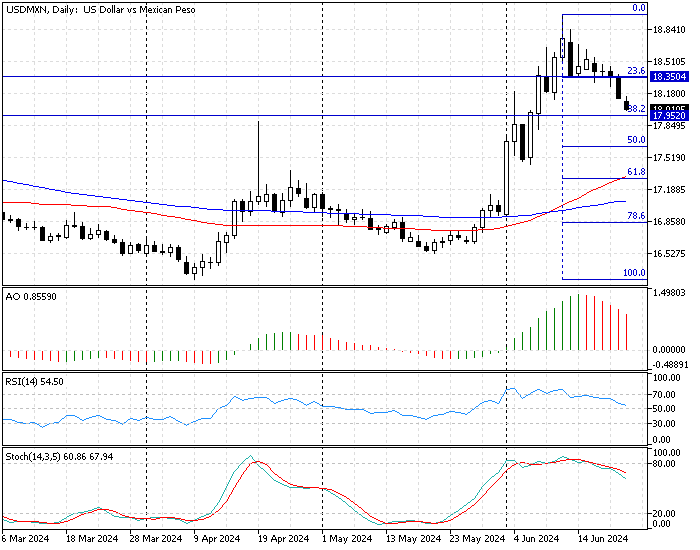

FxNews—The U.S. Dollar fell below the 23.6% Fibonacci retracement level at 18.35, approaching 38.2% at 17.95 in a robust downtrend. The USD/MXN currency pair trades at about 18.0, with the technical indicators suggesting the downtrend prevails.

The daily chart below shows the technical tools such as the awesome oscillator, relative strength index, and stochastic, pointing out that the bearish trend will likely test the 17.95 resistance, the 38.2% Fibonacci support.

USD/MXN Technical Analysis – 24-June-2024

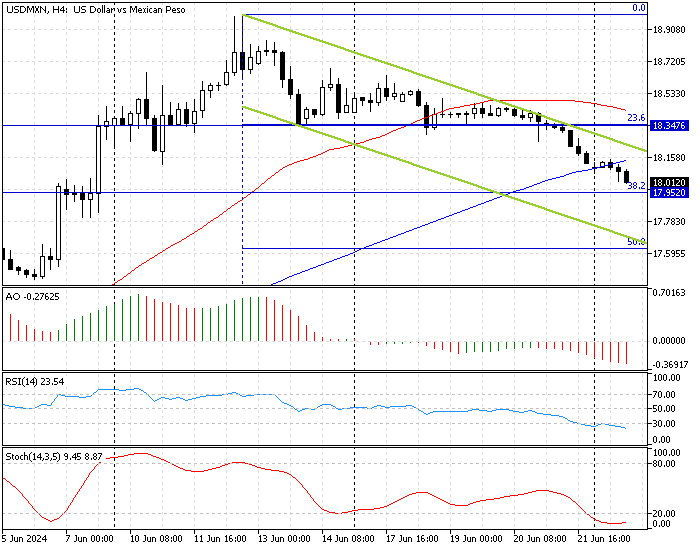

We zoom into the USD/MXN 4-hour chart for a detailed analysis and find key levels and trading opportunities. The 4-hour diagram demonstrates the price floats in the bearish flag, stabilizing itself below the 100-period simple moving average.

Interestingly, the robust selling pressure drove the RSI 14 and the stochastic oscillator into the oversold territory, meaning the market might pull back from this point, and increasing the bid on the bear market is not reasonable. On the other hand, the awesome oscillator bars are red, below zero, and declining. This suggests the bear market prevails.

In conclusion, the technical indicators in the 4-hour chart suggest the USD/MXN is in a bear market. Still, the Mexican Peso is overpriced against the U.S. Dollar, which might result in the trend to change direction or consolidate.

USDMXN Forecast – 24-June-2024

The primary trend is bearish, and the 4-hour chart shows the bears trying to stabilize the rate below the 100-period simple moving average. However, both RSI 14 and the stochastic oscillator signal an oversold market, meaning the trend might reverse, or there might be a pullback from the 38.2% Fibonacci at 17.95.

Hence, from a technical standpoint, we suggest traders and investors wait patiently for the USD/MXN price to consolidate near the immediate resistance at 23.6% Fibonacci, the 18.34, a level backed by the 50-period moving average.

If the price reaches immediate resistance, traders should monitor this demand zone closely, looking for bearish signals such as a long-wick bearish candlestick, a doji, an inverted hammer, or a bearish engulfing pattern. Sighting any of these candlestick patterns is a signal to join the bear market with confidence and low risk.

If this scenario comes into play, 17.95 has the potential to be tested again, and If the selling pressure exceeds 17.95, the next bearish target will be the 50% Fibonacci at 17.629. Furthermore, the SMA 50 supports the bear market, which should be invalidated if the USD/MXN price exceeds 18.34.

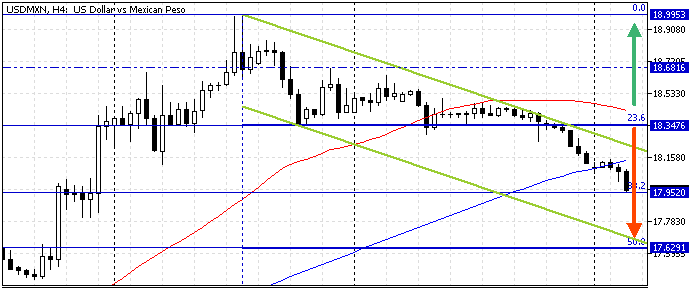

USD/MXN Bullish Scenario

The 23.6% Fibonacci at 18.34 and the 50-period simple moving average play the resistance. If the bulls push the U.S. Dollar above 18.34 against the Mexican peso and stabilize the price beyond the descending trendline in the 4-hour chart, the bull’s road to the 18.68 mark will be paved. Likewise, if the price exceeds 18.68, the next bullish target could be June’s all-time high at 18.99.

USD/MXN Key Support and Resistance Level

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 17.92 / 17.62

- Resistance: 18.34 / 18.68 / 18.99

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.