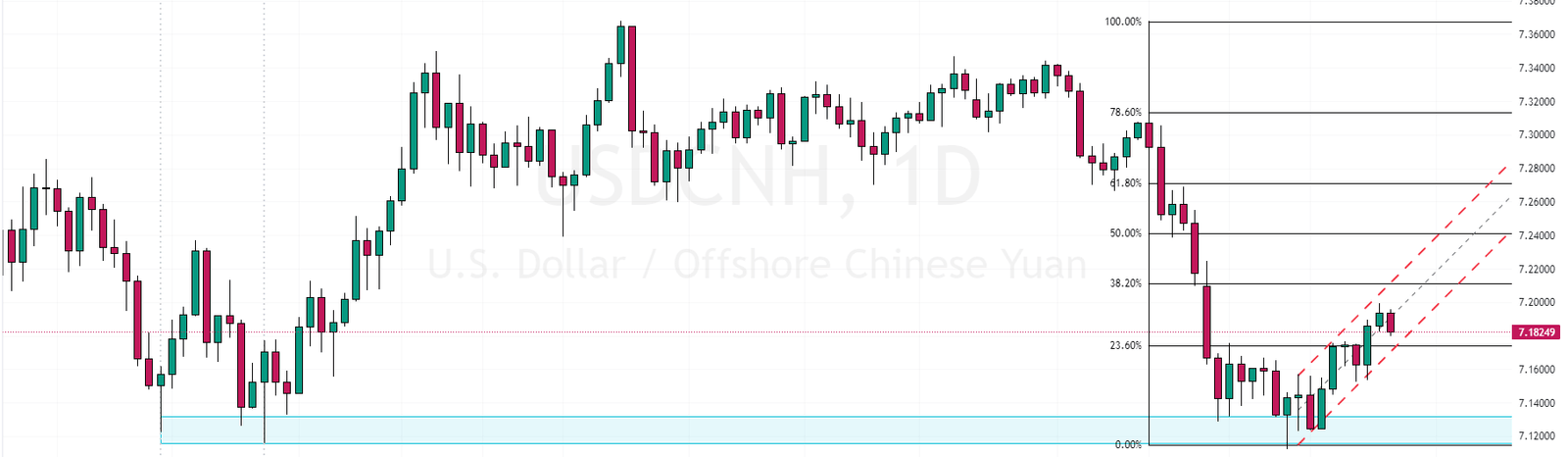

Technical Analysis—The USDCNH currency pair trades within a bullish channel. After reaching the upper band of the flag, the price has declined, indicating that the bears might be targeting the 23.6% support level. If this level remains intact, the bullish trend will likely continue. This upward trend began in late November, following a 2023 low of around 7.12 by the bears.

Conversely, the current bullish technical analysis will be invalidated if the USDCNH price falls below the 23.6% Fibonacci support level.

China Market Awaits Economic Data

Bloomberg—On Tuesday, China’s stock market showed mixed signals. The Shanghai Composite experienced a modest rise of 0.4%, closing at 3,003, while the Shenzhen Component slightly declined by 0.08%, ending at 9,625. This mixed trading pattern reflects the uncertainty among investors, who eagerly await crucial economic updates.

Investors are mainly focused on upcoming US inflation data and interest rate decisions from major central banks, which could significantly impact global financial markets. Domestically, the Chinese market is anticipating important data releases, including industrial production, retail sales, and unemployment figures. Additionally, decisions regarding the medium-term lending rates from the People’s Bank of China, scheduled for next week, are being closely monitored.

In a parallel development, China’s top leaders commenced a private meeting on Monday to set economic goals and formulate policy measures for 2024. Such high-level meetings often influence market directions as they can signal potential changes in monetary policy.

Amid these broader economic indicators, individual companies experienced varying degrees of success. Noteworthy gains were reported by firms like iSoftStone, which surged by 6%; Seres Group, with a 2.7% increase; and Sunyard System Engineering, climbing a significant 7.8%. On the other hand, there were notable declines as well, with Eoptolink Technology dropping by 4.6%, Zhongji Innolight falling by 4.3%, and COL Group decreasing by 1.9%.

Economic Impact and Outlook

The fluctuating stock market in China indicates the broader uncertainty in the global economy. While such volatility can create opportunities for investors, it poses risks, especially for those reliant on market stability. The upcoming economic data and policy decisions are crucial, as they can alleviate or exacerbate this uncertainty.