Our thorough USDNOK forecast examines the intricacies of price movements and technical indicators on the daily and 4-hour charts.

USDNOK Analysis – Comprehensive Analysis for October 2023

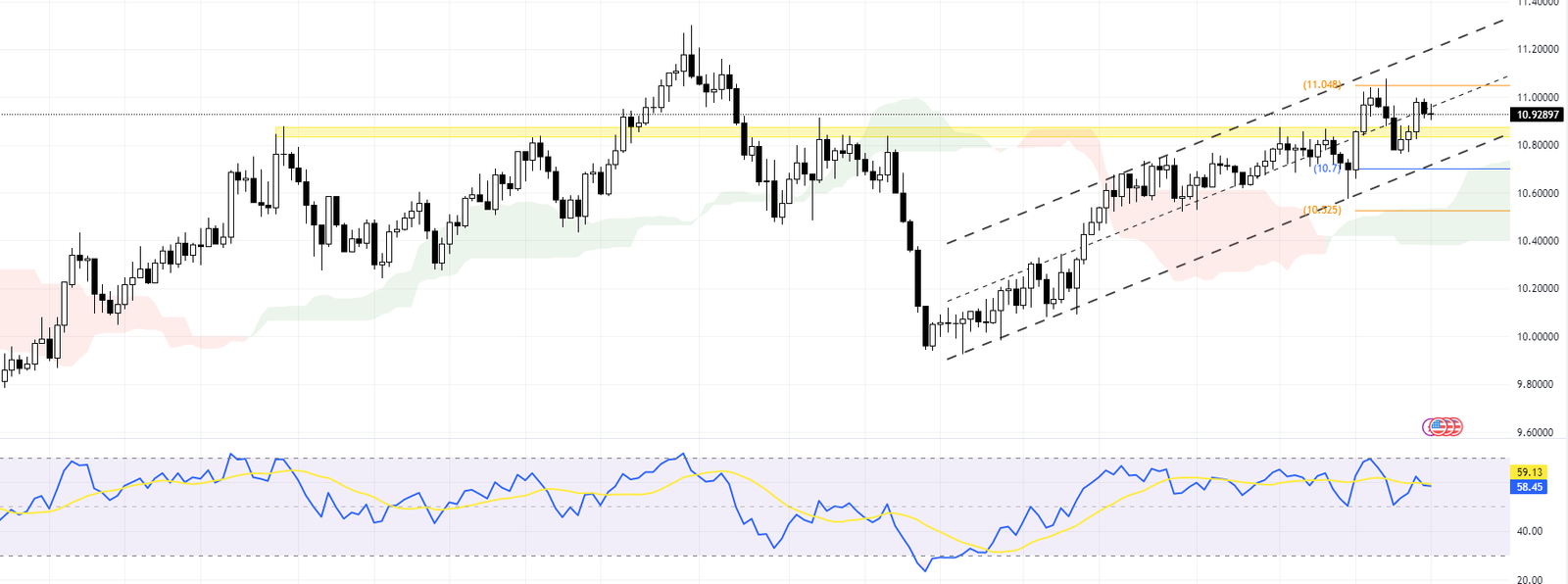

The USDNOK currency pair is experiencing a bullish trend within its trading channel. This trend is evident as the pair is trading above the Ichimoku cloud, a technical analysis tool that provides support and resistance levels, and the Relative Strength Index (RSI) indicator is hovering above the 50 level. These factors lead us to conclude that the outlook for USDNOK is bullish, suggesting that traders should seek opportunities to go long on USDNOK.

When we zoom into the 4-hour chart, it becomes apparent that USDNOK is on the verge of exiting the Ichimoku cloud. However, there is a minor barrier that could potentially hinder the continuation of this uptrend. This barrier is represented by the blue bearish trend line or the psychological level of 11.0.

USDNOK Forecast: Conclusion

In a bullish scenario, if the bulls can close above 11.0 on the 4-hour chart, it would pave the way to the upper line of the bullish channel.

On the flip side, a pivot at 10.89 supports the price. A firm close below this pivot could signal a continuation of the decline that started on October 6, with targets set at 10.797, followed by the lower band of the bullish channel.