FxNews—The interest rate on Switzerland’s 10-year government bonds has climbed to 0.5%. This increase rebounded from its lowest point over two years, 0.35% on October 1. This change occurs as investors anticipate less aggressive interest rate reductions by the Swiss National Bank.

Inflation Trends in Switzerland

In September, Switzerland recorded its lowest inflation rate in three years, dropping to 0.8% from a previous rate of 1.1%. This rate was lower than what traders and investors had predicted. The decrease in inflation suggests less pressure on the Swiss National Bank to make significant cuts to interest rates.

Impact of U.S. Job Market

A positive employment report from the U.S. has also influenced expectations. This report has helped calm fears about significant interest rate cuts by the U.S. Federal Reserve. The job news contributes to a steadier situation for the Swiss franc, making it less likely that Switzerland will need to lower its interest rates drastically.

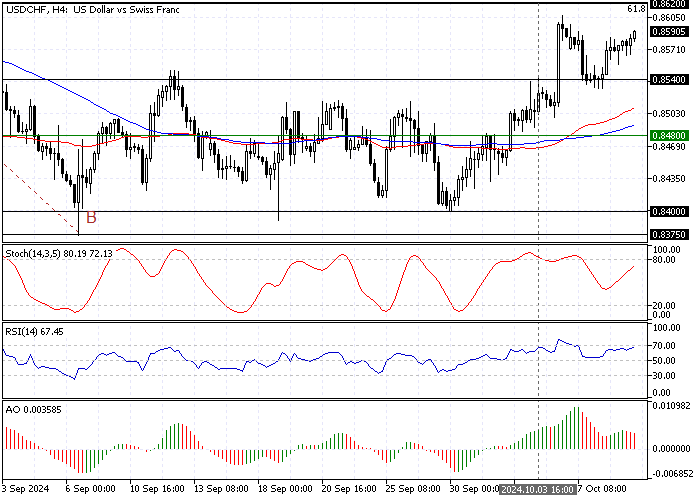

USDCHF Technical Analysis – 9-October-2024

The U.S. dollar trades in a bull market against the Swiss Franc at approximately 0.858, closing the gap to the August 14 low at 0.862. The primary trend is bullish because the USD/CHF rate is above the 50- and 100-period simple moving averages.

However, the Awesome oscillator shows signs of divergence, which could result in the USD/CHF value consolidating near the lower resistance levels.

On the other hand, the Relative Strength Index and Stochastic Oscillator record 66 and 71 in the description, respectively, meaning USD/CHF is not overbought, and the current bullish momentum will likely resume.

Overall, the technical indicators suggest the USD/CHF primary trend is bullish, and the bullish wave should resume and target higher resistance levels.

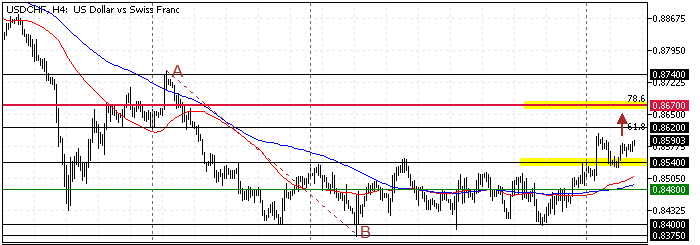

USDCHF Forecast – 9-October-2024

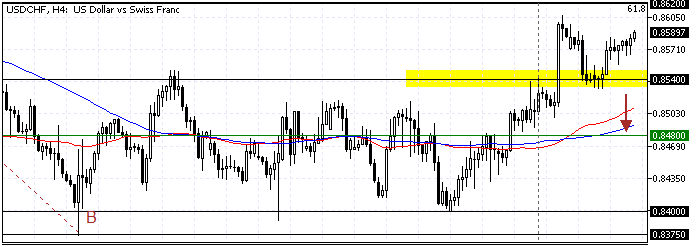

The critical support level to the bullish bias is at the October 3 high, the 0.854 mark. From a technical perspective, the USD/CHF uptrend will likely resume with 0.862 as the first target if the 0.854 level holds.

Furthermore, if the buying pressure exceeds the USD/CHF value above the 0.862 resistance, the next bullish target could be 0.867, the 78.6% Fibonacci retracement level of the AB bearish wave.

USDCHF Bearish Scenario – 9-October-2024

A new bearish wave could be triggered if the USD/CHF value drops below 0.854. If this scenario unfolds, the dip could spread to the 100-period simple moving average at 0.848.

Please note that the 100-period SMA plays the primary resistance for the bearish scenario if it plays out.

USDCHF Support and Resistance Levels – 9-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

Support: 0.845 / 0.848 / 0.840

Resistance: 0.862 / 0.867 / 0.874