FxNews—The U.S. Dollar turned bearish against the Japanese Yen after the price tested the %38.2 Fibonacci resistance level on August 15. As of writing, the USD/JPY currency pair trades bearish at about 143.7, below the 23.6 Fibonacci.

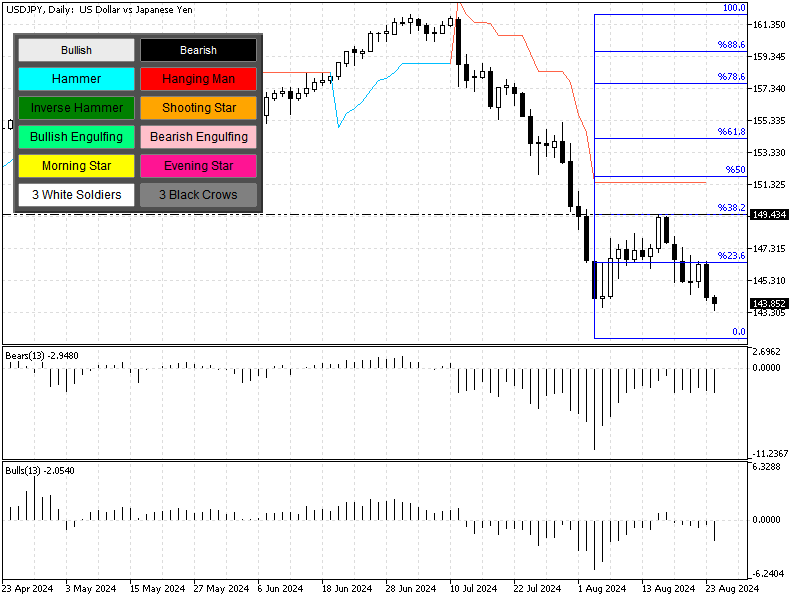

The daily chart below demonstrates the price, the key Fibonacci levels, and the technical indicators utilized in today’s analysis.

USDJPY Technical Analysis – 26-August-2024

The USD/JPY primary trend is bearish because the price is below the 50- and 100-period simple moving averages. Interestingly, the technical indicators suggest the downtrend should resume.

- The awesome oscillator bars are red and below the signal line, meaning the bearish bias prevails.

The relative strength index indicators and the Stochastic oscillator are heading toward the oversold area, recording 32 and 21, respectively. This development in the momentum indicators suggests the trend is bearish, but the USD/JPY pair is not in an oversold state yet, and the downtrend could resume.

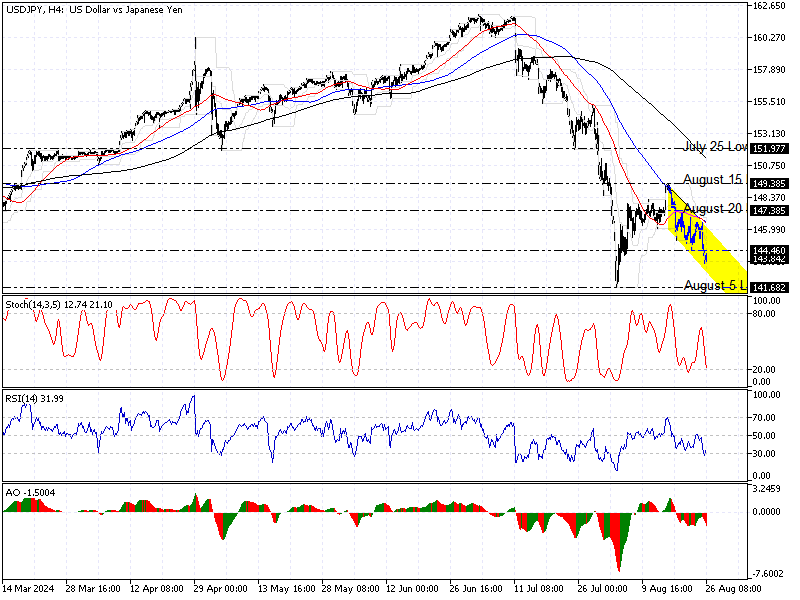

USDJPY Forecast – 26-August-2024

As mentioned earlier, USD/JPY is in a bear market and trades inside the bearish channel. The key resistance level to the current trend rests at the August 20 high, the 147.3 mark. If the price remains below 147.3, the downtrend will likely resume. In this scenario, the next bearish target will be the August 5 Low at 141.6.

Furthermore, if the selling pressure exceeds 141.3, the next supply zone will be the December 2023 low at 140.2.

- Also read: NZD/USD Technical Analysis – 22-August-2024

USDJPY Bullish Scenario – 26-August-2024

The bearish outlook should be invalidated if the USD/JPY bulls (buyers) close and stabilize the price above the descending trendline and the primary resistance at 147.3. This resistance is backed by the 100-period SMA, which makes it a robust barrier for the bulls.

If this scenario unfolds, the bulls’ path to retest the August 15 high at 149.3 could be paved. Furthermore, a push above the 149.3 mark could trigger a new bullish wave that will likely extend to the next barrier at the July 25 low, the 151.9 mark.

USDJPY Support and Resistance Levels – 26-August-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 144.3 / 140.2

- Resistance: 147.3 / 149.3 / 151.9

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.