The American dollar decreased slightly, about -0.3, against the Japanese Yen in today’s trading session. Uncertainty over the Bank of Japan’s future interest rate increases continues to pressure the Yen. On Monday, Bank of Japan Governor Kazuo Ueda indicated that any rate hikes would be gradual and based on how the economy performs. Still, he did not provide a specific timeline.

Traders Eye 160 Level for Potential Yen Intervention

Meanwhile, recent verbal warnings from Japanese authorities seem less effective in calming Yen’s downtrend against major currencies. Traders are now watching the 160 level closely, as reaching this point might prompt further government intervention.

Investors are also awaiting Japan’s October inflation data, scheduled for Friday, to understand the economic outlook better. At the same time, the Yen remains under strain due to a strong US dollar, supported by expectations that the Federal Reserve will maintain higher interest rates to combat inflation.

USDJPY Technical Analysis – 21-November-2024

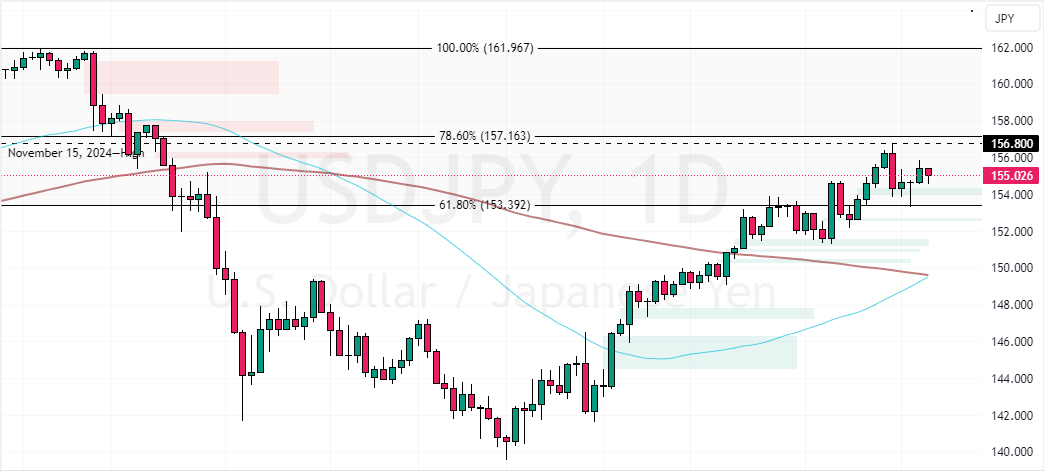

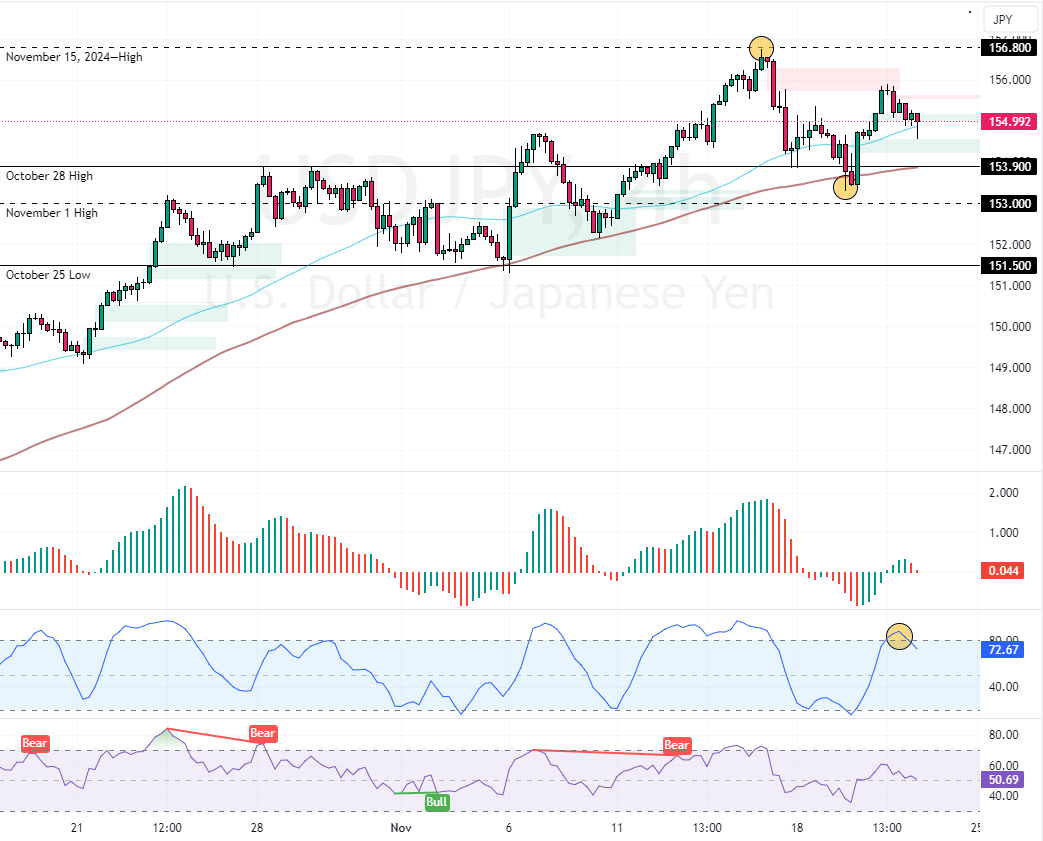

The currency pair trades in a robust bull market that remains valid if the prices are above the 153.0 mark. On the technical front, today’s downtick momentum was expected because the Stochastic signal was overbought in the previous session.

That said, the USD/JPY is expected to revisit the November 15 high at 156.8. Furthermore, if the buying pressure exceeds 156.8, the next bullish target could be the 160.0 mark.

Please note that the uptrend should be invalidated if USD/JPY dips below the 153.0 mark, which is active support.