FxNews—The Japanese yen strengthened beyond 152.4 per dollar on Thursday, rebounding from recent three-month lows. This move came after the Bank of Japan kept its policy rate steady at 0.25%, which was expected.

The central bank also restated that it expects inflation to remain around its 2% target for the next few years, signaling a steady approach toward policy normalization.

BOJ Governor’s Speech Holds Key to Yen’s Future

Market participants are now awaiting insights from BOJ Governor Kazuo Ueda’s post-meeting briefing, hoping for hints about when and how quickly future rate hikes might occur. Over the past month, the yen has dropped nearly 7% against the dollar, its most significant monthly loss since November 2016. This decline has been driven by a strong dollar and rising U.S. Treasury yields.

Additionally, a political shift in Japan has increased uncertainty around the nation’s fiscal and monetary policies, adding to the yen’s recent challenges.

USDJPY Technical Analysis – 31-October-2024

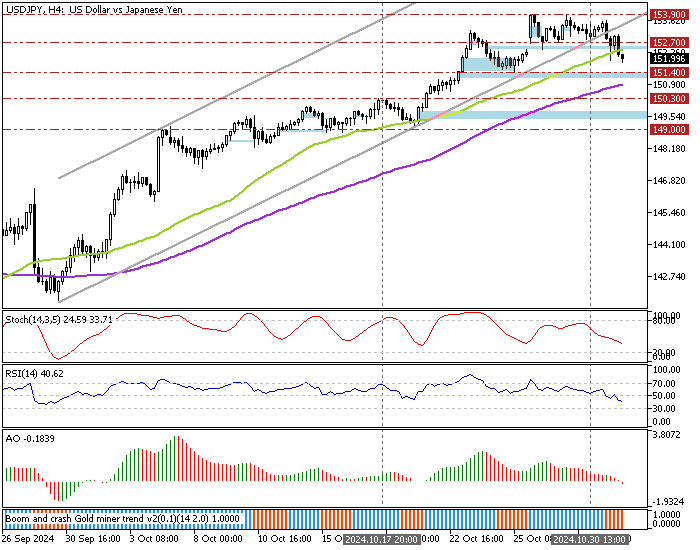

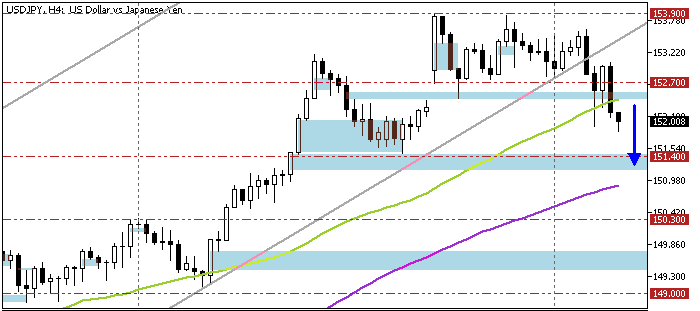

The currency pair trades at approximately 152.0, stabilizing below the 50-period simple moving average. Additionally, the Awesome Oscillator flipped below the signal line, strengthening the bear market. That said, the Stochastic and RSI 14 have room left to become oversold, meaning the current downtick momentum is likely to resume.

Despite the bearish signals from these indicators, the USD/JPY price is above the 100-period simple moving average, meaning the primary trend is bullish.

Can USD/JPY Hold Below 152.7 for More Losses?

The immediate resistance is at the October 30 low, the 152.7 mark. From a technical standpoint, the current bearish wave resumes to the next support area at 151.4 if USD/JPY remains below 152.7.

Furthermore, if the selling pressure exceeds 151.4, the next bearish target could be 153.3, the October 17 high.

Bullish Scenario

The primary trend is bullish because USD/JPY is above the 100-period simple moving average. As mentioned earlier, the immediate resistance rests at 152.7. If bulls pull the price above 152.7, the uptrend will likely resume. In this scenario, the October high at 153.9 could be revisited initially.

Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 151.4 / 150.3 / 149.0

- Resistance: 152.7 / 153.9