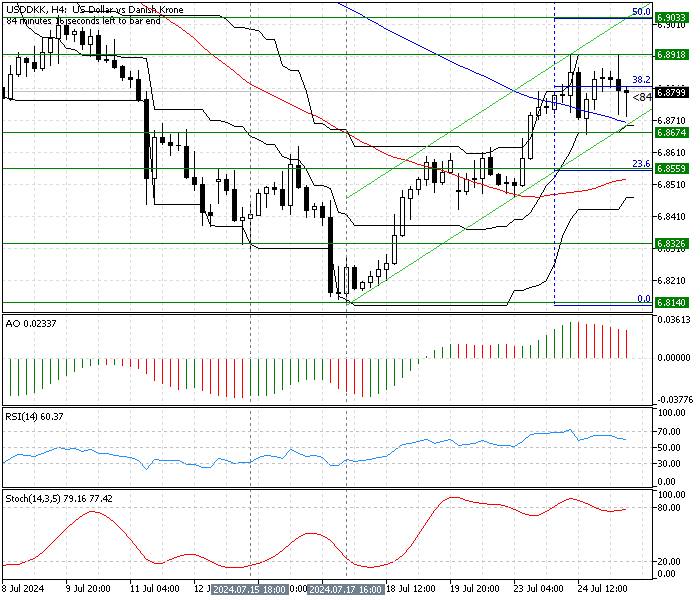

FxNews—The American currency is erasing recent losses against the Danish Krone. As of writing, the USD/DKK pair is trying to stabilize above the 100-period simple moving average in the 4-hour chart, trading at about 6.87.

USDDKK Technical Analysis 25-July-2024

The technical indicators in the 4-hour chart suggest the trend has reversed from a bear market to a bull market because the price hovers above the 50- and 100-period simple moving averages. However, the stochastic oscillator is about to step into overbought territory, meaning the U.S. Dollar could be overpriced against the Danish Krone.

Therefore, we might expect the price to consolidate near the ascending trendline (in green) before the uptrend resumes.

USDDKK Forecast – 25-July-2024

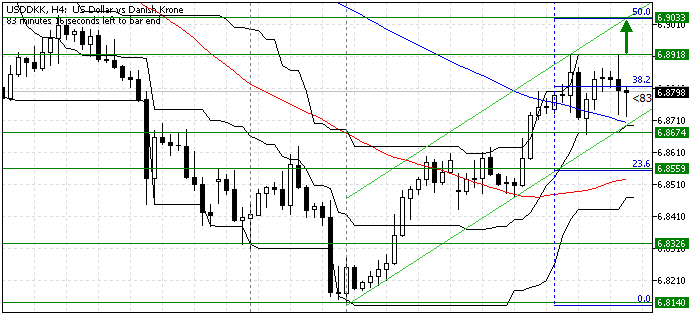

The ascending trendline and the 100-period simple moving average at approximately 6.867 provide immediate support for the current bullish momentum. For the uptrend to resume, bulls must keep the price above the immediate support and break out from the immediate resistance at 6.891.

If this scenario unfolds, the bullish trajectory could initially target the 50% Fibonacci level at 6.90, a demand area backed by the upper line of the bullish flag.

Please note that the bull market should be invalidated if the price dips below the key resistance level at the 23.6% Fibonacci, the 6.855 mark.

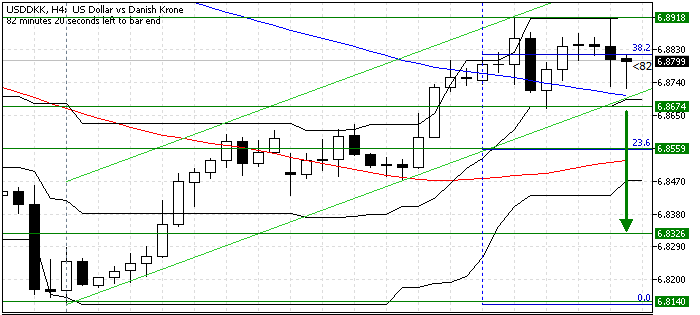

USD/DKK bearish Scenario – 25-July-2024

The key resistance level is at the 23.6% Fibonacci mark, the 6.855 mark. The downtrend will likely be triggered again if the bears (sellers) push the price below 6.855. In this scenario, the Bears’ road to the July 15 low at 6.832, followed by the July 17 low at 6.814, will be paved.

- Also read: Solana Technical Analysis – 25-July-2024

USD/DKK Key Levels – 25-July-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 6.867 / 6.855 / 6.832

- Resistance: 6.891 / 6.903 / 6.924

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.