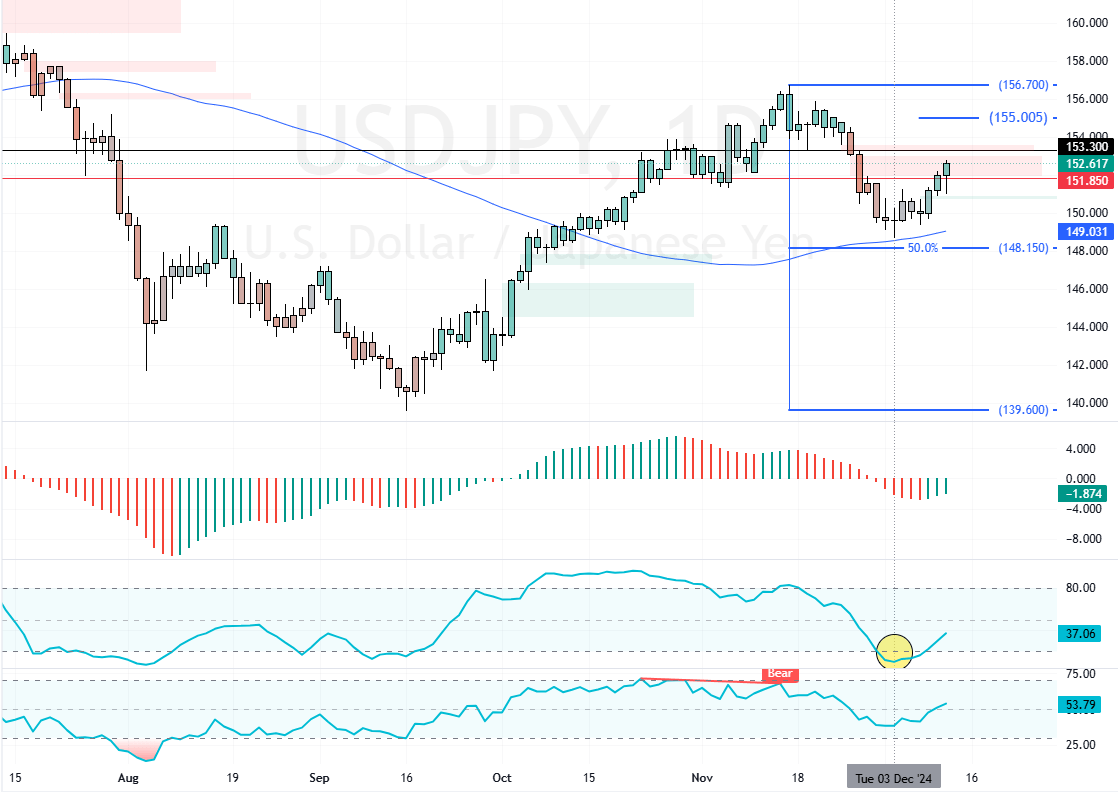

FxNews—USD/JPY initiated a bullish trend from the 50.0% Fibonacci support level at 148.1, backed by the daily 75-period simple moving average. This rise was expected because Stochastic hinted at an oversold market, as shown in the image below.

As of this writing, the American dollar trades at approximately 152.6, filling the bearish fair value gap.

USD/JPY Technical Analysis

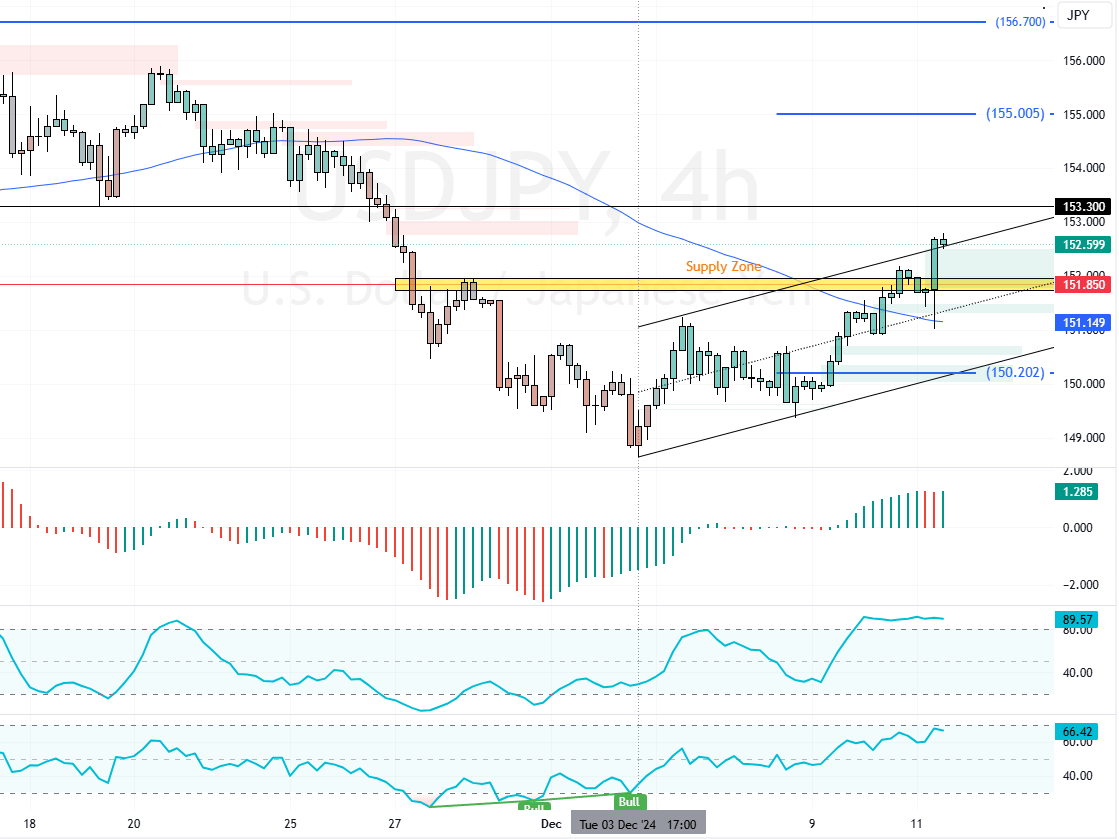

Zooming into the 4-hour chart, we notice the currency pair flipped above the 151.8 critical resistance. However, this bullish sentiment has driven the Stochastic into overbought territory, meaning USD/JPY is overbought. Therefore, a consolidation phase could be on the horizon.

The immediate support rests at 151.8. The USD/JPY trend outlook remains bullish as long as the prices exceed this supply zone. Therefore, from a technical perspective, the American dollar is likely to target the 153.3 mark after a minor consolidation near 151.8.

The Bearish Scenario

Please note that the bullish outlook should be invalidated if USD/JPY dips below the 151.8 mark. If this scenario unfolds, a new bearish wave could begin, targeting the ascending trend line at approximately 150.2.