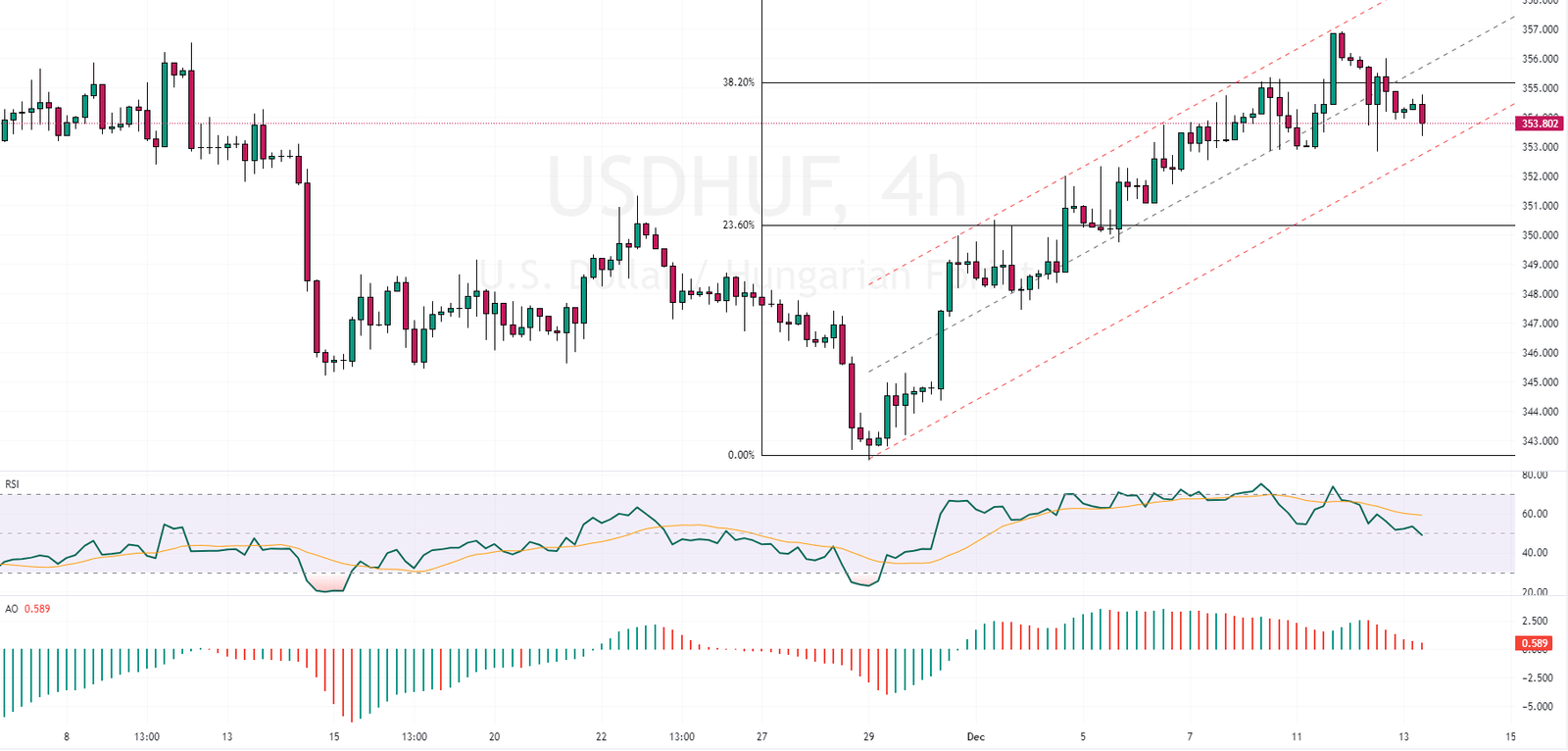

FxNews – The USDHUF currency pair has recently dipped below the 38.2% Fibonacci resistance level.

USDHUF Testing the Waters Below 38.2 Fibo Level

This drop results from the bulls’ inability to maintain the price above this key resistance, leading to a downward trend in the USDHUF pair. Presently, the pair is testing the lower boundary of the bearish flag pattern. The Relative Strength Index (RSI) and the Awesome Oscillator indicate a potential continuation of this downtrend. From a technical standpoint, for a definitive shift away from the current uptrend bias, the bears must secure a close below the flag’s lower boundary.

In this scenario, the USDHUF pair might face further declines, potentially reaching the 348 area and extending to the 346 level.

Conversely, the median line of the bearish flag still plays a critical role in our technical analysis. We could see the uptrend resume if the price exceeds this median line. The initial target would be the 50% Fibonacci resistance level in such a case.

Analyzing Hungary’s Stock Success

Bloomberg—The Budapest Stock Exchange experienced a remarkable achievement recently, with its BUX index reaching a historic peak of 59,042. This milestone represents a marginal increase from the previous trading session by just -0.49 (0.00%). Over the last four weeks, the Stock Index of the Budapest Stock Exchange has seen an encouraging growth of 3.35%. Even more impressive, the index’s value has surged by 31.33% over the past year. This robust performance in the stock market is a positive sign, reflecting investor confidence and a potentially healthy economic environment.

Challenges in the Industrial Sector

However, the picture is not entirely rosy. Hungary’s industrial sector has been facing challenges, as indicated by a 3.2% year-on-year drop in industrial production in October 2023. This decline, aligning with initial estimates and market expectations, marks the tenth month of reduced industrial activity. Although this decrease is the smallest since July, it raises concerns about the manufacturing sector’s health.

In detail, the most significant declines were in the production of computer, electronic, and optical products, which plummeted by 17.8%. Similarly, there were noticeable drops in manufacturing rubber plastics and other non-metallic mineral products, decreasing by 15.4%. The production of basic metals and fabricated metal products, excluding machinery and equipment, also fell by 4.6%, and the food, beverages, and tobacco sector saw a 2.8% decrease.

On the brighter side, some areas of manufacturing showed growth. The production of transport equipment rose by 4.9%, and electrical equipment manufacturing increased by 9%. Despite these gains, industrial output fell by 0.6% in October on a seasonally adjusted monthly basis, negating the 1.2% rise seen in September.

Economic Implications

The contrasting scenarios in Hungary’s stock market and industrial sector present a complex economic landscape. While the stock market’s growth is undoubtedly beneficial, signaling investor optimism and potentially leading to increased capital inflow, the persistent decline in industrial output is worrying.

It highlights potential weaknesses in the manufacturing sector, which could have long-term implications for job creation, exports, and overall economic stability.