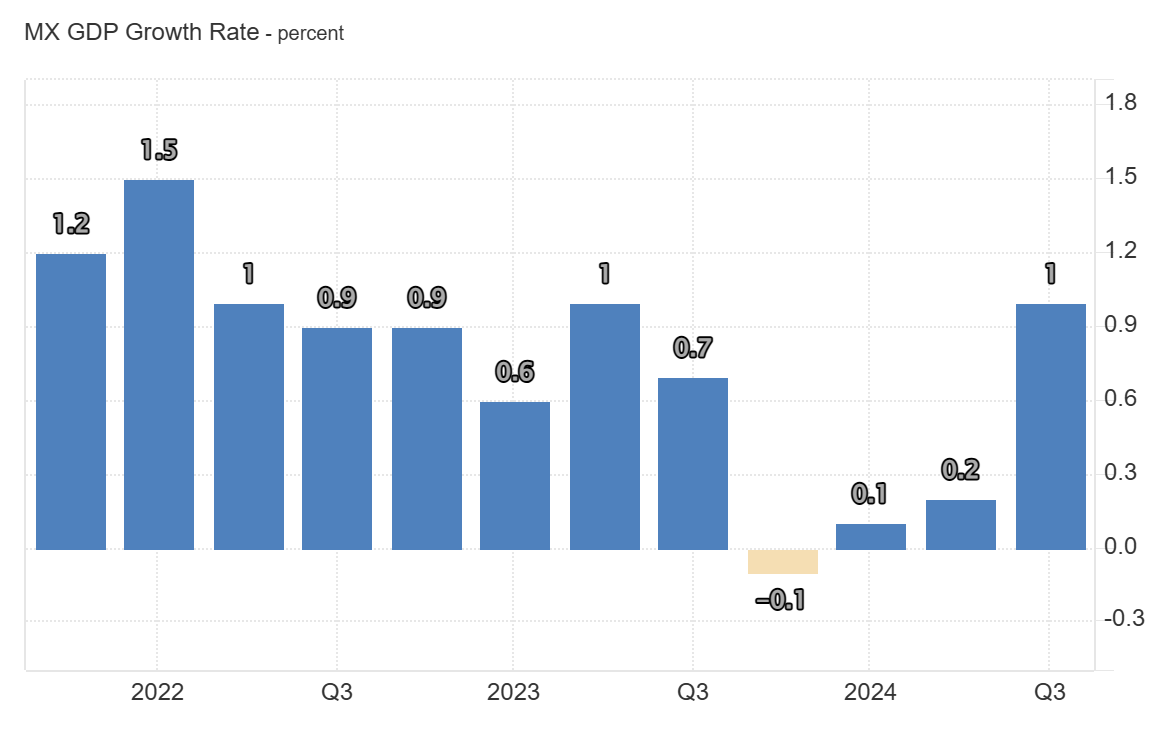

FxNews—The Mexican GDP expanded by 1% from the previous quarter in the three months ending in September of 2024, accelerating sharply from the 0.2% increase in the earlier period and surpassing market expectations of 0.8%, according to a preliminary estimate.

This is the third consecutive year that Mexico’s economy has grown, and this time, it grew the most since mid-2023. Because the economy is doing well, the Bank of Mexico can slowly lower interest rates to help control rising prices.

The biggest growth occurred in farming and mining activities, which improved significantly, from a decrease to a 4.6% increase. Industries and services also grew by 0.9%, which is higher than before. Compared to last year, Mexico’s economy is 1.5% bigger.

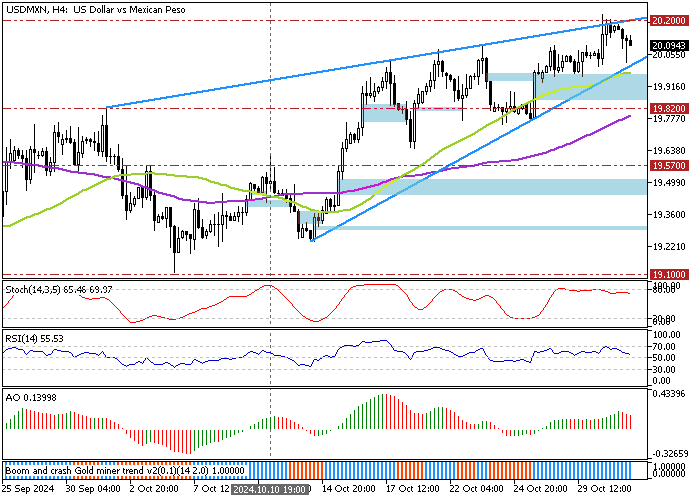

USD/MXN Bulls Eye Breakout Above Key 20.2 Level

The USD/MXN currency pair trades in a bullish symmetrical pattern, nearing the triangle’s apex. As of this writing, the currency pair trades in an uptrend at approximately 20.1, bouncing off the ascending trendline, active support.

The immediate resistance is at 20.2 (August 5 high). The uptrend will likely resume if bulls close and stabilize the price above the 20.20 mark. If this scenario unfolds, the next target could be the late September high at 20.60.

Bearish Scenario

Conversely, the bullish outlook should be invalidated if USD/MXN falls below the 19.82 support, backed by the 100-period simple moving average. If this scenario unfolds, a new downtrend will likely be triggered, which could result in the price dropping to the 19.57 (October 10 High) mark.

Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 19.82 / 19.57

- Resistance: 20.20 / 20.6