FxNews—The Japanese Yen weakened, surpassing 149.5 against the dollar on Monday, edging closer to the critical 150 mark—a level that could trigger another intervention by Japan’s authorities to stabilize their currency.

Last week, the Yen reached 150.32, its lowest in nearly three months, driven by a strong dollar bolstered by positive U.S. economic updates and the increased likelihood of Donald Trump returning as president.

September’s Dip: Japan’s Inflation Falls to 2.5%

On Friday, data indicated that Japan’s main and underlying inflation rates dropped to their lowest in five months, recording 2.5% and 2.4%, respectively, in September. This slowdown could impact economic decisions moving forward.

Mimura Focuses on Yen Stability as Decline Continues

Amid the decline of the Yen, Atsushi Mimura, Japan’s lead official on currency strategy, stressed the government’s focus on minimizing unpredictability in currency values.

The Japanese government previously stepped in to adjust the market when the Yen fell past 160 against the dollar. The 150 mark is now viewed as a critical threshold for potential action.

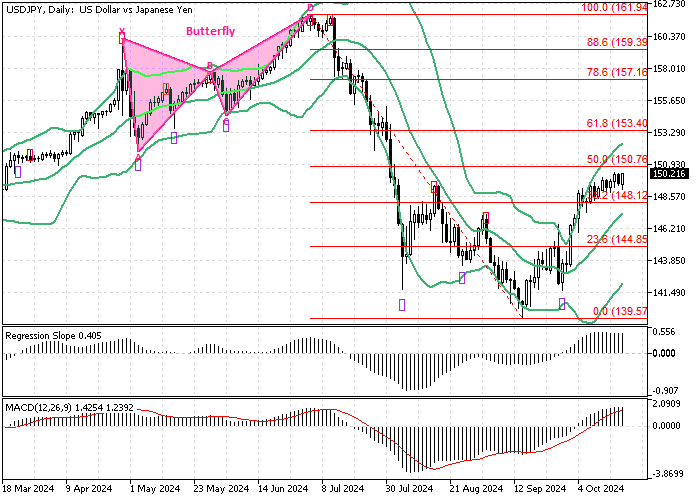

USDJPY Technical Analysis – 21-October-2024

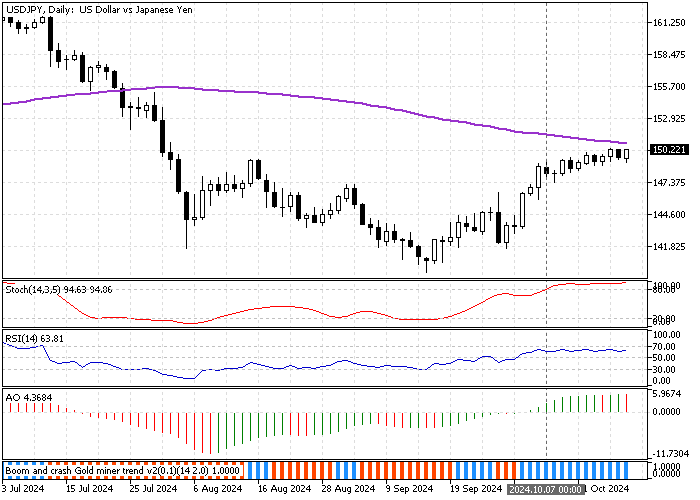

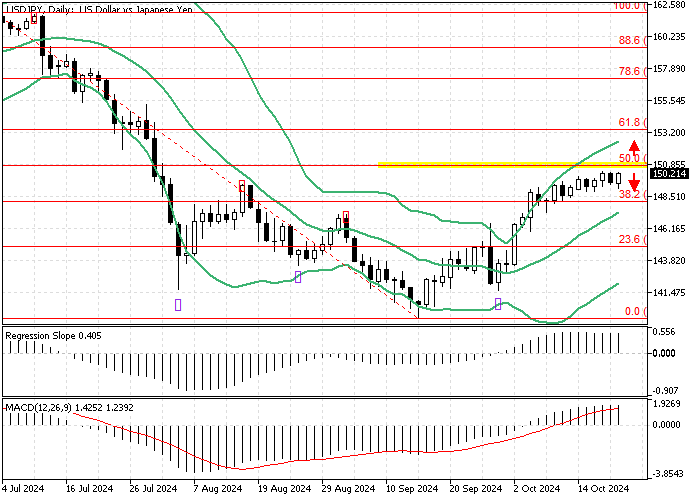

The U.S. dollar is in a robust bull market against the Japanese Yen. As of this writing, the USD/JPY pair trades at approximately 150.2, running toward the %50 Fibonacci retracement level at 150.7.

Looking at the daily chart, we notice that the Stochastic Oscillator has been signaling overbought since October 7th. Furthermore, the USD/JPY price is nearing the 100-period simple moving average, active resistance.

Overall, the technical indicators suggest that while the primary trend is bullish, the U.S. dollar seems to be overpriced against the Japanese Yen, and the price could reverse or consolidate near the lower support levels.

USDJPY Forecast – 21-October-2024

The critical resistance level is 150.7, backed by the daily 100-period SMA. From a technical standpoint, a consolidation phase could be on the horizon if the 150.7 resistance holds. In this scenario, the USD/JPY could dip toward the 38.2% Fibonacci retracement level at 148.1.

On the flip side, if bulls (buyers) close and stabilize the price above the 50% Fibonacci retracement level at 150.7, the path to the next Fibonacci level at 61.8% (153.4) will likely be paved.

USDJPY Support and Resistance Levels – 21-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 148.85 / 147.3 / 146.0

- Resistance: 150.7 / 153.4