FxNews—The Mexican peso weakened past 20.2 per USD, closing in on the weakest level since September 2022 of 20.27, seen November 1, as investors reacted to political developments in Mexico and the U.S. along with recent economic data.

The upcoming ruling by the Mexican Supreme Court on a controversial reform to elect judges could have significant constitutional and economic impacts if the government ignores a negative decision, pressuring the Mexican currency.

Trump Return Could Spark Peso Volatility as Trade Tensions Loom

Adding to the peso’s volatility, Trump’s possible return to office in the U.S. could heighten trade tensions with Mexico, given his historically tough stance on US-Mexico relations and proposed tariffs.

Meanwhile, Mexico’s unemployment rate held steady at 2.9% in September, slightly below forecasts, and Q3 GDP grew 1% quarter-over-quarter, the fastest pace since Q2 2023, providing the Bank of Mexico leeway for moderate rate cuts to balance inflation control.

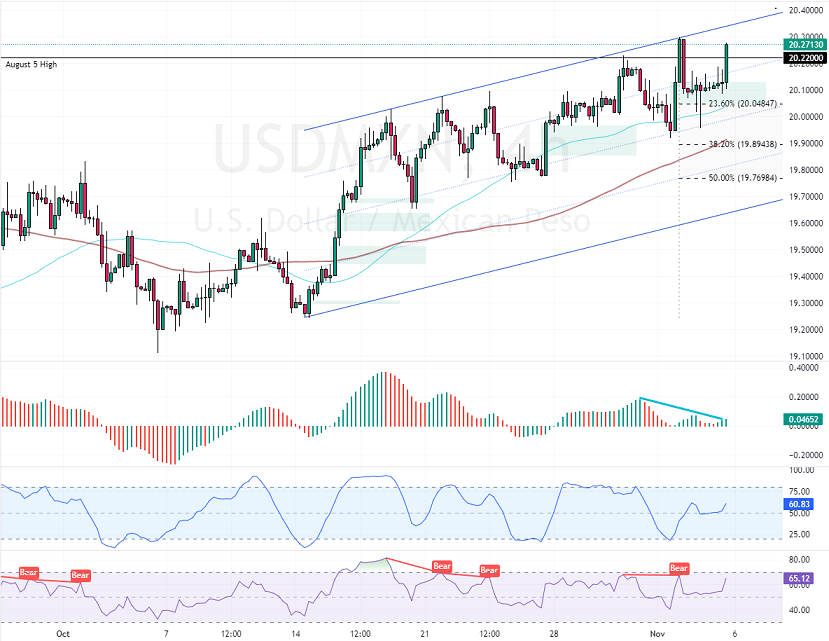

USDMXN Technical Analysis – 5-November-2024

The USD/XMN dip from the August 5 high couldn’t hold below the 23.6% Fibonacci retracement level at 20.04. Consequently, the uptrend resumes, and as of this writing, the pair trades at approximately 20.27, poised to stabilize above the August 5 high.

Meanwhile, the Awesome Oscillator signals divergence but does not impact the market. Furthermore, the Stochastic and RSI 14 depict 61 and 65 in the description, meaning the U.S. Dollar is not overpriced, and the uptrend should resume.

USDMXN Price Forecast – 5-November-2024

The immediate support is at the 38.2% Fibonacci retracement level, the 19.89 mark. The outlook of the USD/MXN remains bullish as long as the price is above that of Fibonacci. In this scenario, the next bullish target could be the 20.56 mark.

Please note that the bull market should be invalidated if USD/MXN falls below the 19.89 mark.

- Support: 20.48 / 19.89 / 19.76

- Resistance: 20.22 / 20.56