The Japanese yen has recently fallen to nearly 155.0 yen per U.S. dollar, marking its weakest point in over three months. This decline is due to the strengthening U.S. dollar, influenced by what’s known as “Trump trades.” In these trades, investors believe President Trump’s inflation-driven policies will prevent the Federal Reserve from lowering interest rates.

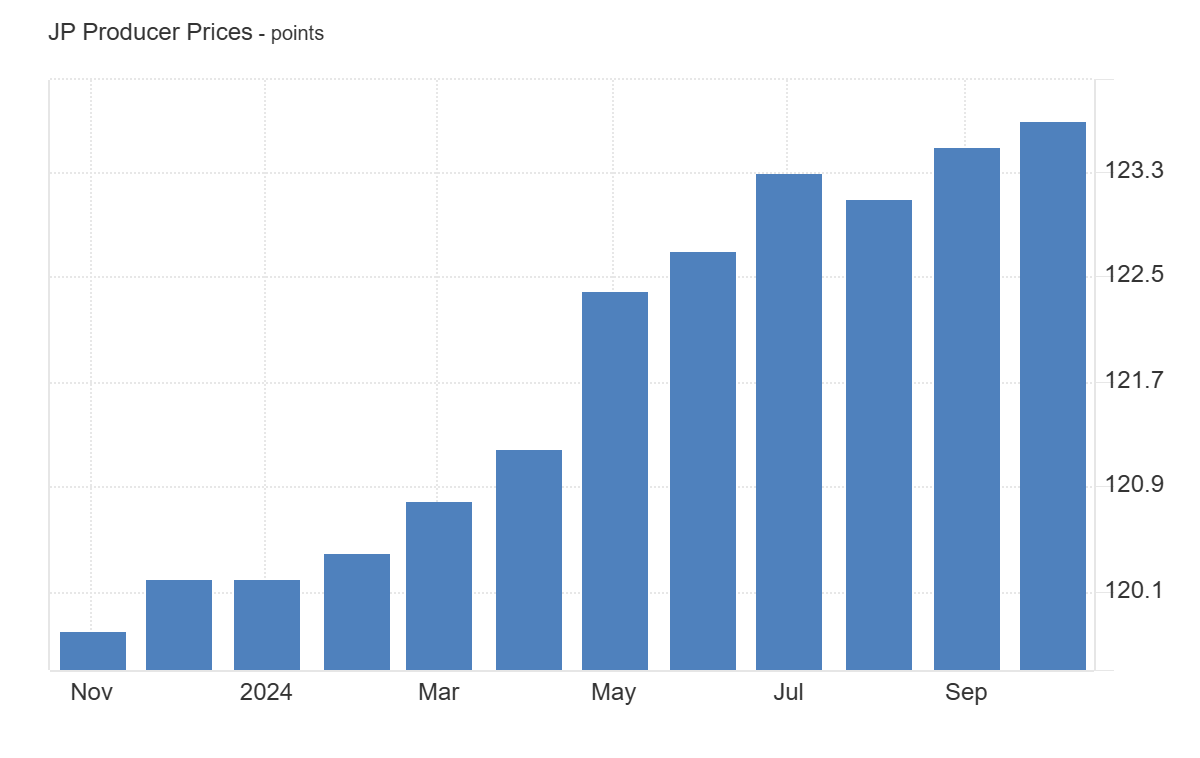

Japan Producer Prices Surge

Meanwhile, in Japan, producer prices rose by the largest amount in 14 months in October, indicating that inflation pressures continue domestically. As a result, investors eagerly await the release of Japan’s third-quarter GDP data on Friday for more insights into the country’s economic health.

Additionally, a recent report from the Bank of Japan’s October policy meeting revealed that policymakers are divided on when to raise interest rates in the future. Despite this disagreement, the central bank still expects to increase its main policy rate to 1% by the second half of fiscal year 2025.

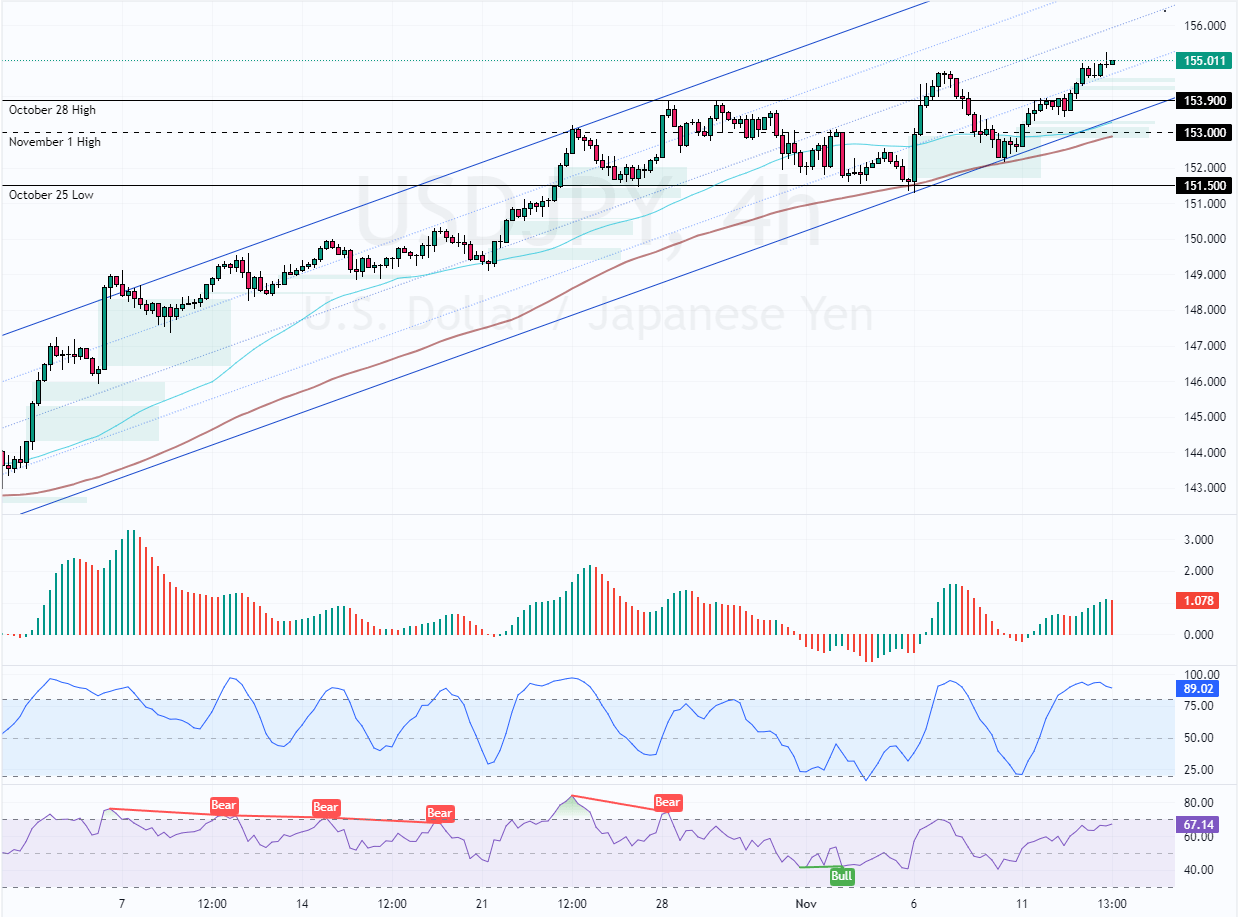

USDJPY Technical Analysis – 13-November-2024

The USD/JPY price exceeded 153.9 and is now trading at approximately 155.0, while the momentum indicators signal the market is overbought. However, we hear less-than-good news from Japan, so the overbought condition can be ignored in the USD/JPY market.

- Good read: AUDUSD Tumbles as Trump Trades Boost Dollar

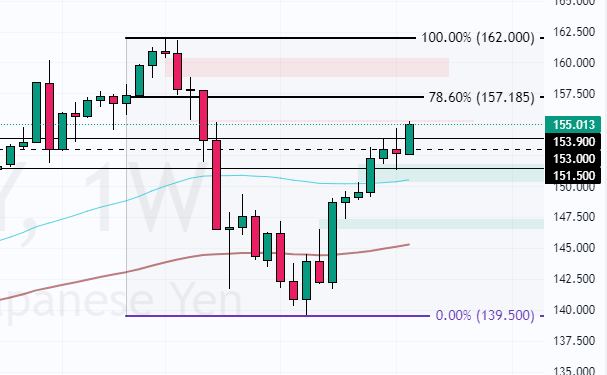

USDJPY Bullish Above 151.5 Eyeing 157.1 Target

From a technical perspective, the USD/JPY trend outlook remains bullish as long as the price is above the 151.5 mark (October 25 Low). In this scenario, the next bullish target could be the 78.6% Fibonacci retracement level at 157.1.

- Support: 153.9 / 153.0 / 151.5

- Resistance: 157.1