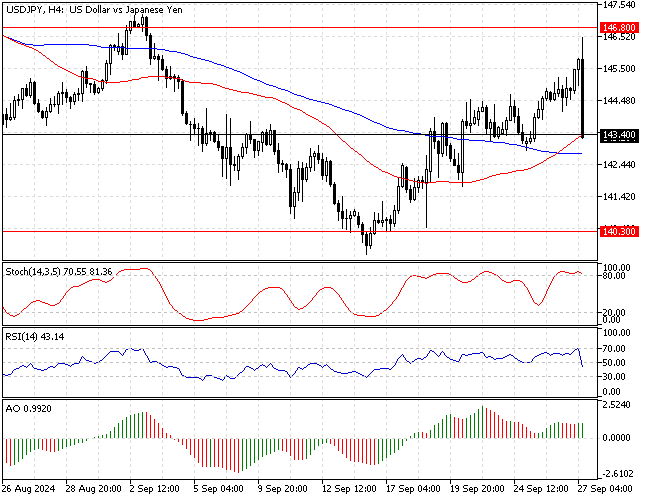

FxNews—The U.S. dollar is in a downtrend against the Japanese yen. Recently, the USD/JPY bulls pulled the price above the 50- and 100-period simple moving averages, resulting in a golden cross signal.

But, the buying pressure did not last, and the U.S. dollar began to dip again after the price peaked at the September 2024 high of 146.8. As of this writing, the USD/JPY currency pair trades at approximately 143.4, testing the 50-period simple moving average as support.

USDJPY Technical Analysis – 27-September-2024

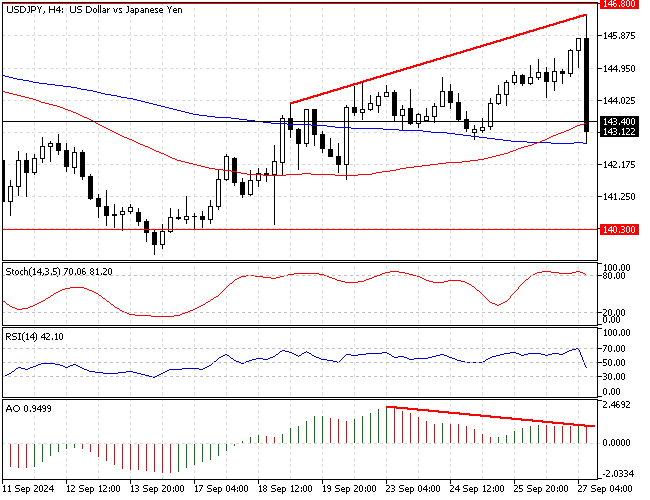

The dip from 146.8 was anticipated because the Awesome oscillator signaled divergence, and the stochastic oscillator was in the overbought territory.

As for the candlestick patterns, the 4-hour chart formed a shooting star candlestick, highlighted in the image above.

Overall, the technical indicators suggest the primary trend is bullish, but the bulls failed to maintain their strength, and the downtrend will likely begin.

USD/JPY Forecast

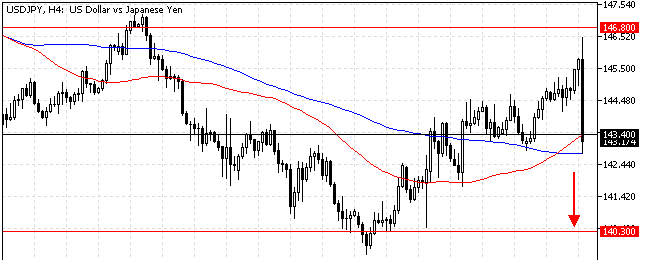

The September 23 low at 143.4, which coincides with the 50-period SMA, is the immediate resistance. If bears (sellers) close and stabilize the USD/JPY price below the 143.4 mark, a new bullish wave will likely start.

In this scenario, today’s decline from 146.8 can potentially retest the September low at 140.3. Furthermore, if the selling pressure pushes the price below 143.3, the bear’s path to the next support level at 137.2, the July 14 low, could be paved.

Please note that the bear market should be invalidated if the USD/JPY price exceeds the 146.8 mark.

USD/JPY Bullish Scenario

The immediate resistance is at 146.8. If bulls (buyers) close and stabilize the price above 146.8, the next resistance area that could be targeted will likely be 149.4.

Please note that the primary support for the bull market is the 50- and 100-period simple moving averages, which should be invalidated if the USD/JPY price dips below them.

USD/JPY Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 140.3 / 137.2

- Resistance: 146.8 / 149.4