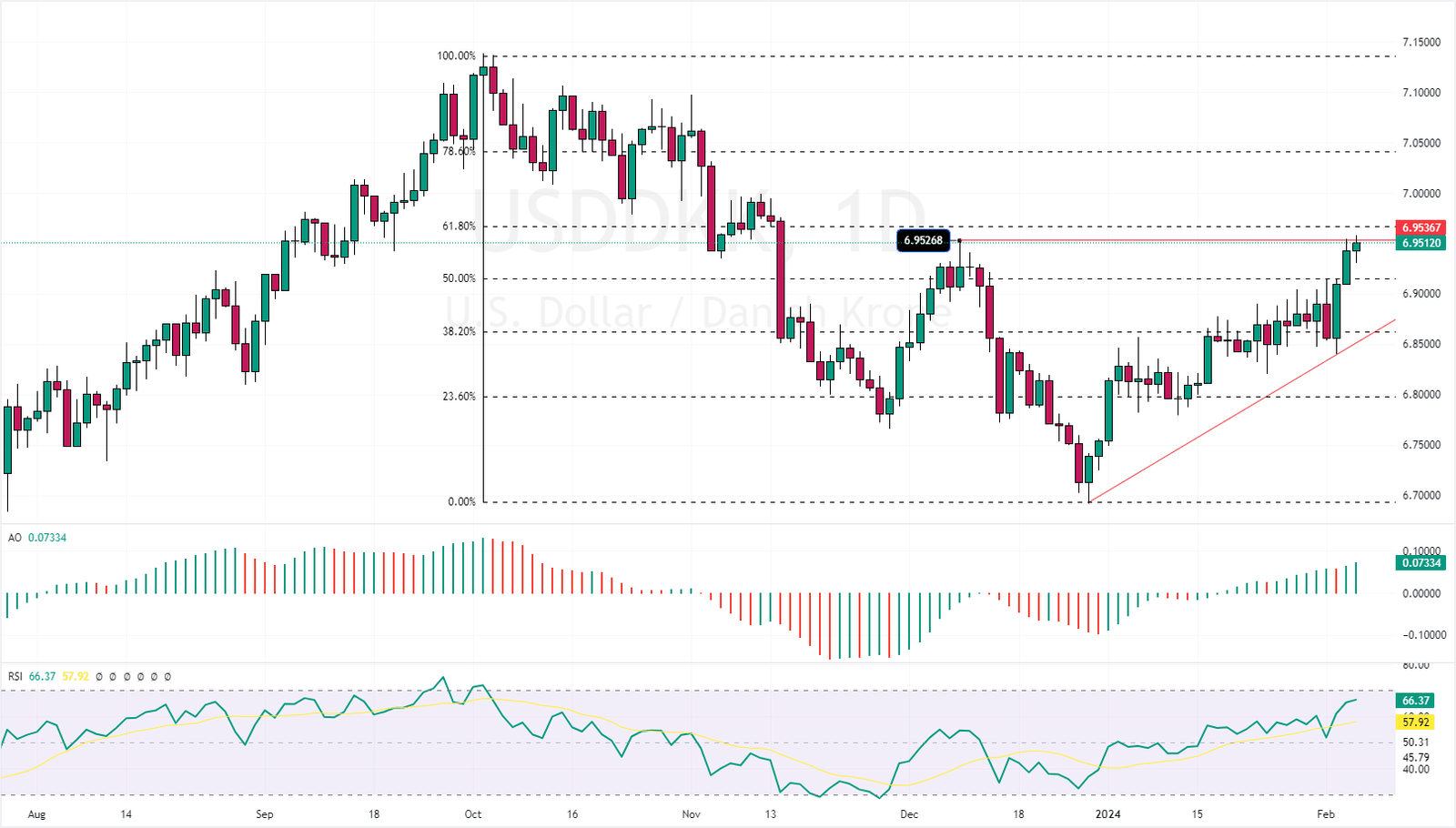

The USDDKK (U.S. dollar vs. Danish Krone) traded close to the 6.9 resistance in today’s trading session. The pair has a slight pullback from the resistance, and the price is 6.949 at the time of writing.

The trend seems bullish, with the RSI and awesome oscillator indicators hovering above the signal line. However, the 6.9 acts as a hurdle that might halt further increase in the pair’s price. The 50% Fibonacci retracement level further supports this resistance area, making it stronger.

USDDKK Forecast: 4-Hour Chart Analysis

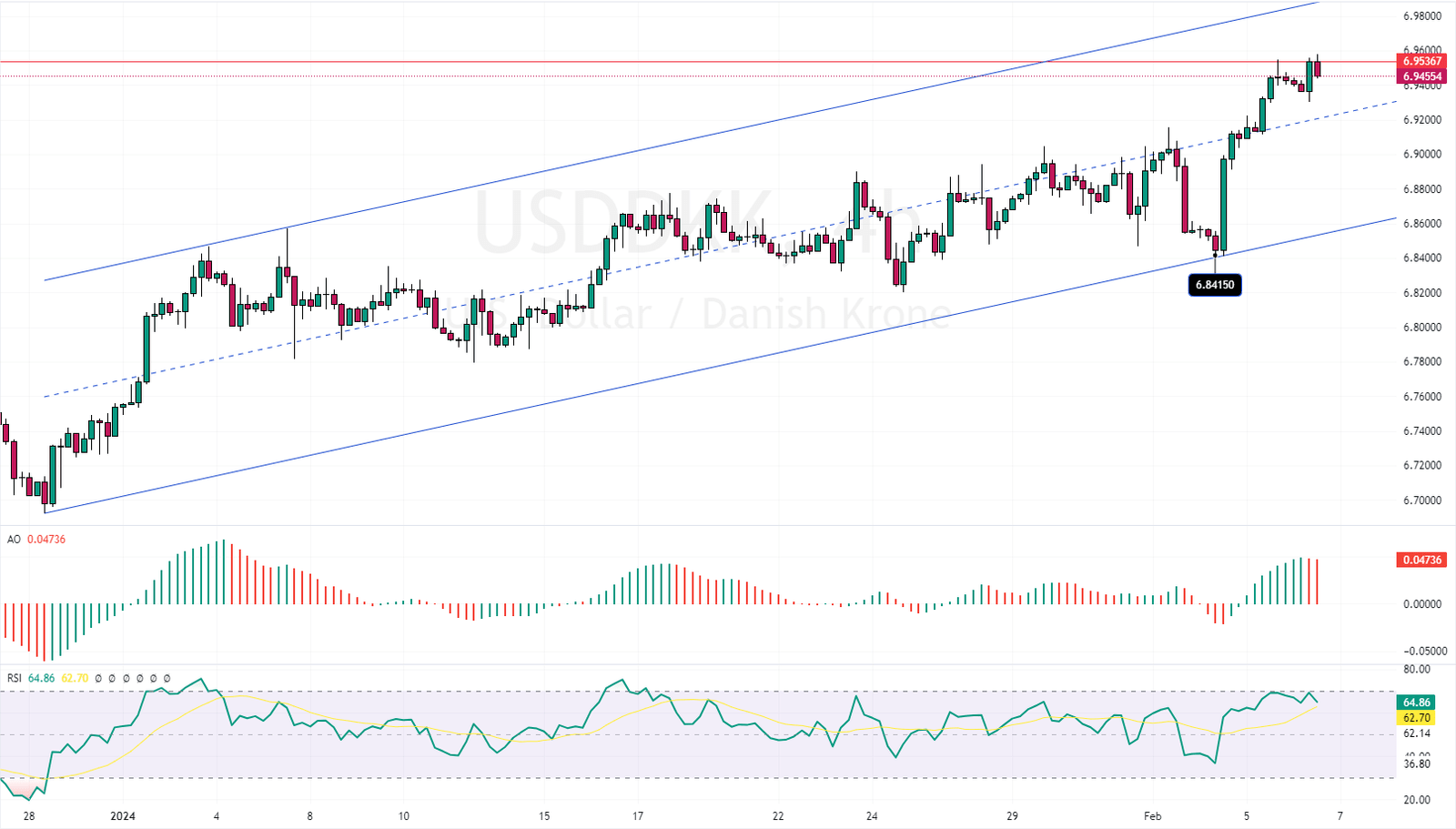

We should zoom into the USDDKK 4-hour chart to better understand the pair’s price action and what might be next.

The 4-hour chart provided us with new data. The pair is trading in the bullish flag, testing the 6.9 resistance as mentioned in the pair’s daily technical analysis. However, the RSI indicator is returning from the 70 level, and the Awesome oscillator bars have turned green, which could signal an imminent pullback or start of a consolidation phase.

In addition, the 4-hour chart formed a doji candlestick pattern, suggesting another correction might be on the horizon. From a technical standpoint, if the USDDKK price maintains a position below the 6.9 resistance or the 50% level of the Fibonacci, it might decline to 6.8 support, the lower band of the bullish flag.

Conversely, if the bulls close above the 6.9 resistance, the road to the upper flag band will be paved.

Copenhagen Index Hits Record Growth

Bloomberg—The Copenhagen stock market index reached a record 2532.00 points. In the last four weeks, it rose by 8.19%; over the past year, it grew by 33.7%.