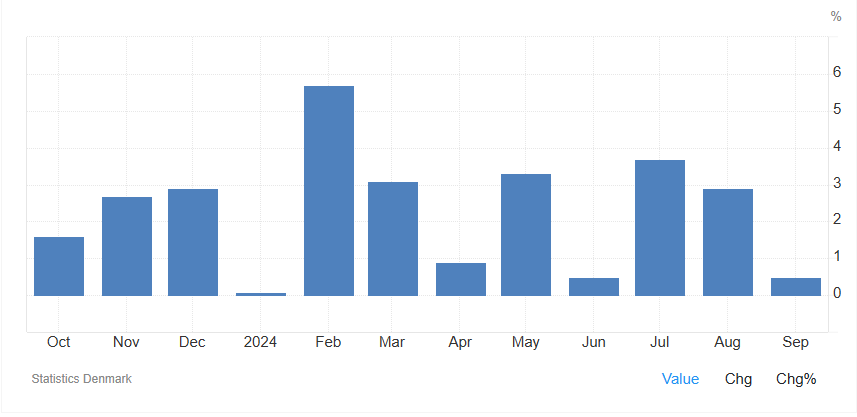

FxNews—In September 2024, retail sales in Denmark grew modestly by 0.5% compared to the same month last year, a decrease from the revised 2.9% growth seen in August. This represents the thirteenth month in a row of increases in retail sales, although it was the smallest rise since June.

Retail Woes: Food and Grocery Sales Drop 3.3%

Notably, sales dropped in the food and grocery sector, declining by 3.3% compared to an increase of 0.8% in August. Sales also slowed in the apparel sector, rising by 1.7% compared to 4.8% previously. In consumable goods, the increase was 3.6%, down from 4.5%.

When looking at the data on a seasonally adjusted monthly basis, retail sales slightly increased by 0.1%, following a small revision to 0.3% growth in the prior month.

USDDKK Technical Analysis & Price Forecast

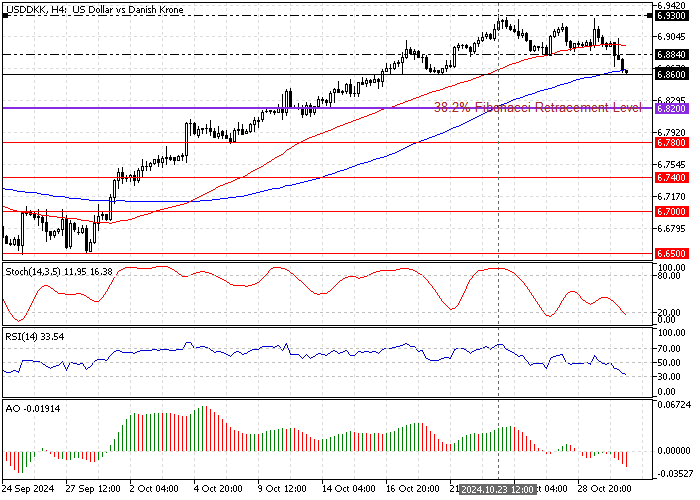

The American dollar has been experiencing a consolidation phase against the Danish Krone since October 23. The dip from 6.92 was expected because the Stochastic Oscillator’s record showed 91 in the description, meaning the Greenback was overvalued.

Consequently, the USD/DKK began a bearish wave that has extended to the 6.86 support, backed by the 100-period simple moving average of the 4-hour chart.

Interestingly, the Stochastic stepped into the oversold territory, meaning USD/DKK could bounce from this point. On the other hand, the Awesome Oscillator histogram is red, below the signal line, indicating the bear market should resume.

Overall, the technical indicators suggest the primary trend is bullish, but USD/DKK might dip to lower support levels.

Dipping Below 6.86 May Start a Downtrend

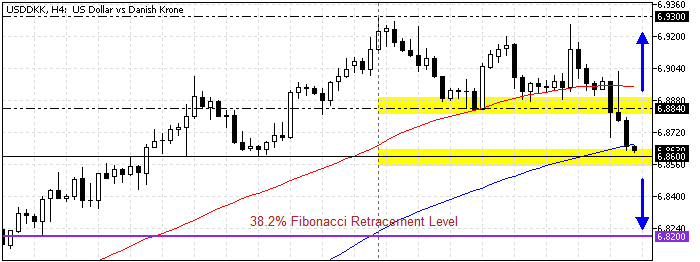

The critical support level is at 6.86, backed by the 100-period SMA. If USD/DKK closes and stabilizes below 6.86 (immediate support), the current downtrend could target the 38.2% Fibonacci retracement level at 6.82.

The Bullish Scenario

Conversely, the bearish outlook should be invalidated if USD/DKK buyers drive the price up and above the 6.88 (October 25 Low) resistance. If this scenario unfolds, the October 23 high at 6.93 could be revisited.

Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 6.86 / 6.82

- Resistance: 6.88 / 6.93