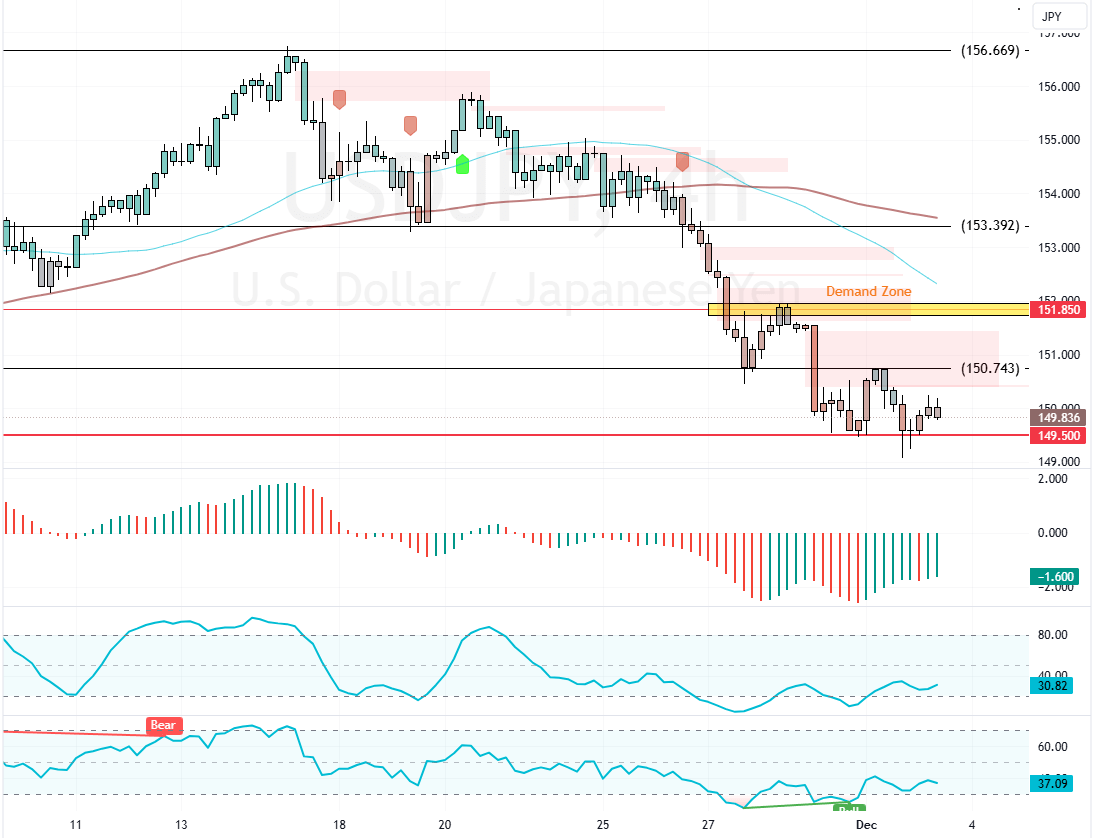

On Tuesday, the USD/JPY currency pair moved closer to 150 yen per U.S. dollar. Despite the strong dollar, the yen remains near its highest levels in seven weeks due to the expectation that the Bank of Japan may raise interest rates again.

- Yen nears 150 per dollar despite strong U.S. dollar

- Anticipation of possible Bank of Japan interest rate hike

- Yen at highest levels in seven weeks

USDJPY Nears 150 Amid BoJ Rate Hike Speculation

Over the weekend, Bank of Japan Governor Kazuo Ueda indicated that further interest rate hikes are “nearing” as economic data meets expectations. He also stressed the importance of momentum from fiscal 2025 wage negotiations.

Markets are now pricing in about a 60% chance of a 25 basis point rate hike in Japan this month, up from around 50% recently.

- Also read: NZDUSD Falls to $0.586 Amid Yuan Struggles

Global Economic Factors Affecting Currency Markets

Investors remain cautious about the strength of the U.S. dollar. Expectations of strong U.S. economic performance and concerns over tariff threats from former President Trump against other major economies have bolstered the dollar. These factors contribute to complex dynamics influencing global currency markets.