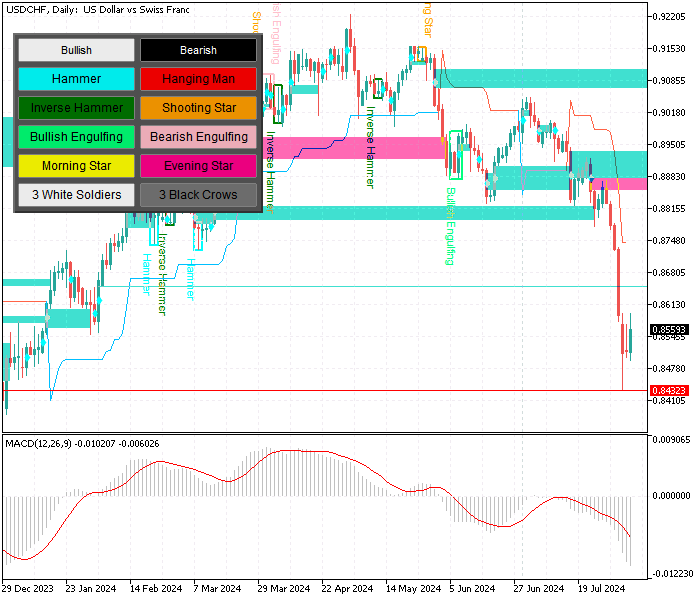

The diagram below demonstrates the price, Fibonacci levels, key support and resistance levels, and the technical indicators utilized in today’s analysis.

USDCHF Technical Analysis – 7-August-2024

We zoom into the 4-hour chart to examine the price action and the technical indicators more closely. As shown in the image above, the price is below the 50- and 100-period simple moving average, meaning the primary trend is bearish.

- The awesome oscillator bars are below the signal line, but their color has turned green, suggesting that the bear market has weakened.

- The relative strength index indicator and the stochastic oscillator have exited the oversold territory and are rising toward the middle. This development in the momentum indicators signifies that buyers are adding bids to the market.

In summary, the technical indicators suggest the primary trend is bearish. Still, a consolidation phase could be on the horizon, and the USD/CHF price might test the upper resistance levels.

USDCHF Forecast – 7-August-2024

The key resistance level is the 50% Fibonacci retracement level at 0.867, as well as the ‘fail value gap’ area. As of this writing, the USD/CHF pair trades above the 78.6% Fibonacci and the ascending trendline at about 0.855.

From a technical perspective, the uptick momentum that began on the August low at 0.843 could extend to the 61.8% Fibonacci at 0.855 if the price holds above the ascending trendline.

Furthermore, if the buying pressure exceeds 0.867, the next resistance level will be the 100-period SMA-backed resistance, the 0.877 mark (the July 25 low).

Please note that the bullish scenario should be invalidated if the USD/CHF dips below the August 5 low at 0.843.

USDCHF Bearish Scenario – 7-August-2024

The August 5 low at 0.843 was the key resistance that held the price down further. If the price dips below 0.843, the downtrend could be triggered. In this scenario, the bears’ path to the December 2023 low at 0.833 could be paved.

USDCHF Support and Resistance Levels – 7-August-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.852 / 0.843 / 0.833

- Resistance: 0.867 / 0.877

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.